Investor valuations indicate that traditional TV players must adapt to TV over IP or else face an uncertain future

Internet-driven innovation is accelerating the transformation of the video and TV markets worldwide.1 As a result, we are seeing valuation multiples of new media players completely outperforming those of traditional media players. In this article, we briefly comment on this observation and discuss the need for traditional players to adapt.

Investors provide higher valuation multiples to new media players than to traditional players

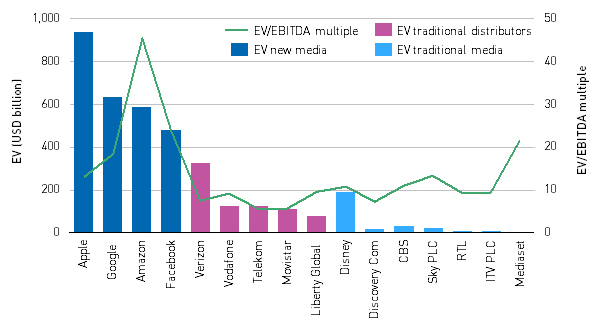

Analysys Mason has compared recent EBITDA to enterprise value (EV) multiples for a selected number of TV and video players grouped in to three categories. These multiples are between two and seven times greater for new media players than for traditional players (content or distribution).

Figure 1: EV/EBITDA multiple and EV (USD billion) for selected new and traditional media companies [Source: Yahoo! Finance, December 2017]

Traditional pay-TV operators face the greatest competitive challenge, but pressure on advertising TV and PSB will follow

The TV and video markets have three principal sources of funding: advertising, subscriptions (pay TV) and public funding. The nature of the challenges presented by TV over IP are different in each case, but we believe that pay TV currently faces the greatest challenge.

- Pay TV is currently most at risk from competition from TV over IP. Although the initial focus of new video players has been on video rather than TV, the launch of paid-for live TV ‘skinny’2 over-the-top (OTT) bundles (such as NOW TV) has put pressure on subscribers and ARPU. Skinny and all-inclusive TV packages, pure OTT and 4P/5P bundles will coexist. However, there is a risk of cannibalisation (by players such as NOW TV and Sky), and as consumers adopting these TV services, operators will need to adapt.

- Advertising TV is bearing up, but is coming under increasing pressure from TV over IP. The migration of traditional advertising to digital advertising will accelerate in the short-medium term, with mass market launches of live TV streaming and the use of data and algorithms to create value through better targeting. Moreover, advertisers are also demanding greater metrics, which the traditional platforms are struggling to provide. This will provide additional incentives for moving to TV over IP.

- Public service broadcasting (via public funding) seems (so far) to be more resilient pay TV and advertising TV. Funded public service broadcasters may appear to be less affected now, but still face pressure to deliver value for money. Other PSB-branded video and TV propositions over IP will increase and will aim to compensate for any losses in the reduction of viewing of traditional linear TV offers.

Traditional media players can adopt several strategies to help them adapt and compete with TV over IP

TV over IP technology can offer consumers their desired TV and video services across multiple devices and at times that suit them. Our research indicates that there are several key elements that characterise winning TV and video strategies and are central to investors’ expectations for sustainable long-term value. These strategies include the following.

- Integrated user experience. An excellent integrated linear and on-demand consumer TV and video experience is essential for retaining viewers and subscribers in the long term. User interfaces should favour discovery and display the most-relevant content prominently.

- Attractive content. New media competitive dynamics will favour the growth of global audiences, fostering the growth of attractive international content. However, it will also be important to include local content to appeal to customers.

- Trusted brands. In a fragmented Internet market, trusted brands will be able to compete for consumer attention and have the means to invest in high quality content.

- Low OTT distribution costs. Some OTT players are already providing lower prices to consumers and greater revenue share to content providers, reducing the value of vertically integrated pay-TV providers.

- Data and algorithms. Data and algorithms can provide a competitive edge to players, enabling them to maximise revenue.

Analysys Mason has broad experience in the audiovisual, telecoms and digital sectors. We work with players and investors, supporting them on transactions across the full media value chain (including producers, tv channels, pay-TV operators, digital terrestrial television (DTT), cable, satellite, IPTV, OTT and vendors).

1 For further details, see Lluís Borrell’s presentation from the IBC2017 Conference: Platform Futures Stream: Is IP really having an impact on broadcasting.

2 The term ‘skinny’ is commonly used to refer to small, or niche, low-cost OTT video or pay-TV offers.

Downloads

Article (PDF)Latest Publications

Article

USD310 billion and growing: the data-centre supply chain is a major growth opportunity for creative investors

Article

CFO interview: Open Fiber CFO Andrea Crenna on raising capital and managing a consortium of 34 lenders

Article

The rise of AI is reshaping data-centre infrastructure and site deployment strategy