Why spectrum renewal policy matters for network investment and service quality

28 May 2025 | Regulation and Policy

Janette Stewart | Gentiana Shiko

Article | PDF (3 pages) | Spectrum

Telecoms regulators worldwide are aiming to create the right market conditions for dynamic, competitive markets that balance the needs of different market players, end users and network operators. Mobile network operators (MNOs) have historically made large investments in high-capex infrastructure roll-outs as mobile networks have evolved through successful technology generations. Retaining existing spectrum holdings is a critical component of an operator’s future network strategy.

With the upcoming expiry of existing mobile licences issued in the pre-4G era, there are choices over how best to achieve the objectives of supporting a competitive market.

One choice is whether to re-assign mobile spectrum licences that have been in the market for some time for legacy (for example, 2G/3G/4G use) through a new award mechanism. Another option is to renew licences to existing holders (possibly with new licence conditions aimed at further investment and/or other coverage improvements that are beneficial to end users).

For MNOs, licence renewal presents an opportunity to reassess existing spectrum holdings. However, it can also be a challenging period, as MNOs must secure the spectrum their networks currently rely on to avoid service disruptions and protect their existing customer base.

MNOs face various challenges to improve network quality

Currently, network quality remains uneven and often fails to meet the expectations of both users and policy makers in many regions worldwide. New technologies are often rolled out more slowly than expected. MNOs’ commercial decisions to prioritise deployment and network upgrades in the most populated areas perpetuate, and even exacerbate, the digital divide.

Licence renewal is therefore an important opportunity for policy makers to demand improved network investment as a condition of renewal. However, it can be difficult to determine where investments are most needed, and to match the investment needed with the type of spectrum on offer (for example, see our recently published article here) depending on current network quality and future goals in terms of service reach and quality. Despite network investment into 4G and 5G, consumer ARPUs are flat or declining in many markets. The investment case is stronger in urban areas to maintain quality of service against competitors, but consumers may not be prepared to pay more than they currently do for additional data or for higher-quality services. In rural areas, the commercial case for further network investment is even weaker where there are fewer subscribers using the infrastructure. Nonetheless, improving the quality of mobile coverage is often cited as a key policy objective by governments and by regulators because of the broad societal and economic benefits from higher-quality networks and widely accessible connectivity.

The right approach to licence renewal depends on regulatory objectives

Many mobile licences in several frequency bands will come up for renewal in different markets worldwide in the next 5 years. The majority of upcoming renewals are in the bands used for earlier generations of mobile technology (for example, 2G, 3G and 4G licences in the 900MHz, 1800MHz, 2.1GHz and 2.6GHz bands). We have seen that upon expiry of initial licence terms, regulators are increasingly offering licences of longer duration or allowing extension of licences currently held by existing players. This reflects the reality of mature mobile markets − an entirely new network build is not only inefficient, but increasingly unviable. The latest radio network equipment must be designed to enable the transition from previous generations to maintain service continuity and take account of the existing base of handsets in the market.

While 15-year and 20-year licence durations have been relatively common for mobile licences, some jurisdictions have embedded extension clauses. Notably, Spain decided in April 2021 to increase the maximum licence duration to 40 years, resulting in new licences (such as for the 700MHz auction in July 2021) that have a 20-year initial term and potential renewal of an additional 20 years.

The licensing approach will affect licensees’ ability to upgrade

One lever that governments and regulators can use to incentivise investment is in the conditions they attach to assignment of mobile spectrum, for both new spectrum licences and renewal of existing spectrum licences.

In some markets, simply maintaining the current licence arrangements at renewal may effectively support policy makers’ objectives around efficiency and service continuity for consumers. However, some might argue that preserving the status quo does nothing to encourage the types of innovation that a more flexible use of spectrum and/or re-assignment of some bandwidth via planning a new spectrum award might make possible.

Service quality matters, and may dictate the approach to spectrum (re)assignment

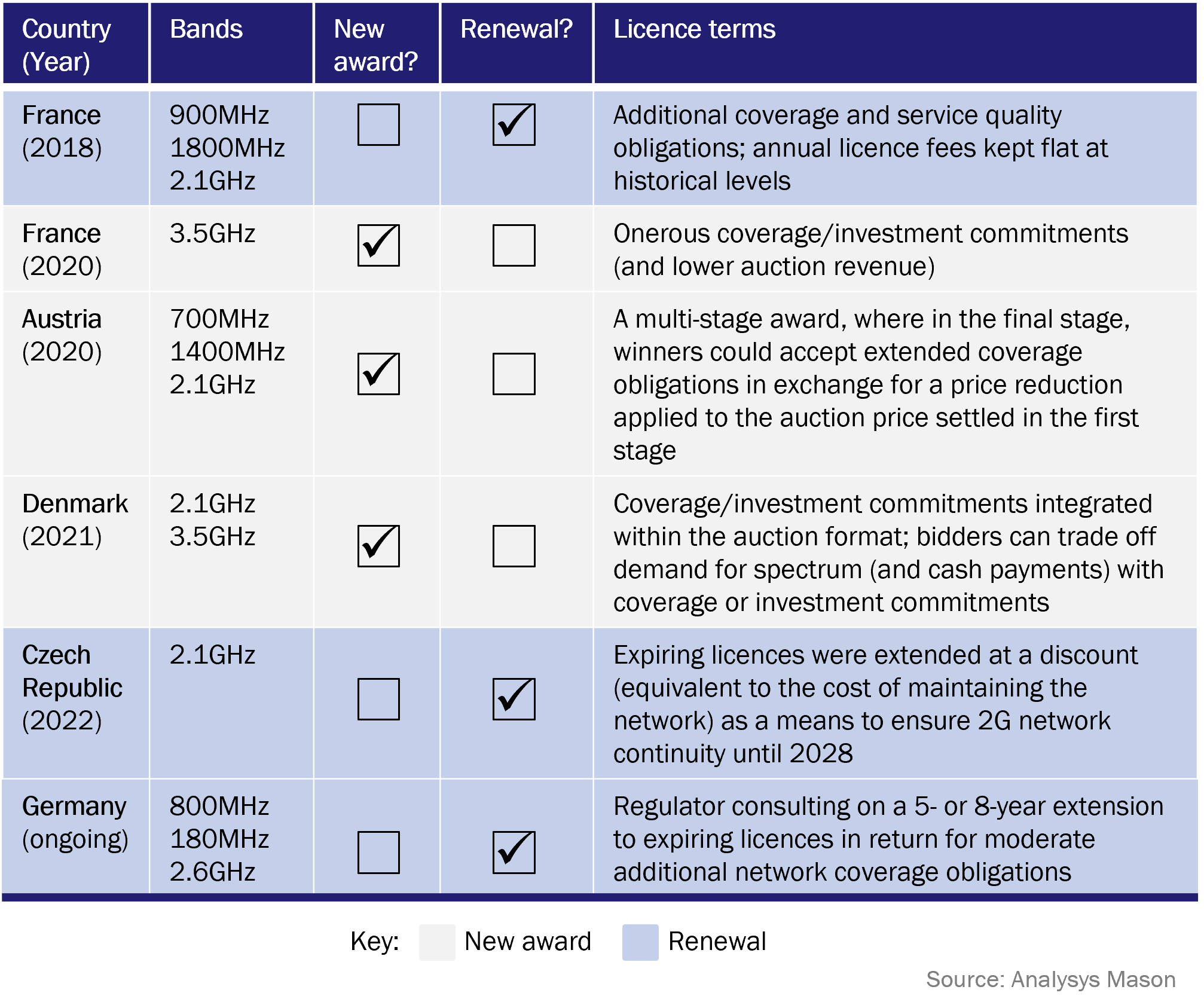

Auctioning spectrum licences for fixed terms with coverage obligations has become the default approach but there are alternatives that can enhance investment in mobile networks and improvements in network quality both directly and indirectly. We have already seen some examples of other approaches to spectrum (re)licensing that are designed to support various market-specific desires for coverage improvement, as summarised below.

Figure 1: Examples of renewals versus new awards for mobile spectrum licences in Europe, 2025

There have been discussions around ‘cashless auctions’, in which the financial payment for licence renewal is removed completely in favour of higher investment commitments. The use of depreciating licences for spectrum has also been proposed but is a significant deviation to current approaches.

Service continuity and re-investment to increase service quality are some of the direct benefits that spectrum licence renewal can bring, but the treatment of licence renewals cannot be fully addressed without also considering how spectrum is priced and paid for. This consideration must include the annual licence fees that are payable in many markets. Relationships between spectrum licence fees and network investment are the subject of much debate, and the arguments in each direction are far from proven:

- An economist would contend that the profitability (or otherwise) of an investment case is not altered by what is spent upfront on spectrum, assuming the investment is commercially profitable over the duration of the licence.

- On the other hand, the CFO of an MNO will readily explain that they are constrained by fixed capex budgets and that cashflow determines network opex; less money spent on spectrum means more money is available to spend on the network operation and upgrading.

For further advice on strategy and investment considerations linked to spectrum licence renewals, contact Janette Stewart or Mark Colville.

Article (PDF)

DownloadAuthors

Janette Stewart

Partner, expert in spectrum policy, pricing and valuation

Gentiana Shiko

ManagerRelated items

Predictions

Satellite D2D will benefit early adopter MNOs in 2026

Article

A changing spectrum landscape offers new opportunities for creative financial sponsors

Article

New thinking on spectrum valuation is needed for upper mid-band frequencies