Cloud developments are providing data centre co-location investment opportunities in the GCC

There have been several significant cloud developments in the Gulf Co-operation Council (GCC) region in the last few months, and a number of global cloud service providers (CSPs) have launched their services (Figure 1).

Figure 1: Recent cloud developments in GCC region, January 2019–June 2020

| Country | Development |

|---|---|

| Bahrain | AWS launched services in Bahrain to serve the Middle East (with three availability zones) in 2019. |

| Qatar | Microsoft Azure announced that it plans to launch services in Qatar in late 2020. |

| Saudi Arabia | Both Microsoft Azure and Oracle Cloud launched in Jeddah in February 2020. |

| UAE |

|

Source: Analysys Mason, 2020

Amazon and Microsoft have been the most-active cloud providers in the GCC region lately, but they are using different approaches. Amazon Web Services (AWS) offers its products from a central hub in Bahrain using its own infrastructure. It relies on remote points of presence (PoPs) to serve other countries in the region. Microsoft has no proprietary data centre in the region and instead relies on a decentralised organisation, and each country is served by a local data centre.

CSPs tend to build their own infrastructure to serve the country/region (for example, Amazon’s hub in Bahrain) once they have launched their services, as demonstrated in more-developed markets. CSPs represent a major source of demand for co-location providers, so this trend is likely to have a significant effect on how the co-location market evolves.

The growing interest in public cloud should reduce the enterprise demand for co-location services

Co-location is the service provided by a data centre facility that enables a business to rent space for servers and other computing hardware. The co-location market is fuelled by enterprises’ demand to outsource their IT equipment for reasons such as cost, scalability and fitting with their IT outsourcing strategies.

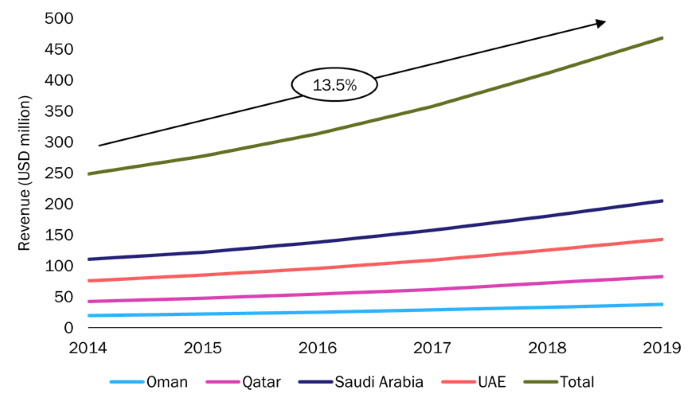

The IT expenses of SMEs and large enterprises have grown substantially thanks to digitalisation and IT transformation. This has provided a solid base for the growth of the co-location market in the GCC in the last 5 years (CAGR of 13.5%; Figure 2).

Figure 2: Co-location revenue, GCC region, 2014–2019

Source: Analysys Mason, 2020

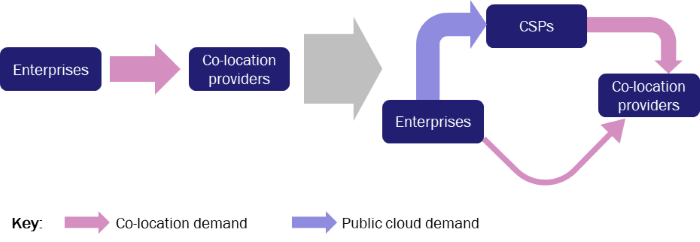

However, the co-location business is under threat from the alternative: public cloud. In this case, the server itself (or the software services that it provides, such as virtual machines, databases and message queues) can be rented from a cloud provider, rather than having to buy a server and hire space, power and cooling for that server in a data centre. Enterprises are increasingly shifting towards public cloud services offered by global CSPs, and this is likely to have a profound effect on the co-location market and its structure. Indeed, the demand that previously came directly from enterprise clients is increasingly being ‘re-routed’ through public cloud providers, who in turn, are outsourcing the data centre co-location parts of their businesses (Figure 3).

Figure 3: The shift in the enterprise demand for outsourcing from co-location to public cloud

Source: Analysys Mason, 2020

Telecoms providers are facing a crucial dilemma on the supply side

There are three types of players in the co-location market:

- carrier-neutral data centre providers that are focused on the co-location market

- telecoms providers that are focused on the continuity of their traditional services as telecoms operators in the data centre space

- specialist IT services players that are focused on value-added services and cloud, but also offer co-location.

The data centre market in the GCC is currently dominated by telecoms providers. Many of these players entered the market by extension of their main connectivity business and have benefitted from their large enterprise clients’ digitalisation and IT transformation activities. However, the demand for co-location services is shifting, in terms of both quality and quantity, and the growth in this demand is now expected to come from tech players and global CSPs. CSPs’ demand is different to enterprises’ in terms of scale, and requires greater sophistication and adaptability, as well as multi-carrier connectivity.

Telecoms providers are therefore facing a crucial dilemma. They either have to invest to keep up with the market demand or sell off parts (or all) of their data centre businesses. The latter will provide investors with interesting opportunities to buy stakes in an operator’s data centre business or their infrastructure and there have been several examples of such deals in other markets. Carlyle recently announced its plans to acquire a 25% stake in Bharti Airtel (India’s largest integrated telecoms operator), Brookfield invested in A&T’s data centre business (mainly in the USA) in 2019 and Asterion Industrial Partners invested in Telefónica’s data centres in seven countries in North and Latin America.

Investments in the co-location market should enable infrastructure providers to match CSPs’ requirements in terms of reliability and performance, which should limit CSPs’ motivation for building their own infrastructure to just economic aspects, that is, cost efficiency (which should be conditioned by the size of the demand due to economies of scale).

A number of legal and technical factors are driving the demand for local co-location in the GCC

Many enterprises need to be close to their co-located hardware, meaning that their co-location provider needs to be local. A shift to the cloud could remove this particular constraint. However, a variety of legal, technical and financial factors are strongly encouraging local co-location.

There is no federal law for data protection in the GCC and only some aspects of data protection are covered in the general laws. However, governments are starting to place a greater emphasis on data protection for the sake of their citizens’ privacy and are thinking of constraining or regulating the handling or location of sensitive data, particularly when it comes to serving the government, healthcare and banking sectors. Proximity to end users is also important in achieving low latency, which affects application responsiveness. Content providers need to cache some of their data close to the end user in order to minimise distribution costs, so international bandwidth costs can be reduced if local data centres are used. All of these factors favour the use of local data centres, but it is not yet clear to what extent CSPs will self-supply.

Indeed, CSPs may have plans to build their own infrastructure in the region, and this is likely to be a threat to the co-location market. However, the aspects discussed in this article should offset the impact. Firstly, global CSPs will need to have a certain level of local demand before it is efficient for them to open their own infrastructure (and this why Alibaba has put the building of its second data centre on hold; see Figure 1); this may take some time, even for very large players. Secondly, we expect to see a shift from centralised facilities towards resources that are closer to the end user (and are thus smaller), which will increase the number of ‘edge data centres’ in locations where CSPs’ investment in private facilities is not justified.

Article (PDF)

DownloadRelated items

Article

USD310 billion and growing: the data-centre supply chain is a major growth opportunity for creative investors

Article

CFO interview: Open Fiber CFO Andrea Crenna on raising capital and managing a consortium of 34 lenders

Article

The rise of AI is reshaping data-centre infrastructure and site deployment strategy