Backhaul networks: comparing the economics of using satellite mega-constellations rather than fibre optics

25 October 2022 | Research

Christopher Baugh | Carlos Placido (independent adviser)

Article | PDF (3 pages)

The recent deployment of high-capacity, low-latency LEO satellite mega-constellations brings challenges for telecoms operators in the retail broadband market but also provides new options for the economic expansion of terrestrial backhaul networks.

Satellites are becoming mainstream, which is altering the dynamics of the telecoms market

Telecoms carriers have long partnered with satellite operators to enable communication services in remote communities, but this been a niche market.

Over the last few years, technology advances have made satellites more cost-efficient for broadband and mobile backhaul, but – compared to terrestrial options – link latency and bandwidth costs have been high, which has tended to limit satellites to being the ‘technology of the last resort’. However, players in the LEO satellite mega constellation market, including Amazon (Kuiper), OneWeb and SpaceX (Starlink), are bringing satellites into mainstream use, thereby altering the dynamics of the telecoms market.

SpaceX disrupted the satellite business by taking a vertically integrated approach to satellite manufacture, launch and network operation. The company has launched more than 3000 satellites and announced services in around 40 countries, and its their mission to “rebuild the Internet in space” is underway. Other players, such as Amazon, OneWeb and Telesat, have established partnerships with network providers and telecoms operators. Amazon and Verizon are collaborating in the USA on the yet-to-launch Kuiper constellation, and several other partnerships involving AT&T, Vodafone and others have been announced.

Constellations are an alternative to fibre-optic backhaul

Hundreds of terabits deployed in space can serve multiple applications including MNO backhaul. If we compare the relative costs of fibre and satellite backhaul, it turns out that satellites can be a cost-effective alternative to fibre for some combinations of the distances that need to be bridged and communities’ aggregate demand.

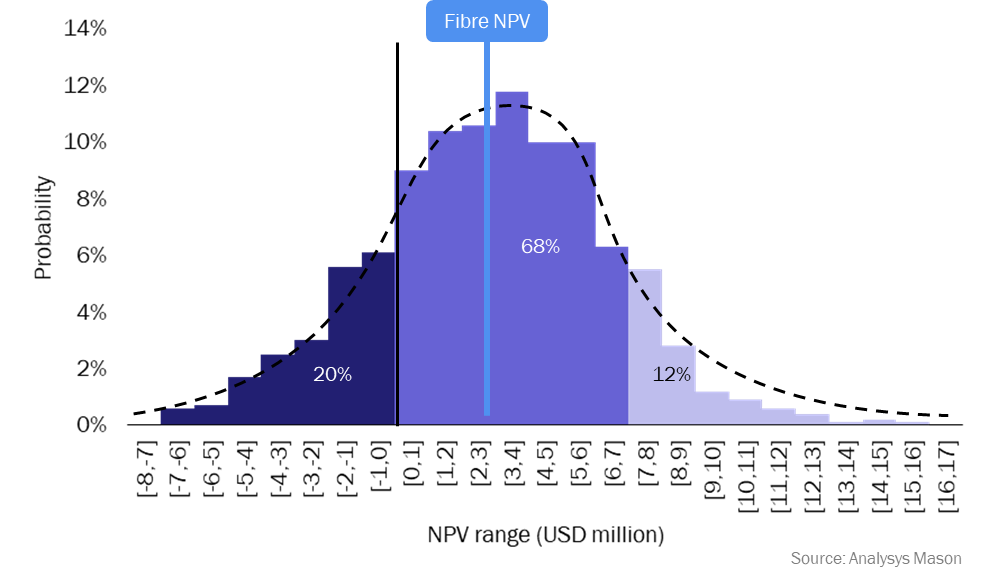

Deploying multi-billion dollar mega-constellations is capex-intense; Elon Musk said, “every new satellite constellation in history has gone bankrupt. We hope to be the first that does not.” However, a proper benchmark for deciding on the preferred approach to telecoms operator backhaul depends on fairly comparing the net present value (NPV) of a potential investment in (say) a fibre-optic network (regional/long-haul/festoon) compared with leasing aggregate capacity from a managed-services satellite operator. Given the unknowns that surround mega-constellations, a sensitivity analysis may be a good way to conduct such an assessment.

Sample sensitivity analysis: fibre versus satellite

Northern Sky Research (NSR) has a toolkit that can be used to perform such an analysis; the Non-GEO Constellations Analysis Toolkit 3.0 (NCAT3) can help to evaluate the pros and cons of connecting previously unserved communities with fibre and satellite (Figure 1).

Figure 1: A net present value (NPV) sensitivity analysis of satellite and fibre optics

The sample case assumes that an operator plans to serve 10 very remote communities with projected aggregate bandwidth demand of 7Gbit/s, requiring a fibre-network deployment of 3000km. Fibre projects vary in cost widely but, for this assessment, we made the following assumptions.

- Cost. The cost per kilometre includes the fibre itself, splices, amplifiers and civil work related to buried-cable installation. We have assumed USD8000 per kilometre, which is low and may be misleading because terrain challenges and other local/regional conditions can increase such costs substantially.

- Unprotected network. Our analysis assumes an unprotected, single-path fibre network; a protected ring would be more expensive.

One thousand possible results were recorded via a Monte Carlo simulation driven by randomly generated input ranges. Sample-case results show that if the telecoms operator leases 7Gbit/s of high-throughput satellite (HTS) capacity to reach 10 remote communities (instead of building a 3000km fibre-optic backbone network), there is a high chance (72%) that NPV will be positive, in the range of USD266 000 to USD7.1 million. There is a low probability that NPV will turn negative for the satellite option. On the other hand, if the telecoms operator builds a fibre-optic backbone network, NPV will be USD2.5 million.

Bandwidth costs are a key element of this comparison

Naturally, the satellite business case is sensitive to capacity costs. In Figure 1, NPV becomes negative for the sample case if bandwidth cost is higher than USD65 per Mbit/s per month. Also key to this analysis, is having realistic multi-year projections of aggregate traffic demand, because the point at which satellite is preferable to fibre is traffic-dependent. The marginal cost for fibre to serve virtually unlimited levels of bandwidth demand is low, diminishing the opportunity for satellites to compete for such links. However, the example shows that LEO constellations can potentially become a cost-effective alternative, if priced properly, for addressing a particular range of demand levels and the required distances to bridge. At other ranges of demand and distance, other solutions may be more appropriate including microwave point-to-point links or hybrid solutions that combine fibre links, microwave point to point and satellite solutions.

Because constellation players are doing the capex ‘heavy-lifting’, satellite backhaul is a relatively low-capex solution for telecoms operators (requiring only suitable satellite terminals), which could enhance specific metrics such as return on investment. Lastly, when aggregate traffic-demand projections are uncertain, an opex-based satellite solution can reduce risks by allowing the carrier to postpone the fibre investment decision.

Conclusions

Fixed and mobile network operators that want to connect the unconnected by expanding core and backhaul networks may find attractive satellite solutions from newly deployed LEO mega-constellations, at least for some ranges of demand and distance to bridge.

Recent trends indicate that backhaul via satellite may become attractive under a wider range of conditions if competition intensifies and oversupply drives down the cost of satellite bandwidth, particularly for high-volume telco leases.

NSR’s Non-GEO Constellations Analysis Toolkit 3.0 (NCAT3) is an assembly of flexible, easy-to-use analytical models that benchmark LEO and MEO satellite constellations at architectural and business layers.

Questions? Please contact us.

Article (PDF)

DownloadAuthor

Christopher Baugh

Partner, expert in space and satellite telecoms