Many operators have sub-scale IoT divisions and must make bold choices if they want to succeed

Many mobile network operators worldwide have invested heavily in the IoT market, but the return on investment (ROI) has been mixed. Connectivity accounts for the majority of an operator’s IoT revenue, and the low average revenue generated per connection (ARPC) – typically under USD1 per month – means achieving scale is critical in order to produce a profitable IoT business.

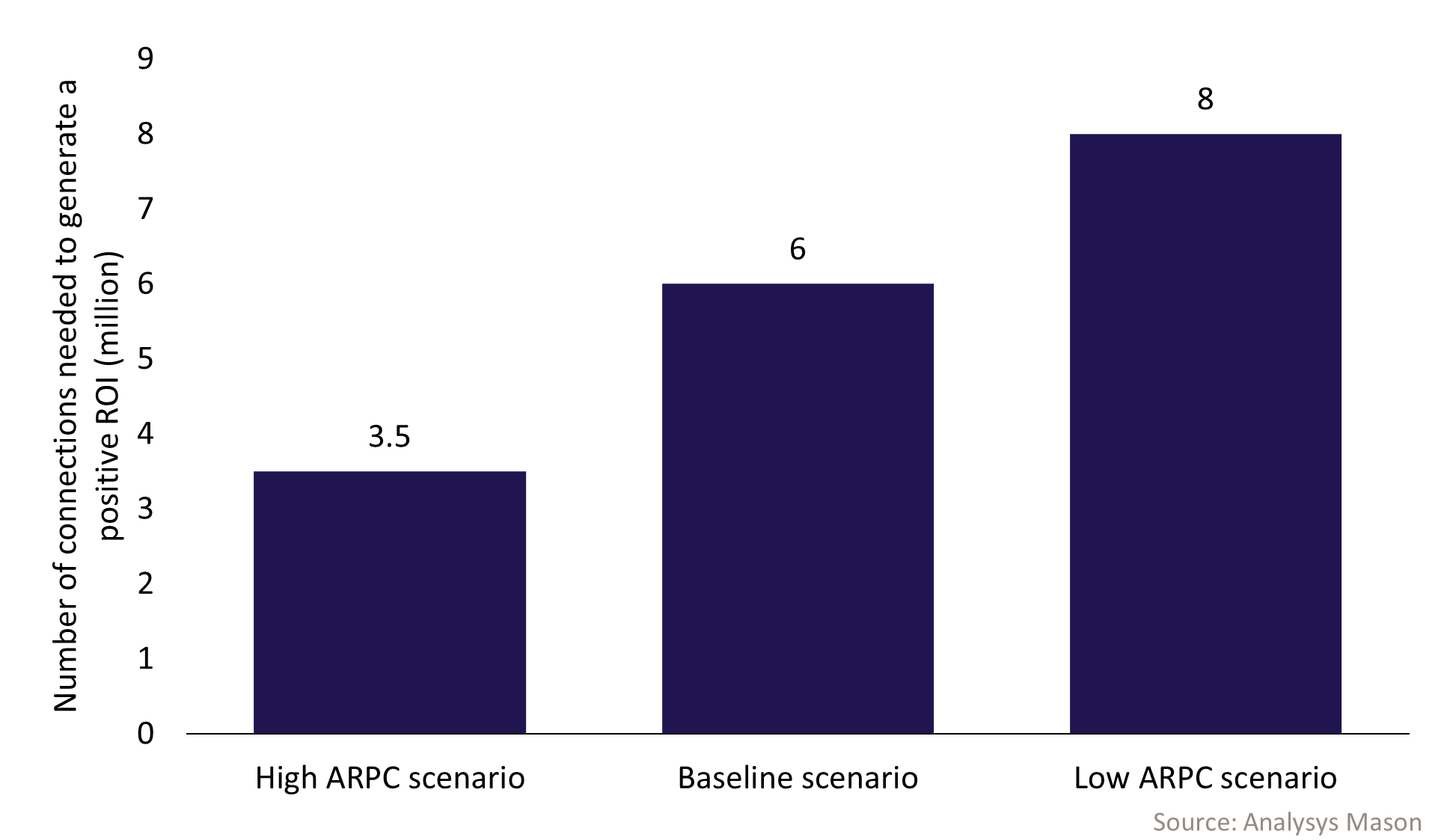

Analysys Mason believes that many operators’ IoT businesses have yet to reach the scale needed to unlock sustainable profitability. Our analysis suggests that operators with around 6 million or fewer IoT connections are likely to be sub-scale in a baseline scenario. This is not a hard rule – operators with an above-average ARPC or with lower operating costs can still have profitable IoT businesses with fewer than 6 million connections (and operators with higher operating costs/lower ARPC will need more than 6 million). However, our 6 million IoT connections threshold serves as a rough benchmark.

Operators with sub-scale IoT businesses need to take proactive steps rather than wait for conditions to improve. Operators could move away from IoT, either partially, by concentrating on the wholesale market, or fully, by selling their IoT businesses. Alternatively, operators could explore bolder options to reach the necessary scale, such as acquiring an IoT mobile virtual network operator (MVNO) or merging with or acquiring another mobile network operator’s (MNO) IoT business.

Operators with fewer than 6 million connections could struggle to become profitable

We have modelled the business plan of an operator’s IoT division with some high-level assumptions.

- An ARPC of USD0.7 per month in the baseline scenario to estimate annual revenue (flexed by +/–20% in low- and high-ARPC scenarios)

- Conservative estimates on growth in the number of connections (10% per year) and ARPC erosion (2% decline per year)

- Some simple assumptions on the costs to an operator of running an IoT business. This includes:

- the cost of connectivity

- recurring platform costs; some operators own their own connectivity management platform but we assume here the operator licenses its platform from a third party

- costs for staffing and other administrative expenses such as marketing and legal fees; this will typically be the biggest cost contributor

- fixed costs such as platform integration fees and R&D investments which are typically low relative to variable costs.

Figure 1 shows the output of the model – the thresholds for the number of connections needed to generate a positive 10-year return, based on the different ARPC scenarios.

Figure 1: Estimated number of connections needed to reach scale in IoT, 2025

The number of connections needed to achieve scale is highly sensitive to the ARPC. If the ARPC is 20% lower than the baseline scenario, the number of connections needed to reach scale jumps from 6 to 8 million, a 33% increase.

We have used the best data we have to develop this model but it should not be taken as a hard and fast rule. Each operator has its own set of costs, position in its value chain and local market dynamics that will affect its addressable market and ARPC. But the implications are clear: operators with fewer than 6 million IoT connections, and with limited growth prospects, are likely to struggle to reach profitability.

A number of operators remain below or just at the sub-scale level

A select few operators worldwide have scaled their IoT businesses to over 100 million connections (AT&T, Vodafone and the three MNOs in China) and a handful have between 10 and 100 million (such as Orange, Telefónica and Verizon). The majority manage fewer than 10 million connections. Figure 2 lists some examples from operators that report the number of IoT connections, and some operators for which we have made informed estimates.

Figure 2: Operators with 10 million or fewer IoT connections, select examples, 2024

| Operator | Number of IoT connections, 4Q 2024 (reported unless otherwise stated) |

| Bouygues Telecom, MTN, Telstra, Vodacom | 8.1–10.0 million |

| LGU, SK Telecom, Telia | 6.1–8.0 million |

| MasOrange, Proximus, Turkcell | 4.1–6.0 million |

| Korea Telecom, Spark, Telus | 2.0–4.0 million |

| BT, Bite, Chunghwa Telecom, Elisa, Globe, NOS, Odido, Omantel, SFR, Singtel, TDC, Telenet, Telkomsel | Estimated to be fewer than 6 million |

Source: Analysys Mason

Not all of the operators in this group have unprofitable IoT businesses. Some enjoy higher ARPCs due to limited market competition or by developing solutions beyond connectivity. Some will have realistic expectations of strong future growth in connection numbers. Many others rely on low-value connectivity, have limited prospects of future growth in connection numbers, and may be in a vulnerable position. They have a few options on how to respond.

- Make a push to scale up organically. It will likely be difficult to find strategies that have not been tried already but an operator may be able to make a push in a new or emerging area, or there may be new contracts that can be aggressively targeted.

- Retreat to a wholesale role. They could decide to only pursue wholesale opportunities by selling data and network access to other operators and MVNOs, providing a small revenue stream with minimal costs. The operator would need to find a solution for its existing retail customer base (perhaps selling the customer base to another player). The operator would also need to consider how to offer IoT services where a customer wants them as part of broader enterprise contracts (perhaps through a resale or referral agreement with an MVNO).

- Exit the market altogether. This is a more extreme solution (that is, not even have a wholesale offer) but we do not expect operators to follow this path.

- Use acquisitions. The operator could gain scale by buying market share. This could be through the acquisition of an MVNO or IoT reseller. A more radical step could involve buying the IoT division of another MNO. In this acquisition scenario, the IoT division remains wholly owned by the MNO.

- Spin off and merger. An alternative option would be to spin the IoT division into a separate company and then use this as a vehicle to merge with IoT divisions of other MNOs. In this scenario, the new company could be fully owned by the MNO, or jointly owned with other investors or MNOs.

We will explore these options in detail in an upcoming report, planned for 3Q 2025.

Operators assessing options for their IoT divisions fits a wider delayering trend

Delayering has been a broad trend for operators in recent years. Operators have sold off fixed assets (such as towers and fibre networks) and explored options for other divisions, including content divisions and business divisions. Operators exploring options for their IoT division are not following an exceptional trend but part of a bigger story of telecoms operators revaluating their role and what they should own.

Analysys Mason’s IoT Services programme provides data and strategic analysis on the cellular IoT market. It includes detailed forecasts and reports that provide insights on the IoT strategies of operators, MVNOs and other connectivity disruptors. For further insight, contact Ibraheem Kasujee.

Article (PDF)

DownloadAuthor