Live TV OTT offers are accelerating the transformation of TV and video markets: implications for stakeholders

The growth and innovation of video-on-demand (VoD) services from providers such as Amazon and Netflix has been widely reported, and we have suggested that VoD services and players could have a major impact on the traditional TV and video markets. However, the VoD market is smaller than that of TV, and the double-digit growth of revenue in the VoD market has mainly been at the expense of the physical video market rather than TV.

We can illustrate this using European data. According to the European Audiovisual Observatory’s (EAO’s) latest data, revenue in the TV and VoD markets was about EUR100 billion in Europe in 2015 and increased at a CAGR of about 2% from 2011 to 2015.1 The TV market accounted for over EUR91 billion in 2015 and grew at the same rate. However, the VoD market increased at a CAGR of almost 46% during the same period and the physical video market declined at 10% during the same period (see Figure 1).

Figure 1: Video market revenue, Europe, 2011–2015 [Source: EAO Yearbook 2016]

![Video market revenue, Europe, 2011–2015 [Source: EAO Yearbook 2016] Video market revenue, Europe, 2011–2015 [Source: EAO Yearbook 2016]](https://www.analysysmason.com/globalassets/x_migrated-media/images/lluis-figure-1-600-px2.jpg)

In fact, the VoD market overtook that of physical video in 2015, but the TV market has continued to grow despite the pressure on viewing and changes to consumption patterns, particularly among young people.

Demand- and supply-side trends in IP-based live TV streaming suggest that the transformation will soon also affect TV revenue

We believe that demand- and supply-side evidence suggests that IP will begin to have a negative impact on revenue in the TV market from 2017. From the demand side, consumers continue to watch online and on-demand TV and video in addition to live, using multiple devices (not just the TV set) and in different locations (home, away and on the move). The changes are noticeable across all demographic segments and the transformation seems to be durable and non-reversible. For example, consumers are:

- spending significant amounts of time watching VoD or TV content on devices other than TV sets – more than 2.5 hours per day compared to more than 4 hours on TVs in the USA in 20162

- showing that they are satisfied with the quality of online live TV

- using mobile and portable devices to watch audiovisual content

- adopting new flexible subscriptions to pay for their audiovisual content

- watching premium, local and viral on-demand content online

- interacting directly with audiovisual content from trusted brands (such as Disney and HBO).

Supply-side evidence also suggests that the TV market will be transformed in the next couple of years. Following the launch of the first OTT VoD services about 10 years ago, traditional and new players have introduced a growing number of innovative and flexible IP-based TV and VoD propositions that increasingly include live TV or video features, such as:

- ‘free’ IPTV managed services associated with a broadband subscription (Freebox)

- freemium OTT plays including live FTA DTT and cloud DVR (Molotov TV)

- single-brand direct-pay OTT services (HBO)

- live premium sports events available on social media (La Liga on Facebook

- premium traditional TV players offering OTT services (Sky without a dish)

- live OTT streaming ‘skinny’ pay-TV packages (Amazon channels and YouTube TV launched such services in 2017).

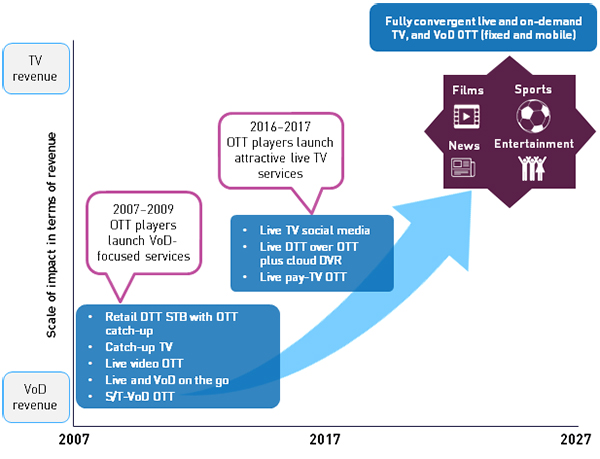

The figure below illustrates the acceleration of this transformation on the supply side.

Figure 2: Key supply-side developments in the IP transformation of the TV and VoD markets (illustrative)

We believe that the proliferation of live TV OTT streaming services and packages will accelerate the IP transformation of the TV market, which will affect the distribution of TV revenue between players.

Global and national players are increasing their focus on live TV OTT propositions, which will transform the TV market

We have concluded from some of the demand- and supply-side dynamics that the transformation of the TV market will accelerate from 2017. TV propositions will become more flexible, on demand and better quality, which will empower consumers. This market will require a more-focused and thinner consumer segmentation with targeted and flexible propositions to meet consumers demands. This will transform the dynamics of the underlying TV business models, particularly the commercial advertising and consumer spending model, and will challenge players’ strategies, regulators’ perspectives and investors’ preferences.

TV and video market revenue will be affected, but whether it will expand or contract will vary by country and will depend on: the maturity and saturation of the markets; the demand elasticity of new flexible advertising and consumer pay entertainment; and the incentive that each player type has to take advantage of the opportunities that IP-based live and on-demand TV offer.

The changes will be many and the implications are complex. We will continue to monitor the situation and are identifying scenarios to help clients to assess the implications, but it is worth noting that unless current regulatory frameworks are changed, new players do not need to respond to same national policy and regulatory oversight as existing TV and telecoms players. This is already an area of debate and will be a source of dispute.

Given that the transformation of the TV and VoD markets will accelerate from 2017, Analysys Mason can help:

- operators to understand (a) the competitive dynamics of more-flexible and skinny packages as well as large convergent bundles (b) the elasticity of demand in each country to new offers and the potential for the market to expand or contract (c) the incentives of existing players and new intermediaries to favour new business models in the value chain (d) the new advertising and business opportunities that OTT content and new platforms can provide

- regulators to understand (a) the blurring differences between audiovisual reference markets that were traditionally distinct (VoD and TV, FTA and pay TV) (b) the potential threat of the accelerated transformation to their goals and policies and (c) the regulatory and policy responses that will be required.

- investors to understand (a) the evolving value of premium and original content to national and local distributors because this will change the approach that rights owners take to selling their rights (b) the value of national and international distribution to different rights holders (c) the consolidation of players to gain scale (content and/or distribution) (d) investment in very focused content offers benefiting from the global scale of online distributors.

Analysys Mason has broad experience in the audiovisual, telecoms and digital sectors – we work with media, telecoms and Internet players, regulators and investors on specific issues, such as assessing: consumer attitudes to new flexible TV propositions; regulatory challenges that new digital platforms pose to the TV market; and how the future value of traditional broadcasting company assets depends on the diversification and mitigation strategies of these companies.

1 Yearbook of the European Audiovisual Observatory (2016). Available at http://yearbook.obs.coe.int.

2 www.nielsen.com/us/en/insights/reports/2017/the-comparable-metrics-report-q4-2016.html.

Downloads

Article (PDF)Latest Publications

Project experience

Enhancing Microsoft’s product and marketing strategy and strengthening its position as a thought leader in the SMB segment

Project experience

Using segmentation and insights from digital-native businesses to inform a global networking vendor’s sales and marketing strategy in Asia–Pacific

Project experience

Transforming a global financial management software vendor’s go-to-market strategy through advanced customer segmentation