Using segmentation and insights from digital-native businesses to inform a global networking vendor’s sales and marketing strategy in Asia–Pacific

Client project | Strategy

“Our client wanted to understand what set digitally native mid-sized businesses apart in Asia–Pacific, and how their success could be replicated by more traditional firms. Through a tailored research programme and in-depth analysis, we identified best practices that are now helping to shape the client’s sales and marketing strategies in the region.”

– Hugues-Antoine Lacour, Analysys Mason Principal

The challenge

Identifying and applying digital best practices in support of slower technology adopters in Asia–Pacific

A global technology vendor was looking to identify the behaviours and success factors of digitally native medium-sized businesses (500–1999 full-time employees) in the Asia–Pacific region. The aim was to extract best practices that could inform strategies to accelerate technology adoption among slower-moving firms.

Drawing on our expertise in designing robust primary research frameworks and delivering actionable insights, we were commissioned to conduct a targeted survey in two Asian markets: India and South Korea. The focus was on organisations within the financial, insurance, real-estate and retail sectors – industries expected to include a higher proportion of digital leaders.

Our approach

Segmenting customers and identifying digital leaders through a quantitative and qualitative research programme

We conducted a bespoke survey of over 400 technology decision makers in India and South Korea, selected to represent middle- and high-income economies respectively. The survey explored the extent of digital technology adoption and the role of technology partners in supporting transformation.

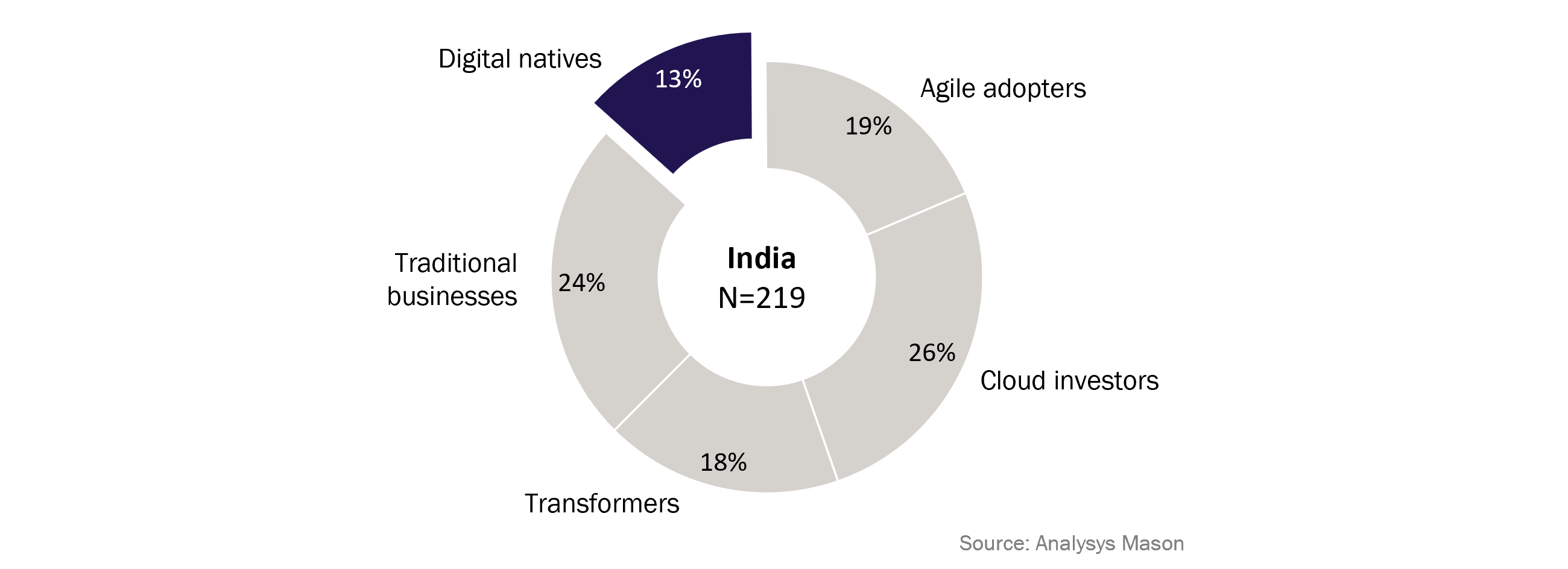

We applied multivariate cluster analysis to segment respondents by technological and process maturity, identifying sub-groups with distinct adoption behaviours. Digital-native businesses (DNBs) emerged as a key segment, defined by early and extensive cloud adoption, platform-based business models, and strong internal cultures of collaboration and technology enablement. Other segments displayed some advanced characteristics – such as widespread cloud adoption or frequent use of Agile and DevOps – but lacked the defining attributes that distinguished truly digital-native organisations.

Figure 1: Enterprise technology customer sub-segments identified in India, 2022

To deepen our understanding, we supplemented the survey with in-depth interviews with six executives from DNBs, which helped to validate our hypotheses and explore how organisational behaviours translated into sustained digital maturity.

The impact

Delivering best-practice guidance to inform sales and marketing strategies targeting slower adopters

We created a toolkit of best practices based on the behaviours and strategies of the leading DNBs, offering a practical template for organisations looking to accelerate their digital transformation journeys.

Our final report provided:

- detailed recommendations for how slower adopters could adapt internal processes and talent strategies to mirror DNB success factors

- strategic guidance for how our client and its partners could refine their product, sales and marketing efforts to better support these organisations.

The findings directly supported the client’s efforts to tailor its go-to-market strategy across diverse customer segments in the region.

Contact

Hugues-Antoine Lacour

PrincipalRelated items

Client project

Building a corporate strategy to achieve over 20% revenue growth, diversify the portfolio beyond core telecoms and harness AI-driven value creation

Client project

Developing a go-to-market strategy and a first-of-its-kind business case for an Asian telecoms operator’s entry into the GPUaaS market

Client project

Building the business case for a major 5G launch in South Asia, unlocking 250 million users and 10% 5G-driven ARPU growth in 3 years