Greenhouse gas reporting requirements create an opportunity for the space and satellite industry

Space and satellite organisations have their own environmental, social and governance (ESG) strategies and aims but should also see the data that is required for ESG reporting as a significant revenue opportunity. Recent examples of partnerships based on satellite data being used to help companies to address ESG strategic goals include those such as Planet Labs’ partnership with risk assessment firm Moody’s and ICEYE’s work on flood risk management and mitigation. However, space and satellite companies, such as those in the Earth Observation segment, will also have a significant opportunity to provide data on emissions to their peers within their own industry.

NSR, an Analysys Mason company, recently conducted a survey of 67 space and satellite companies to find out more about their ESG-related strategies. Of these companies, we expect that 70% will need to report on their greenhouse gas (GHG) emissions to meet at least one regulatory requirement within the next 5 years.

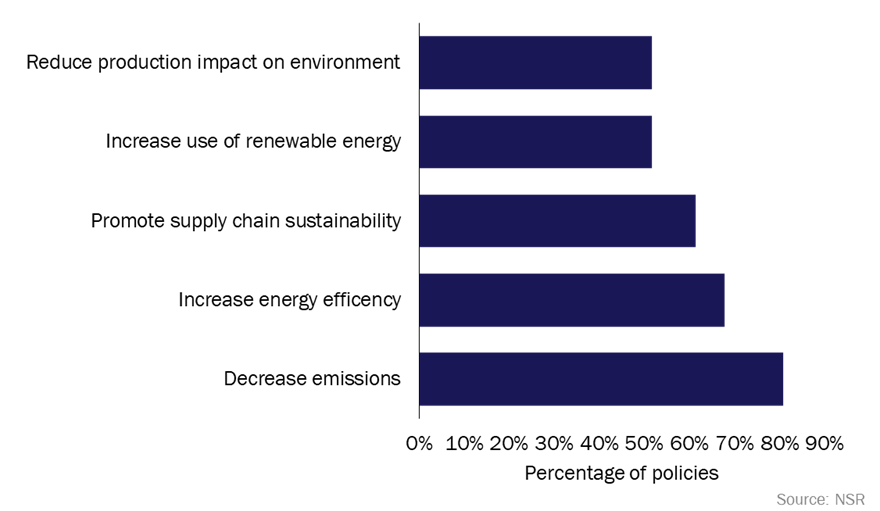

As part of this study, NSR also analysed the published ESG strategies of 31 space industry players. This analysis identified that most of the ESG objectives that were related to the environment were designed to address regulatory or social pressures for carbon-neutrality (Figure 1), and that all could use advances in space-based analytics to help to measure and monitor these goals.

Figure 1: GHG-related goals mentioned in ESG policies in the space and satellite industry, January 2023

As GHG emissions monitoring becomes mandatory worldwide, the space and satellite industry will be well-placed to provide data inputs.

Space and satellite companies have an opportunity to provide data on emissions to their peers in the industry

Advances in space-based earth observation data and related analytics can be harnessed to help to measure and monitor environmental goals. NSR’s Space ESG Assessment report notes that with the right impact and price-point, the Earth Observation segment of the space industry is well-positioned to gain significant revenue from serving the GHG emission data market. Companies in this segment use satellite-related imaging data to monitor aspects of Earth such as carbon emissions, land-use or environmental impacts. Existing reporting has used known standards, reported emission statistics and historical data, but a market for data is now forming in which there is an opportunity for satellite players. The recent increase in the availability of earth observation data has significantly reduced the price for end users, which is making satellite data more accessible to newer and smaller players in the space industry that are seeking to address GHG-related regulatory requirements.

We expect interest in this field to continue to increase. Data providers in the Earth Observation segment should be prepared to communicate and demonstrate the full range of satellite offerings. For at least some players, this will be a new area of industrial engagement, and service providers will need to be able to promote their services, such as the ability to validate technological emissions calculations, provide actual seasonal variation numbers (particularly useful for energy and land use) and make available precise information as newer technology comes online. Companies need to know about new service options if they are to purchase them.

The bottom line

The total addressable market for companies in the Earth Observation segment of the space and satellite industry will increase as the industry continues to respond to ESG regulatory developments.

NSR, an Analysys Mason company, provides satellite and space market research and consulting services. It specialises in identifying growth opportunities in four industry sectors:

- satellite communications

- satellite and space applications

- financial analysis

- satellite and space infrastructure.

For more information on the items discussed here, contact Sarah Halpin.

Article (PDF)

DownloadAuthor