Regulators face difficult decisions in assigning 26GHz spectrum

The EC proposed, in its 2016 5G action plan, that member states should grant access to at least 1GHz in the 26GHz band for mobile use by 30 March 2020, provided that there is market demand.1 The plan envisaged that 5G networks would start to be introduced by 2018, and that at least one major city in each country would be ‘5G-enabled’ by the end of 2020. All urban areas and major terrestrial transport paths in all member states were expected to have uninterrupted 5G coverage by 2025. The Implementing Decision2 set out common technical conditions in order to allow the use of the 26GHz band for 5G systems by 31 December 2020. At present, it is expected that this band will initially be used in traffic hot spots, transport paths and/or industrial sites, with enhanced mobile broadband (eMBB) services likely to be deployed first.

The deadline for assignment that was originally set in the EC’s 5G action plan has now passed, and awarding 26GHz spectrum by 31 December 2020 continues to look ambitious. At the time of writing, regulators in Italy and Finland were the only ones to have awarded 1GHz in the 26GHz band for mobile services, and consultations (with the aim to award some of the 26GHz band in 2020) were only underway in a further six member states.3 The COVID-19 pandemic is likely to slow progress for these states and others that are working towards a post-2020 timescale.

Uncertainty regarding the commercial use case remains, in our view, the main barrier to further assignments in the 26GHz band. This uncertainty makes it difficult for operators to assess when and how the spectrum might be of use to them and hence, the quantity of spectrum that they need and the value that they might place on it.4 At the same time, there is a potential demand from enterprises for spectrum to use in private networks, which could, at least partly, be addressed by spectrum in the 26GHz band.

It is therefore extremely challenging for regulators to determine how much 26GHz spectrum to assign for mobile services, when to assign it and how this should be done, including the detailed design of an appropriate award mechanism, such as an auction. Nonetheless, regulators are required to both uphold the EC Implementing Decision and meet their other statutory duties such as ensuring an efficient assignment of spectrum and protecting (or enhancing) competition. In this context, we suggest that regulators focus their thinking around four key considerations.

- Sufficient bandwidth needs to be made available to support emerging commercial use cases and encourage competition in the market. There is some variation in the approach used in the 26GHz spectrum awards in Europe that have already been planned, but typically, at least 1–1.2GHz is being made available to MNOs via exclusive national licences. This is broadly consistent with equipment vendors’ suggestions of optimum bandwidths of at least 200–400MHz per operator. Regulators in a small number of countries are following a hybrid approach, whereby the upper 1–2.4GHz is awarded via exclusive nationwide licences, and the lower 26GHz band is reserved for use by local private networks.5 It will be important to monitor market developments in order to understand whether larger spectrum blocks will be beneficial and, specifically, for what applications, noting that existing users of spectrum in the 26GHz or adjacent bands may impose additional constraints in some markets.

- Licences should be issued with appropriate geographic scope and duration in order to encourage investment and large-scale deployments, while supporting local demand and innovation. Nationwide exclusive licences allow the greatest flexibility for MNOs, while regional licences could be considered if there is evidence of localised demand that may not be met by MNOs in individual markets. Licences with a longer duration (akin to the 15–20 year licences typically issued for low- and mid-band mobile spectrum) will allow for time to recover any initial investment and may encourage higher capital expenditure, thereby widening the geographic coverage and potentially bringing forward the launch of new services.

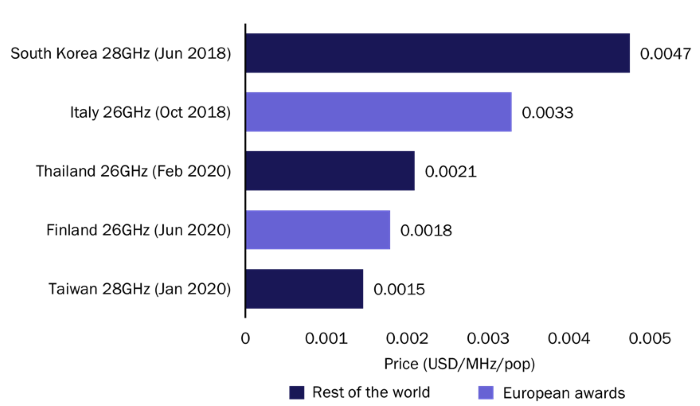

- Licence costs and obligations should be carefully considered. Low licence costs, particularly in terms of upfront fees (which can potentially be either deferred or partially replaced by annual licence fees), may stimulate demand. Benchmarks are limited in number, but licence costs for spectrum in the 26GHz and 28GHz bands have so far been reasonably low, as shown in Figure 1. Licence obligations for mmWave bands have generally been minimal and tailored to the most likely deployment scenarios (for example, high-capacity small cells), although the deployment requirements in South Korea were more stringent.6

Figure 1:Normalised prices7 for recent spectrum awards in the 26GHz and 28GHz bands

Source: Analysys Mason, 2020

- The award process needs to reflect the local market demand and the expected competition for the spectrum. A competitive process such as an auction may be most appropriate in markets where the total bandwidth available in the 26GHz band is limited and/or there is high or uncertain demand for additional spectrum. By contrast, an administrative approach may provide additional flexibility and encourage new entrants in markets where the demand is likely to be lower and/or be significantly localised.

Careful consideration of each of these areas should help to ensure that regulators are able to assign 26GHz spectrum licences in the most appropriate manner for the individual market concerned.

Analysys Mason offers services including spectrum valuation and auction support, as well as advice on business planning and spectrum management issues, to operators and regulators around the world. For more information about our services, please contact Mark Colville, Janette Stewart or Gentiana Shiko.

1 EC (2016), European Commission 5G for Europe Action Plan, COM(2016) 588 final. Available at: https://ec.europa.eu/newsroom/dae/document.cfm?doc_id=17131.

2 EUR-lex (2019), EU decision 2019/784 of 14 May 2019. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32019D0784.

3 These states are Belgium, Denmark, France, Germany, Spain and the UK; the regulator in Sweden is planning to award some 26GHz spectrum in 2021.

4 We will consider the issue of 26GHz licence valuation in more detail in an upcoming article.

5 The regulator in Finland reserved 850MHz for local private networks, and the Swedish regulator has plans to do the same. The regulator in Hong Kong reserved 400MHz for local shared access. The regulator in the UK has made 2.25GHz available for local shared use, but this is limited to indoor use in order to lower the risk of interference with current users.

6 In Italy, services are to be made available in each region 48 months from spectrum assignment date. In Hong Kong, the regulator relaxed the short-term roll-out obligation timelines following feedback from the MNOs. In South Korea, the conditions for the award of 28GHz spectrum include that it should be rolled out to 100 000 base stations (macro or small cells), including 15 000 within the first 3 years. In Finland, services should be launched within 2 years of the licence start date (1 July 2020), but this is open for reconsideration based on technology advances and the economic situation.

7 Normalising to a licence duration of 20 years, assuming a 6.0% WACC and adjusting to 2020 real terms; ALFs are included where applicable.

Article (PDF)

DownloadAuthors

Mark Colville

Principal

Gentiana Shiko

ManagerRelated items

Article

New thinking on spectrum valuation is needed for upper mid-band frequencies

Article

Why spectrum renewal policy matters for network investment and service quality

Article

Does the mobile market need additional sub-1GHz spectrum?