The success of Digital India depends on ubiquitous, affordable and secure infrastructure

30 January 2017 | Regulation and policy

It has been a busy couple of years for India’s digital economy. In July 2015, the government launched ‘Digital India’. This ambitious programme aims to harness digital infrastructure and software, and engage Indians online, to transform the country’s economy. During 2015 and 2016, the Unique Identification Authority of India (UIDAI) accelerated the roll-out of the Aadhaar national identity programme, with a very strong digital component.

Fast-forward to November 2016, and one of the largest-scale efforts ever attempted to remove currency from circulation was underway: the government announced it would cancel all INR500 and INR1000 notes by the end of the year, inciting hundreds of millions of people to deposit their cash in bank accounts and register for income tax. Although the government’s primary goal appears to be curbing the use of undeclared money in the economy, it is also promoting the use of digital, cashless payment mechanisms.

Beyond the immediate difficulties that the government faced in managing the demonetisation and addressing the ensuing challenges of money supply and public discontent, some challenges in the digital space are now becoming clear. If the demonetisation process is to succeed, with people using less cash, and if the Digital India programme is to truly help with the economic transformation of India, the availability of safe and secure digital infrastructure is an essential first step.

Analysys Mason has published three major reports looking specifically at the challenges for Internet connectivity in India, the importance of strong encryption in supporting the use of the Internet, and the potential impact of data-driven innovation in developing Asian countries, including India.

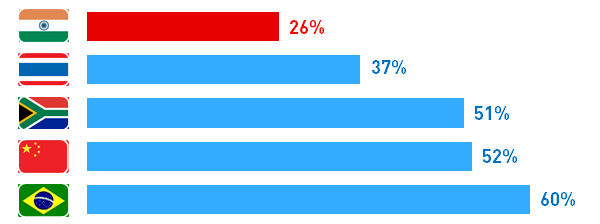

The vast majority of the Indian population is not yet online: at the end of 2015, only 26% of people had recently accessed the Internet according to the ITU. Although this was a significant increase over the previous year, India still lagged behind nearly every other major developing economy. Nearly all Internet access in India is via mobile technology, either cellular or Wi-Fi.

Figure 1: Internet penetration at the end of 2015 in selected countries [Source: Analysys Mason, ITU, 2015–16]

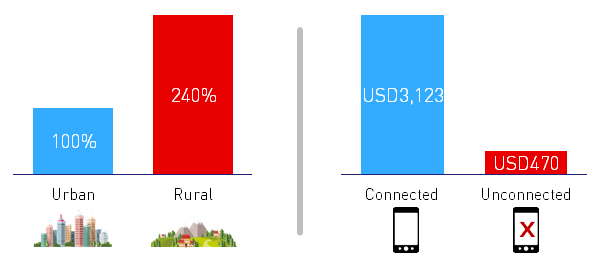

The challenges of expanding Internet connectivity in India are significant: our analysis shows that the cost of coverage in new areas can be two to three times higher than in urban areas, whilst the median income of the unconnected is only one-eighth of that earned by those who are already online.

| Figure 2: Cost of deploying a rural cellular site vs. an urban site in India [Source: Analysys Mason, 2016] | Figure 3: Median income for connected and unconnected Indians [Source: Analysys Mason, 2016] |

If connectivity is to improve, supply needs to expand to meet demand, at a price level that many more people can afford. This will require significant investment by service providers, as well as innovation at all levels of the broadband value chain. For example, several companies are now actively deploying carrier-grade Wi-Fi to alleviate the load on cellular mobile networks and provide more cost-effective connectivity across the country (such as RailTel’s partnership with Google).

Nevertheless, the government has a central role to play to make this happen, as the whole country stands to benefit strongly from being more connected. We estimate that expanding the number of people connected to the Internet by 250 million in 2020 (i.e. reaching 1 billion connected Indians, up from the current forecast of 750 million) would add USD200 billion to India’s GDP between 2016 and 2020, with durable output gains after that point.

The recommendations detailed in our report on the challenges for Internet connectivity fall into three areas:

- TRAI and the government should consider an in-depth reform of the spectrum-management regime, to focus on connectivity outcomes through realistic spectrum pricing and make new spectrum available in a timely and open manner.

- Regulation should work together with market forces to improve affordability. In particular, the norms imposed on mobile devices should remain in line with international standards, to avoid increasing costs and preserve the prospects of India’s original equipment manufacturers (OEMs) in the global market. Data pricing should only be regulated if absolutely necessary, with a preference for improving affordability wherever possible.

- Public investment should be designed to complement and support private investment. This means ensuring that the publicly funded BharatNet national broadband network meets the needs of mobile and Wi Fi operators which are working to improve broadband availability across the country. It also implies supporting a partnership-led approach to connectivity, particularly through Wi-Fi.

Beyond connectivity, the Indian government also has a role to play in enabling and encouraging strong information security. CERT-In, the government department in charge of national civilian cyber-security, is very active in educating individuals and organisations about cyber risks, and has been on particularly high alert since the start of the demonetisation process. Its efforts should be supported by policy that encourages the use of strong cyber-security measures, including encryption: we estimate that strong encryption will underpin growth in the value of online markets to over USD200 billion in India and USD800 billion in Asia–Pacific (excluding China) by 2020.

We look forward to supporting all types of stakeholder in the transformation ahead, from connectivity to data-driven innovation, in 2017 and beyond. Please contact David Abecassis (Partner) or Rohan Dhamija (Partner and Head of India and South Asia) to discuss this further.

Downloads

Article (PDF)Authors

David Abecassis

Managing Partner, expert in strategy, regulation and policyLatest Publications

Article

M&As such as the recent XL–smartfren merger are reshaping Indonesia’s telecoms market

Country report

Sri Lanka: state of the telecoms market 2025

Article

Developed Asia–Pacific market update 4Q 2024: New Zealand utility operators cross-sell to increase revenue