From diligence to delivery: how private equity can secure value in a volatile technology market

Investment in the technology sector is going through a period of major change, as evolving regulation and market dynamics reshape the competitive landscape. For enterprise resource planning (ERP) and software as a service (SaaS), the most successful investors are those that have switched their primary focus from growth potential to proven outcomes. Across the technology sector, market structures are being transformed as agentic AI, sustainability and vertical specialisation come to the fore. The regulatory environment is becoming much more stringent as policy makers anticipate future risks.

Private-equity players must adapt to these evolving needs and opportunities. Commercial and technology due diligence assessments are expanding well beyond the essentials to achieve an accurate understanding of risk. Much greater weight is now given to compliance, resilience and integration capacity, which in turn is creating demand in specialised areas such as cyber security, AI-enhanced platforms and technology that supports legal and regulatory needs. Value creation depends on growth, cost efficiency and capital discipline, with ERP modernisation providing a proven foundation for sustainable returns in the European mid-market.

Assessments of businesses are based on a cautious and comprehensive approach

Results are more powerful than theoretical potential

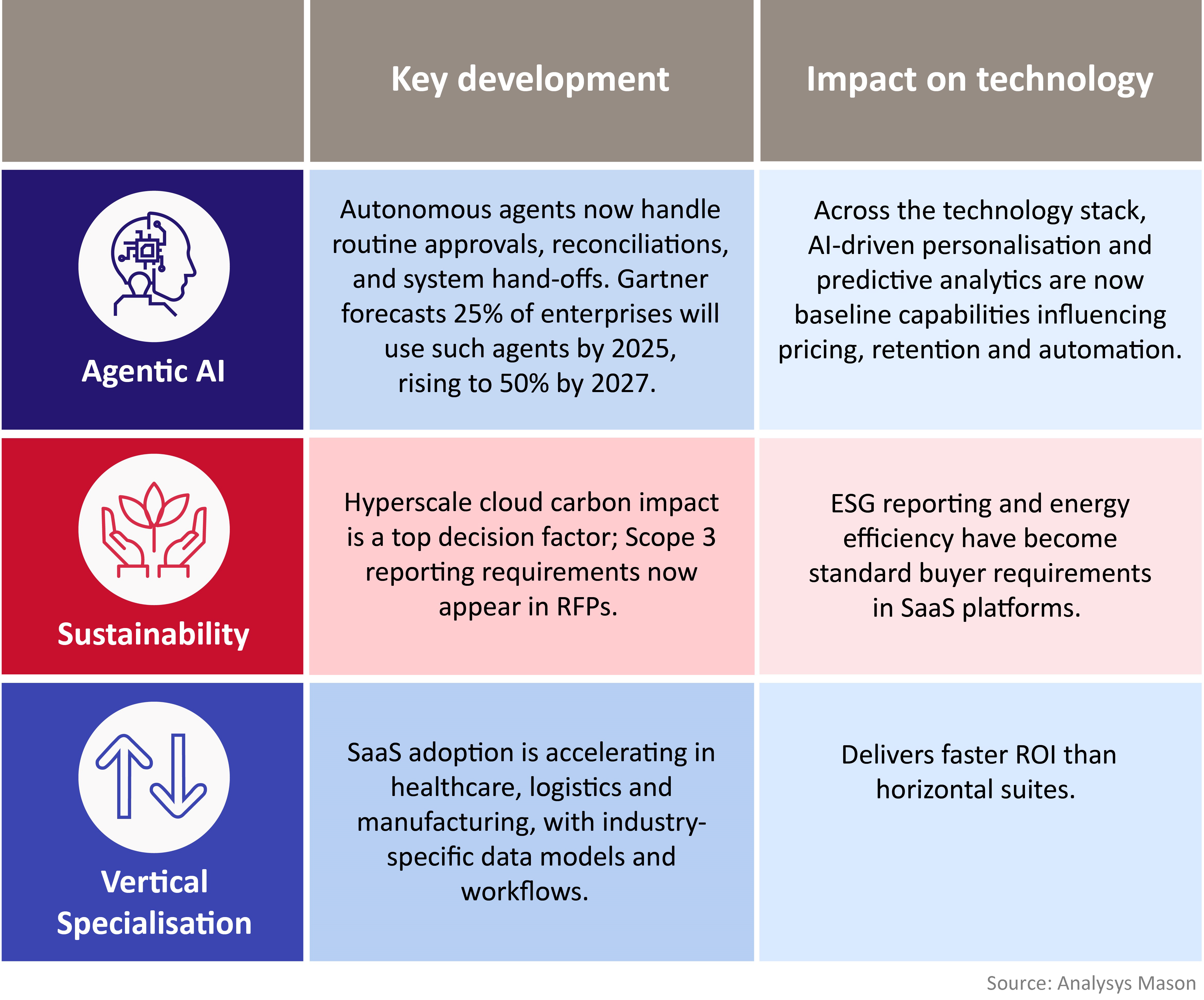

ERP/SaaS value success is defined by demonstrable operating outcomes, not growth narratives. Buyers are prioritising platforms that deliver measurable gains in cost efficiency, cycle time and compliance readiness. Three forces are shaping this shift: auditable AI embedded in core workflows, sustainability as a selection criterion, and vertical specialisation with industry-specific data models.

Due diligence assessments must go well beyond the essentials to properly quantify risk

Technology due diligence in 2025 encompasses far more than the assessment of a company’s security, scalability and value of intellectual property. An industry standard due diligence assessment now includes detailed analysis of AI advantages; environmental, social and governance (ESG) compliance; data governance and integration economics.

Cyber security and AI ethics are top priorities. For example, the EU AI Act introduces strict requirements for high-risk applications for AI in HR, finance and healthcare. Investors must identify regulatory compliance gaps early and account for them in both bids and 100-day plans. This includes reviewing documentation, testing processes, monitoring tools and human oversight controls. Ultimately, deal pricing must account for both the time and resources needed to address any gaps in these areas.

The European Council adopted a regulation on ESG ratings in 2024. Clear ownership of data quality, privacy and retention is required, supported by systems that track lawful basis and enable sustainability reporting that meets both customer and regulatory expectations.

Due diligence requirements are complex, covering robust threat modelling, incident response capabilities, verification of software bills of materials, open-source compliance, data lineage and training-data rights. Model governance systems must be in place to detect bias or drift while maintaining full auditability.

Digital transformation readiness is an important quality, and more readily quantifiable than previously. Architectures should scale, integrate and automate in line with the investment thesis, featuring application programming interfaces (APIs) and data models that support add-ons without increasing operational costs. Resilience metrics, such as recovery time objectives, recovery point objectives and reliability service-level objectives, must hold up under growth conditions.

Figure 1: Growth in ERP and SaaS is based on AI adoption, sustainability requirements and verticalisation

ERP modernisation is viewed as a repeatable value lever rather than a one-off project. In the mid-market, while SaaS remains attractive, the standard is higher for validation before a deal is made and execution after it. Early focus on regulatory readiness and integration capacity can help to avoid post-deal value erosion that might arise from compliance fixes or re-platforming costs.

Modern ERPs/SaaS attract a substantial premium in assessment frameworks

Cyber security, compliance tech and AI-enhanced SaaS dominate European mid-market deals

In 2024, SaaS M&A deals accounted for 61% of software transactions worldwide (1285 of 2107), over double what it was a decade ago. Investor confidence is also reflected in valuations: median enterprise value/revenue multiples for ERP and supply-chain SaaS climbed from 7.7× in Q4 2023 to 9.0× in Q4 2024, the sharpest increase among major SaaS categories.

In Europe, mid-market SaaS deal flow is concentrating in resilient niches. Cyber-security platforms will remain in high demand due to persistent exposure to threats and intensifying regulatory scrutiny, both of which are buoying associated budgets. Legal and regulatory technology sectors are growing, as pan-European regulation tightens and investors value solutions with localised workflows.

AI-enhanced SaaS is also attracting capital, particularly where generative capabilities deliver measurable productivity gains with clear governance and defensible data rights. Most activity is in the EUR15–500 million enterprise value range, with notable activity in the Nordic region and Iberia. Players show increased use of co-investment and club deals to scale up and manage risk.

Top-line growth, technology cost reduction and capital efficiency underpin private-equity value creation

Value creation in technology portfolio companies is shifting from financial engineering to an operating model built on top-line growth, technology cost reduction and capital efficiency. Growth comes from ‘digital-first’ sales approaches, AI-driven demand generation and product packaging that minimises the time to realise value. Cost optimisation focuses on delivery unit economics, refining cloud spend and automating core functions. Capital efficiency aims for shorter cash cycles, real-time forecasting and phased capex allowances linked to measurable performance indicators.

Modern ERP/SaaS is driving operational improvements in private-equity portfolios

ERP modernisation is a proven lever for improving operating performance indicators in companies backed by private equity. Recent adopters report average reductions of 40% in IT costs, 38% in inventories and 35% in cycle times. Modern ERP standardises processes, automates reconciliations and delivers real-time data for better planning and shorter cash cycles. Clean APIs, consistent data models and shared services make acquisitions faster to integrate and cheaper to operate, supporting net revenue retention and gross margins.

The outlook for ERP/SaaS investment remains strong, but disciplined execution is all-important

With clear demand drivers, heightened regulatory scrutiny and proven value-creation levers, ERP and adjacent SaaS markets offer a resilient opportunity set for private equity. To gain a competitive advantage, success depends on disciplined execution – from pre-close diligence that addresses compliance and integration readiness, to post-close initiatives that deliver measurable gains in efficiency and capital use.

Analysys Mason’s transaction support practice works extensively with private-equity investors and portfolio companies to assess market opportunities, evaluate target capabilities and design long- or short-term post-acquisition value-creation plans. Our work spans technical and commercial due diligence, specific technology and data-governance assessments, and ERP/SaaS integration strategies.

For further advice on ERP and SaaS investment strategies, commercial and technology due diligence, and value-creation approaches, please contact Severin Forstner.

Article (PDF)

DownloadAuthor

Severin Forstner

Principal, expert in transaction support, especially software and IT servicesRelated items

Podcast

Is Europe entering a new phase of mobile consolidation?

Podcast

TMT M&A predictions 2026

Podcast

TMT predictions 2026: operators are at a crossroads