Fibre carve-out: apparent similarities hide important differences that investors need to understand

Over the last few months, we have seen a significant number of fibre transactions all over the world. Analysys Mason has been fortunate enough to be involved in most of them. We expect that this trend will continue (or even accelerate) in the next few months.

On the demand side, the recent COVID-19 outbreak has, if anything, demonstrated the need for good broadband, and fibre connections in particular. This is expected to incentivise customer migration and fibre take-up. On the supply side, fibre deployment requires significant investment that operators will find difficult to finance from their own cashflows.

One option used in several recent deals is a fibre carve-out, whereby (in a manner similar to creating a towerco from a mobile operator), a fixed retail broadband operator splits its current (and/or to be deployed) fibre network into a newly created ‘neutral’ wholesale-only-focused fibre operator. The retail operator becomes an anchor tenant to the wholesale operator (often keeping a share of the new vehicle) while giving exclusivity to the new vehicle and agreeing on wholesale prices.

Based on our significant experience, we note that these deals have specific characteristics that are important. Even deals that seem alike can in reality be materially different, due to important features such as anchor tenant commitments, network technical factors or regulatory aspects.

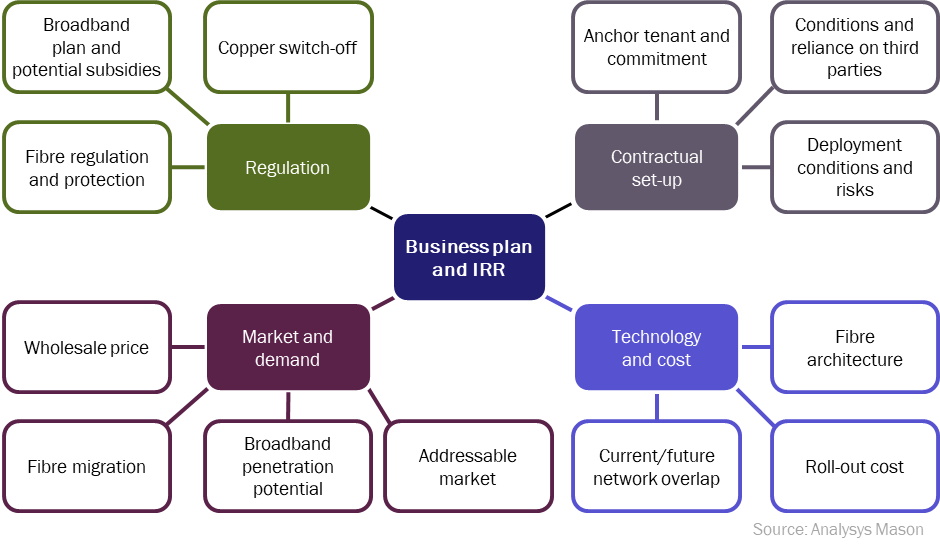

In the figure below, we present the key characteristics to review when performing commercial and technical due diligence of fibre carve-outs.

Figure 1: Key parameters of a due diligence for a fibre carve-out

Regulation

- Broadband policy/plans and potential subsidies. The existence of government initiatives and specific targets for fibre take-up and coverage can shape the market. In particular, the associated measures and any ways in which the regulator and government may intend to intervene (allocation of subsidies, binding commitment …) are relevant to assessing future fibre demand/supply.

- Fibre regulation/extent of overbuild protection (if any). The extent to which fibre is likely to be regulated (or not) will influence wholesale price levels and their evolution. Similarly, the potential legal protection or regulatory/economic disincentives for network overbuild may or may not result in a quasi-monopoly for fibre deployment.

- Copper switch-off plans. The timing of copper switch-off is a key driver for the schedule of broadband users migrating to fibre.

Market and demand

- Addressable market. Care is needed to understand the potential market size: not all premises passed are potential subscribers (second homes, addresses with no buildings or empty buildings, agricultural buildings, etc). Furthermore, the source of information should be carefully considered. The number of premises in initial network roll-out designs is often based on an estimate from national statistical institutions, for which the most recent census could be a few years old. Real network deployment projects will often reach between 5% and 10% more premises than census data may suggest.

- Wholesale price (co-investment/rent). The tariff structure scheme (monthly rental, co-investment/indefeasible right of use (IRU)) and price levels (current and expected evolution, and their consistency with retail tariffs) are obviously essential for the revenue assessment and the cash generation profile of the project.

- Fibre migration and long-term potential. Short to medium term take-up is mainly fuelled by standard broadband migration. In this context, the assessment of the retail market dynamics (market share, incentives and strategies to promote fibre take-up in covered areas) will dictate the shape of that curve. The long-term potential is a reflection of the overall potential for fixed broadband in the covered areas. The potential typically depends on the nature of the premises covered (that is, the proportion of secondary/empty sites) and the country’s macroeconomic environment.

Contractual set-up

- Anchor tenant and commitment. A key characteristic is the existence of one or several anchor tenants. The strength of these operators on the retail market (typically their market share) and the type of commitment they want or can legally take (due to deconsolidation objectives) provide quasi-guaranteed revenue and minimise the project risk.

- Conditions and reliance on third parties. Similarly, the reliance of the business plan on third parties and therefore not committed revenue is a key risk factor.

- Deployment conditions and risks. Some projects are based on a fixed cost deployment contractually agreed with companies that manage the deployment and often the maintenance of the network. This set-up obviously minimises the risk of cost overruns. Penalties for deployment delays are also sometimes covered.

Technology and cost

- Fibre architecture. The architecture (point-to-point network or GPON network with associated splitting ratio) and the type of services offered (passive, active, access, backhaul, co-location, residential, business etc.) are important to the cost and revenue potential.

- Roll-out cost. The deployment cost (even if in some cases contractualised) should always be assessed. The network architecture, capacity to reuse existing ducts and poles, the use of aerial or buried infrastructure, the need for civil engineering, site density and local labour costs are all key parameters.

- Current and future network overlap. The capability, economic incentives and strategic incentives of other operators to overbuild the expected network fibre deployment of the project are paramount to assess the retail market share that the fibre network can ultimately serve.

Please contact Stéphane Piot, if you want to discuss fibre due diligence projects or just want to discuss the key characteristics and differences of most recent (or forthcoming) operations.

Article (PDF)

DownloadAuthor

Stéphane Piot

Partner, expert in transaction servicesRelated items

Article

USD310 billion and growing: the data-centre supply chain is a major growth opportunity for creative investors

Article

New thinking on spectrum valuation is needed for upper mid-band frequencies

Article

CFO interview: Open Fiber CFO Andrea Crenna on raising capital and managing a consortium of 34 lenders