Cold wind of competition blows through Swedish municipal fibre networks

A shifting outlook for Sweden’s municipal fibre networks

Sweden’s municipal networks pioneered the open-access model for fibre networks, which helped drive the nearuniversal FTTP coverage the country enjoys today.1 As focus shifts to wireless technologies to expand networks in uncovered areas, the role of smaller municipal networks may change. Recent court rulings have set precedents enabling further competition from the national operators, which benefit from economies of scale as networks transition from intensive expansion to a more stable maintenance phase. This comment piece examines the historical development of the Swedish fibre market and how recent events may shape its future. The open-access model for fibre networks was introduced to promote competition between retail service providers The Swedish open-access model took shape in the late 1990s, as municipalities started investing in fibre networks. The model’s success was underpinned by various factors, including ICT development plans, access to government funding and widespread dissatisfaction with the price and performance of the copper-based alternative offered by the national incumbent Telia. Municipalities started deploying fibre to homes and businesses in significant volumes, most often using the local utility company as a vehicle.

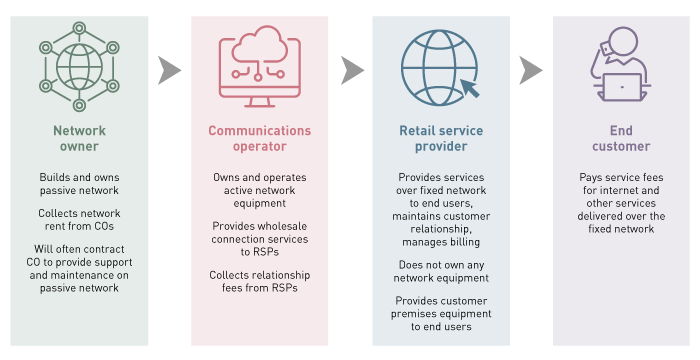

In parallel, the Swedish energy market was going through deregulation and the newly built fibre networks embraced the same set-up the utility networks were adopting: publicly managed infrastructure open to private retail service providers (RSPs) on equal terms. While municipality-owned local networks were happy to provide the passive infrastructure, it quickly became clear that RSPs were unwilling to invest in the active equipment needed to deliver services. The solution came in the form of an additional layer. Communications operators (COs) would own and manage the active equipment, and the commercial relationships with RSPs. Thus, a threetiered open access-model was formed, with network owner, CO, and RSP (see Figure 1).

Figure 1: Overview of the Swedish open-access model [Source: Analysys Mason, 2023]

Market success and challenges to the open access model

Today, some 20 years later, the municipality-driven deployment of fibre networks using the open-access model has on one level been hugely successful: it has led to the highest FTTP coverage among Nordic countries.2 However, it also resulted in a highly fragmented fixed broadband market. There are currently around 170 different municipal networks that are active in 200 out of Sweden’s 290 municipalities; 90% of those 170 are owned by municipalities.3 When we factor in networks built at the instigation of local communities frustrated by the slow progress of fibre connectivity from municipal networks, there are no fewer than 1500 fibre network owners in Sweden, according to data published by the Swedish national regulator (PTS).

Fragmentation has allowed localised engagement that has been hugely beneficial for infrastructure roll-out. In October 2022, roughly 97% of businesses and households had access to gigabit-capable fixed broadband.4 For the remaining (exclusively rural) coverage gap, PTS expects fixed wireless access (FWA) and satellite to cover roughly 2%, complementing the additional fibre roll-out needed.

Thus, the expansion phase of Swedish fibre is largely complete, and the market is now in transition to a maintenance phase, characterised by a much reduced need for local presence and active management.

In 2017, The Swedish Local Fibre Alliance (SSNF), an industry interest group, conducted a survey among municipal networks regarding the perceived future risks and opportunities. Various economic challenges were identified, including a lower buildout rate with a consequent loss of fees from new connections. The largest perceived future risk, though, was increasing regulation affecting the operational model of the networks.

As commercially driven build-out nears completion, and the market absorbs the news of a string of court rulings, it appears both fears are now materialising.

Court rulings have set precedents that increase competitive pressure on municipal networks

Swedish national regulators have in several instances reprimanded municipalities for protecting their in-house fibre networks:

- In 2011 a municipal network was forced to restructure its CO as it was found to be unlawfully competing with private actors beyond municipal borders

- In 2017 a municipality was fined for refusing to offer land rights to private actors competing with its own fibre network.

These rulings are creating precedents and sharpening competitive pressure for municipal networks, and have recently been compounded by a third ruling which may have even greater impact for municipal networks.

In April 2023 a contract for CO services between a municipal landlord and the local municipal network was found unlawful since it had not considered any competing providers. The court decided the contracts should have gone through public tender. In a public tender process the municipality-owned CO would have to compete against national players, which are likely to have significantly different economies of scale. The prospect that the municipal landlord would contract a competing CO would mark “the beginning of the dismantling of the municipal network in its current form” according to its CEO.5

The implication for other municipal networks does however not stop at the need for public tender processes. Municipal networks providing CO services are often also RSPs in their networks, most often enjoying a disproportionally high share of total subscriptions compared to networks with a third-party CO, where subscriptions are more evenly distributed.6 There is therefore a risk that a municipal network losing its position as CO will also see a reduction in its share of retail subscriptions.

Municipal networks must brace for a new financial reality

Municipal networks must brace for a new financial reality As the expansion phase for Swedish fibre networks comes to an end, the value that smaller networks can add through local experience and contractor relationships is reduced.

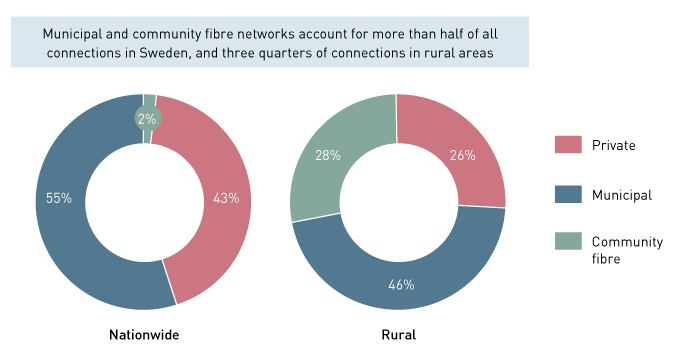

Furthermore, revenue from new connection fees have been an important source of income for many networks, the loss of which does not have a clear replacement. Given the significant share of connections that is under the control of municipal and other smaller networks, especially in rural areas (see Figure 2), this shift is poised to have market-wide impacts.

Figure 2: Market share of broadband networks7 [Source: Analysys Mason, 2023]

The precedents set by Swedish courts, favouring further competition (from what are likely to be larger players), may lead to national operators leveraging economies of scale to grow their presence as CO in several municipalities, challenging another important source of revenue for the municipal networks. In a statistics report published by SSNF in 2020, 53% of the municipal networks also acted as a CO in their networks. Should the recent ruling regarding contracting CO through a public tender process become the norm for municipal landlords, it may thus entail a fundamental shift for more than half of Sweden’s municipal networks.

In the maintenance phase of Swedish fibre networks, the reduced need for local expertise and increased competition from national actors driven by the competition regime is likely to promote the formation of larger constellations of networks and network owners. Increased competition is also likely to put a larger focus on operational aspects such as efficient network operations and maintenance, which also benefit from economies of scale. While the intense fragmentation of fibre networks has been an important factor in the expansion phase of Swedish fibre, the next few years may see extensive market consolidation.

1 97% of all households and businesses had access fibre in their immediate vicinity as of October 2022 (PTS, 2023)

2 European Commission (2022) Digital Economy and Society Index 2022 Available at: digital-strategy.ec.europa.eu

3 SSNF (2022) Available at: www.regeringen.se

4 PTS (2023) Available at: www.pts.se

5 Telekomnyheterna newsletter (April 2023)

6 Phaze Adnet (2017) Available at: phaze.se

7 Data from SSNF (2020) Available at: www.ssnf.org

Article (PDF)

Download