Transforming a global financial management software vendor’s go-to-market strategy through advanced customer segmentation

Client project | Strategy

“As our client shifted to a Software-as-a-Service (SaaS) model, it needed a fresh lens on its small and medium-sized business (SMB) customers. Our large-scale segmentation study uncovered five distinct segments and seven actionable personas, enabling a more targeted go-to-market approach that contributed to improved business performance and deeper engagement in the SMB segment.”

– Hugues-Antoine Lacour, Analysys Mason Principal

The challenge

Reimagining SMB engagement amid a shift to Software as a Service (SaaS)

A global provider of financial management and enterprise resource planning (ERP) software was transitioning its core business model from perpetual licences to an SaaS-based offering. To support this transformation, the client needed to better understand its large and diverse small and medium-sized business (SMB) customer base. It aimed to concentrate resources on high-potential segments – those demonstrating both interest in SaaS and a higher willingness to spend – while continuing to support a broader base of legacy customers.

The client engaged Analysys Mason to conduct a robust, large-scale segmentation study to uncover not just firmographic characteristics, but also the psychographic traits and behavioural drivers that influence SMB technology purchasing. The goal was to enable more informed targeting, improve customer engagement, and increase sales effectiveness across the organisation.

Our approach

Delivering granular customer insights and actionable personas to inform go-to-market strategy

We undertook a comprehensive research programme involving a large-scale quantitative survey and deep qualitative follow-up:

- In the quantitative phase, we surveyed over 10 600 SMBs across nine high-income markets (USA, Canada, UK, Ireland, France, Germany, Spain, Australia and South Africa). The survey covered traditional metrics – such as company size, sector, and revenue – as well as attitudinal, behavioural and psychographic indicators, including openness to change, IT decision-making approach and digital outlook.

- In the qualitative phase, we conducted in-depth interviews with 223 SMB technology decision-makers to contextualise and validate survey findings and add depth to customer narratives.

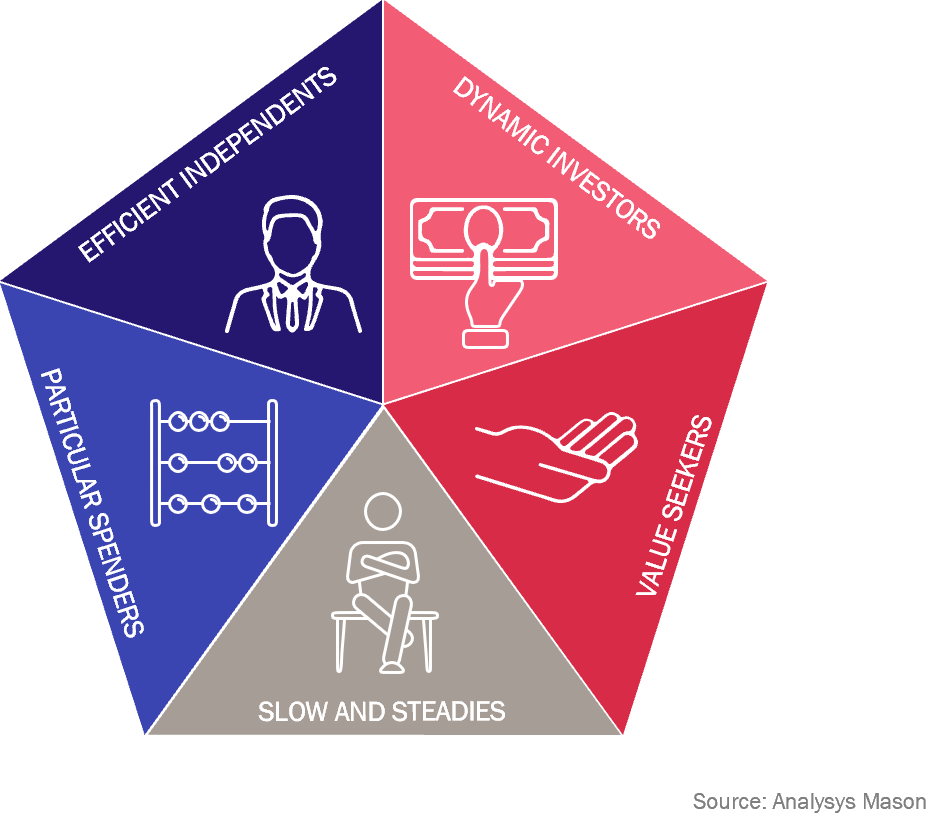

Using multivariate cluster analysis, we identified five core SMB segments, two of which showed particular strategic promise. We then developed seven distinct buyer personas, synthesising personal and professional characteristics that influence technology adoption – providing the client with a humanised, nuanced view of its target customers.

Figure 1: Overview of customer segments

To support long-term internal adoption, we facilitated a series of collaborative workshops and brainstorming sessions across the client’s global teams. These sessions were designed to embed the segmentation framework and equip staff at all levels with the knowledge and tools needed to engage more effectively with SMB customers.

The impact

Enabling a step-change in SMB sales effectiveness

Our work represented a fundamental shift in how the client approached its SMB segment. It delivered both immediate and long-term commercial value:

- We developed a tagging algorithm to classify existing and prospective customers within the client’s customer relationship management (CRM) system into each of the five core segments, enabling focused sales outreach and improved pipeline prioritisation.

- Our analysis also identified customers at high risk of churn and offered targeted retention strategies.

- More broadly, our client used our findings to reframe its go-to-market strategy, product roadmap, and value propositions for SMB buyers.

Within 2 years of implementation, the client reported its strongest-ever operational and financial results in the SMB segment.

Contact

Hugues-Antoine Lacour

PrincipalRelated items

Client project

Building a corporate strategy to achieve over 20% revenue growth, diversify the portfolio beyond core telecoms and harness AI-driven value creation

Client project

Developing a go-to-market strategy and a first-of-its-kind business case for an Asian telecoms operator’s entry into the GPUaaS market

Client project

Building the business case for a major 5G launch in South Asia, unlocking 250 million users and 10% 5G-driven ARPU growth in 3 years