Digital parcel locker infrastructure is a rapidly growing element of the parcel delivery market in the UK

Digital infrastructure is the foundation upon which smart cities and nations will be built, thereby enabling always-connected consumers to engage with physical and digital services, including the Internet of Things. Parcel lockers, also known as automated parcel machines (APMs), represent an important, nationwide, emerging digital infrastructure of the future, and we predict that the UK is about to become one of Europe’s largest parcel locker nations as a result of millions of pounds of investment.

There are numerous types of smart city solutions, including connected dustbins and self-driving shared taxis, but the APM technology that is now emerging serves the immediate and growing user demand for physical item delivery, while providing a solid foundation for important environmental and social improvements to the supply chain. The use of parcel lockers can reduce the emissions from delivery vehicles because it is more efficient to deliver a large number of items to a locker than individually to each door/address, though the effect of recipients travelling to collect items does need to be considered. It is also possible for smart cities to integrate digital parcel locker infrastructure with other smart technologies. For example, the delivery of a vanload of parcels to the same fixed locations on a fixed schedule is arguably the easiest and best application of self-driving vehicles. APM technology can also be used for services such as the delivery of groceries and prescription medicines to a locker, the collection of parcels and the sharing, reuse or recycling of used goods.

Digital infrastructure is a prerequisite for a smart city, and parcel lockers are an important part of this. Parcel lockers are also expected to be deployed outside urban areas, thereby leading to nationwide benefits and additional choice for all senders and recipients.

The deployment of APM infrastructure involves more than just installing visible locker banks in supermarket car parks and on street corners; it extends to the software intermediaries that control the data, the network and therefore the value exchanged between sender, recipient, infrastructure, logistics and customer-facing operatives. In time, traditional postal services may benefit from parcels or other post being delivered to parcel lockers (rather than doorsteps), but this is not a focus of postal systems and policies today (it remains a topic for a future debate).

Locker networks should be open and should serve several carriers to ensure high levels of efficiency and eco-friendliness. Networks can also be supplemented with pick up/drop off (PUDO) locations such as parcel shops; these add density and can be used to test new locations and to allow for peaks of demand without the need for additional locker cells, which may be under-utilised during off-peak periods.

APM infrastructure could address the growing demand for out-of-home delivery in the UK

The UK is one of Europe’s largest e-commerce-driven markets and we believe that there is significant potential for the deployment of APM infrastructure. The UK has not yet got any complete out-of-home (OOH) delivery solutions that offer all of the desired features including good nationwide proximity and a mix of PUDO and APM services, although Amazon has widespread reach for its own parcels.1 However, more recently, DPD has gained access to the Post Office network (over 10 000 locations), and InPost has restarted its APM deployment in earnest. Consumer distance purchasing behaviour in the UK is evolving too; the use of C2C channels (such as Etsy and eBay) is growing, as is the use of returns services for which APM may be more convenient than traditional methods.

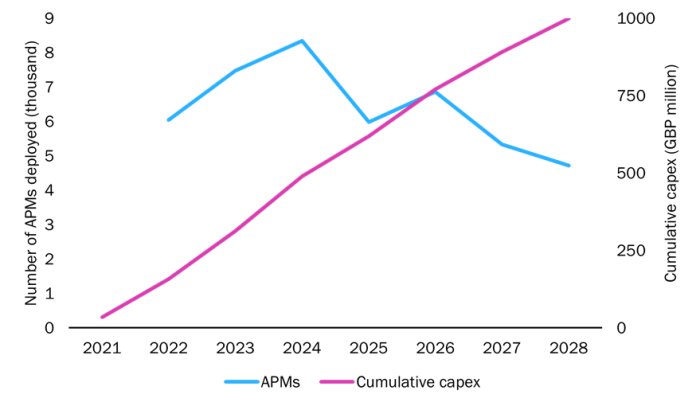

Last Mile Experts (LME) is about to release the next edition of its European OOH report, and its latest data suggests that there is significant growth in the demand for OOH delivery in the UK. Indeed, projections from Analysys Mason and LME indicate that this growth in demand will result in the deployment of over 50 000 APMs before 2030, with a cumulative investment of GBP1 billion (Figure 1).

Figure 1: Forecast for the deployment of APMs and associated capex, UK, 2021–2028

Source: Analysys Mason, 2022

Parcel locker infrastructure will be a key component of digital development in the delivery sector and is a must-have to serve growing OOH delivery volumes following the COVID-19 pandemic. The major players, challengers and various vertical partnerships and acquisitions will lead this dynamic in the coming years, but not all players will be best-placed to win. Analysys Mason and Last Mile Experts have recently worked together on projects in this space, and combine digital infrastructure investment transaction advice with OOH last-mile expertise. For more information, contact Ian Streule, Analysys Mason. Analysys Mason thanks Marek Różycki for their help with this article.

1 Out-of-home delivery is defined as a delivery in which items are deposited at a location, facility or receptacle that is some distance away from the home or business address of the actual recipient.

Article (PDF)

DownloadAuthor