Telcos need to develop a satellite strategy now

Mobile operators’ capacity to generate economic and social value is limited by the reach of their network coverage. However, better-performing satellites, lower satellite costs and easier adoption are unlocking tremendous opportunities for telecoms operators (telcos) to integrate satellite services into their portfolios.

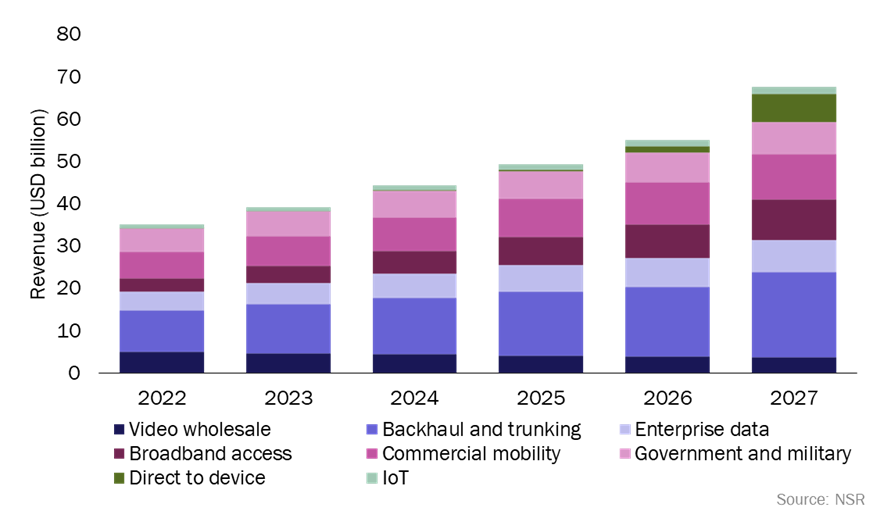

Satellite-related revenue for telcos is set to grow by USD32.5 billion between 2022 and 2027 (Figure 1), according to forecasts produced as part of Analysys Mason’s Satellite Strategies for Telcos programme. How can operators capture a share of this market?

Figure 1: Satellite-related revenue for telcos, worldwide, 2022–2027

Telcos should embrace satellites as a new source of differentiation and growth

Telcos need to find solutions to address the decline in their traditional revenue streams. The satellite market is almost wholly greenfield for telcos and offers a promising growth opportunity. In fact, NSR (an Analysys Mason company) forecasts that satellite solutions will account for 40% of the growth in telco enterprise connectivity revenue between now and 2027.

Telcos may need to change their outdated perception of satellites. Recent technological developments have transformed the satellite market. Developments such as low-Earth orbit (LEO) constellations (for example, Starlink) and software-defined satellites have improved the bandwidth and performance of satellite services. The economics of satellite communications have also improved significantly over the last few years. For example, the total cost of ownership (TCO) of satellite backhaul is such that connecting rural mobile base stations via satellite can be more cost-effective than alternative solutions. Furthermore, the emergence of common standards in the satellite and telecoms markets, and the development of ‘satellite-as-a-service’ solutions are lowering barriers to adoption and helping mainstream telcos to integrate satellite services.

Integrating satellite services will benefit telcos in the following ways.

- Mobile broadband. Telcos can extend the coverage of their networks into remote areas by backhauling base station traffic via satellite.

- Rural connectivity. Telcos can deploy satellite terminals to serve households in areas that were previously unserved.

- Direct to device. Multiple systems are being developed to offer direct satellite connectivity to handheld devices. These will complement terrestrial technologies and extend mobile coverage everywhere.

- Access to new enterprise segments. Use cases such as in-flight connectivity need satellite solutions, as do some use cases in the maritime and the government and military sectors.

- Enhanced services. Satellites could be used to offer private connectivity, ensure data ownership and enhance network resilience.

Telcos need to evaluate their skills and market synergies to determine the best satellite strategy

Telcos that rely exclusively on terrestrial networks will miss revenue opportunities and fall behind their competitors. Telcos should use satellites to enter new verticals and enhance services. Telcos’ satellite strategies need to fit into their overall action plan; they should prioritise their target verticals and take advantage of their existing capabilities.

Telcos have a range of strategies to choose from.

- Organic growth for telcos with existing capabilities. For example, Orange expanding its broadband offer with satellite.

- M&A activity such as the deal between Dish and EchoStar, which will enable the combined organisation to offer new services such as SD-WAN, network resilience or data ownership, and enter new segments such as government and military, mobility and eventually direct-to-device services.

- Adoption of ‘satellite-as-a-service’ offerings, such as the ones offered by Africa Mobile Networks to deploy and manage end-to-end rural mobile coverage.

- Some might prefer to spin off satellite branches to favour growth like the recent acquisition of Telenor Satellite by Space Norway.

Telcos need to define their strategy carefully as some moves might prove unsuccessful. For example, Qualcomm’s deal with Iridium. Additionally, some industries, such as oil and gas, or particular use cases, such as in-flight connectivity, are currently served by niche integrators and may be difficult to penetrate for mainstream telcos given the specialised know-how required.

Telcos should leverage 5G standards to accelerate deployment of satellite services

Telcos could generate revenue from satellite deployments rapidly because the relevant use cases already exist. Many satellite operators offer, or plan to offer, solutions that comply with the Metro Ethernet Forum’s (MEF’s) standards or are compatible with SD-WAN and eventually 5G core. These developments will facilitate the adoption of satellite solutions by mainstream telcos. The standardisation of 5G non-terrestrial networks will break down the barriers to satellite adoption and enable satellite solutions to be included in unmodified phones. Telcos should prioritise these standards-based solutions to accelerate integration and revenue generation.

For more information about Analysys Mason’s Satellite Strategies for Telcos research programme, contact Lluc Palerm.

Article (PDF)

DownloadAuthor