OTT’s VoD and TV services are changing traditional TV’s business models and retail pricing dynamics

The widespread use of IP distribution is driving the transformation of TV services worldwide. This transformation is being achieved primarily through the development and take-up of OTT video-on-demand (VoD) (such as those services that have evolved from traditional physical video including Amazon Video and Netflix) and on-demand TV services (including those that have evolved from traditional TV such as BBC iPlayer, NOW TV and Sky Go), which can be watched across an increasing number of device types. These developments are prompting changes to content production and rights agreements, as well as TV content monetisation business models.

This article explores how OTT services and IP distribution can be supported by the launch of innovative retail business models that better respond to consumers’ demands to watch and pay only for the content that most interests them. These new offers and associated changes to retail prices are likely to have enduring consequences, first transforming physical video and then TV markets. In particular, the introduction of low-cost, flexible or short-duration retail options – including innovative models such as day passes or ‘skinny subscriptions’ (for example, NOW TV’s day pass or DisneyLife’s subscription models) – are reducing the divide between free-to-air (FTA) and pay-TV markets. Consequently, all FTA players (including public service broadcasting (PSB) and pay-TV players) need to review their free and pay services, packages, bundles, and pricing strategies and business models.

The proliferation of OTT VoD and TV offers is a response to consumers’ underlying content preferences

There is no single VoD or TV offering that addresses the content interests, affordability, and willingness to pay of each household or household member within a given country. Consumer research suggests that many consumers would prefer to pay “only for what they watch”. For example, although the volume of audiovisual content that is available to consumers from digital FTA and pay-TV platforms has increased substantially, consumers typically watch no more than about 20% of the content on offer from physical video retailers’ catalogues, and they tend to only watch a few TV channels from the hundreds (between 100 and 500 in Europe, for example) of TV channels available to them. Therefore, new niche OTT VoD and TV’s offers will allow some subscribers to find cheaper options. However, subscribers with wider interests and higher consumption patterns may benefit from large bundles from traditional players.

Complete pay-TV packages (such as Sky’s package of 500 TV channels) have relatively high prices and, unsurprisingly, are not attractive to all consumers. Many consumers opt instead for ‘skinny’ OTT packages that better respond to their content preferences. It is this trend that has shaped the proliferation of OTT VoD and TV services. Most of these services are available at much lower price points, which may threaten the ongoing success of large pay-TV packages. In particular, large TV packages may be unbundled, with one or several OTT services taking their place, and some FTA consumers may elect to subscribe to additional ‘thin’ or ‘niche’ pay-TV or VoD services.

Consumers are now able to choose and switch, at a click, between an increasing number of TV and VoD offers, with few, if any, physical lock-ins (for example, aerials, set-top boxes or network infrastructure) or commercial lock-ins (long-term contracts with minimum subscriptions and up-front capital costs). These new offers address different types of usage, including:

- multi-screen services and devices: subscriptions allow content to be viewed across devices

- daily, weekly or short-duration passes: subscriptions allow consumers to access pay-TV channels for a limited period of time

- hybrid passes: packages that include free video catalogue content, offered in conjunction with a per-event transaction model.

As a result, consumers in different countries can access some flexible pay-TV OTT daily package offers that only cost between 3% and 34% of the monthly fees for a traditional subscription or, for some fortnightly packages, only cost between 59% and 66% of the monthly tariff (depending on operators’ strategies).

Strategies for TV content monetisation require a complex balance of rights, infrastructure, consumer demand and retail propositions

The development of new VoD and TV services, as well as new content, presents the main stakeholders with different opportunities.

- Consumers’ content choices were previously restricted to either FTA or pay-TV offers, but they can now view content using Free VoD (F-VoD), advertising-based VOD (A-VoD), transaction-based VoD (T-VoD), subscription-based VoD (S-VoD), or a combination of these. Some combinations will be available at a click, removing the previously high barriers between FTA and pay-TV universes.

- Broadcasters and distributors can offer a greater variety of TV and VoD services to consumers, regardless of their original positioning within the market as either FTA or pay-TV players. For example, PSBs are developing pay services (for instance, the BBC Store), and pay-TV players are developing FTA or low-cost entry options (for example, Sky’s NOW TV content offer) as new business lines, with the aim of attracting consumers to higher ARPU pay-TV subscriptions (that is, a balanced approach that involves exploring the market extension for lower ARPUs while also maximising the benefits of higher subscription tiers). Most new players offer consumers a wide choice of retail models (for example, Amazon Video and Amazon Prime).

- From the perspective of rights owners, as the online and OTT market expands and achieves a critical mass, rights owner will adapt and expand the way in which they manage and release the OTT rights, with similar catalogues available across all devices and networks, and at a distance of ‘just a click’ from each other.

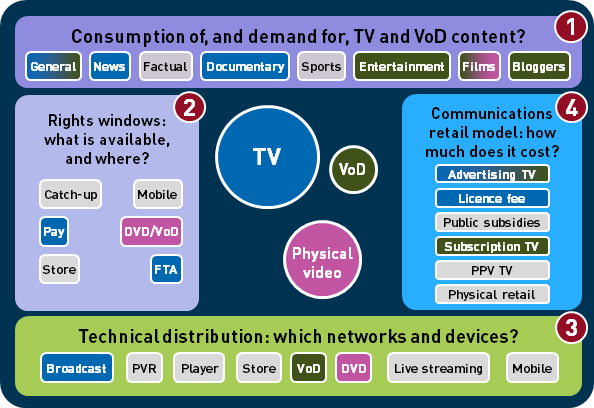

Players in the audiovisual value chain must evolve dynamically to respond to consumers’ demands for content. They can respond to these demands by adopting strategies that allow them to optimise a combination of content rights windows, infrastructure and device types and associated business models and retail propositions. The combination of these four factors will determine the complementarity and substitutability of VoD and TV markets driven by OTT and IP transformation (see Figure 1).

Figure 1: Four variables that determine the complementarity and substitutability of TV and VoD markets, including retail offers

Source: Analysys Mason 2016

Therefore, it is essential that all players understand which combination of factors will best support their strategies. This knowledge will also enable these players to maximise revenue and profits, although this will vary depending on each player’s presence in traditional FTA and pay-TV markets.

Analysys Mason is working on several projects that aim to understand consumers’ willingness to pay for the types of innovative offers discussed here. This expertise enables us to provide clients with recommendations for the most effective TV and VoD pricing strategies in order to capture consumer demand.

Downloads

Article (PDF)Latest Publications

Project experience

Enhancing Microsoft’s product and marketing strategy and strengthening its position as a thought leader in the SMB segment

Project experience

Using segmentation and insights from digital-native businesses to inform a global networking vendor’s sales and marketing strategy in Asia–Pacific

Project experience

Transforming a global financial management software vendor’s go-to-market strategy through advanced customer segmentation