As AI breaks open the CSD market, private-equity investors must adapt quickly to avoid falling behind

30 October 2025 | Transaction Support, Transformation and Value Creation

Article | PDF (3 pages) | AI

The relentless pace of enterprise digital transformation has propelled the market for custom software development (CSD) to new heights. Robust growth, especially in the context of a fragmented market structure, has made CSD an attractive ground for value creation, particularly for private-equity ‘buy-and-build’ strategies.

The CSD sector’s record in outpacing broader economic trends looks set to continue, with its current annual growth rate of 22% set to drive revenue above USD99 billion in 2028. But major changes are remodelling the industry as AI disrupts the traditional, labour-centric CSD model. Adaptation is vital, as no business model will survive simply by scaling up headcount in a sector where productivity has become decoupled from labour.

CSD is a market at a crossroads

The foundational principles that have underpinned success in the CSD market are being systematically eroded by AI. A peripheral tool up until recently, AI is an increasingly effective transformative force, acting as a catalyst for a paradigm shift.

Like most disruptions, AI will condemn those who fail to evolve but create great opportunities for those ready to embrace the change: AI is unlocking a growing wave of demand and creating a new frontier for CSD.

The legacy model is over: AI spells the end of labour arbitrage

The traditional CSD business model is, at its core, a professional services model built on labour arbitrage. Value is generated by deploying large teams of skilled developers, with profitability directly tied to maximising billable hours while managing personnel costs. The linear relationship between project scope and team size makes human capital the primary asset and largest cost centre.

AI developments increasingly allow the progressive automation of core functions across the entire software development life cycle (SDLC). AI is commoditising and excelling at labour-intensive tasks such as writing boilerplate code, executing repetitive tests and debugging. This shift fundamentally challenges the economics of software creation and threatens to commoditise CSDs whose primary value proposition is simply access to a large pool of coders.

Smaller teams/pods will be central to developing cross-collaborative, cost-effective, AI-enabled roles

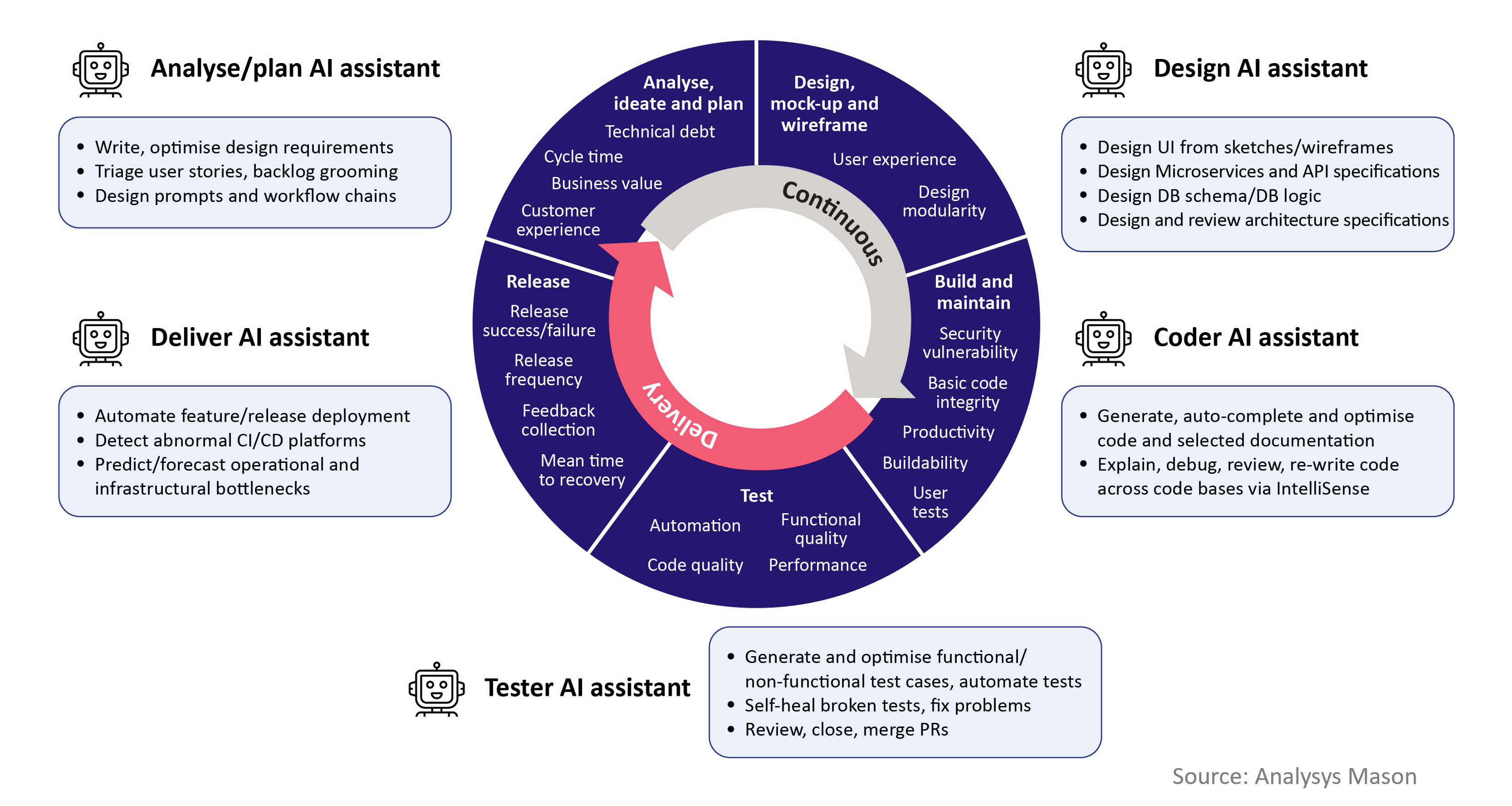

AI’s impact on the SDLC is transformative. It is driving a transition for human developers from routine tasks towards higher-value activities like systems architecture, creative problem-solving and strategic planning. AI is reshaping demand towards new AI-augmented developer roles with more strategic focus and exponentially more productive tasks. AI has already shown its worth as a collaboration tool for the following.

- Accelerated development. AI assistants can now write entire functions, refactor complex legacy systems and convert codebases across languages, dramatically increasing individual developer productivity. Microsoft’s CEO, Satya Nadella, stated that up to 30% of the company’s code is already AI-generated, a figure he expects to grow.

- Enhanced quality and testing. The quality assurance phase has historically been labour intensive. AI supports test automation by generating comprehensive test cases, performing sophisticated visual testing and even ‘self-healing’ test scripts that adapt to application changes, reducing manual effort and improving coverage.

- Intelligent project management. AI tools can analyse historical data to predict project timelines, identify potential risks and optimise resource allocation, bringing a new level of data-driven precision to planning and execution.

Figure 1: AI bots across the SDLC

The strategic imperative for CSD firms is to claim territory in the AI-native future

Enterprises across the economic landscape are adapting to AI and changing how they work. Many are seeking efficiency improvements by digitising their existing processes, but the greatest leaps forward occur when the right AI tools become an embedded part of the fabric of their businesses. From predictive maintenance in manufacturing to AI-driven diagnostics in healthcare and real-time fraud detection in finance, the demand is for increasingly sophisticated, high-value AI-enabled application solutions that require deep domain expertise and advanced AI capabilities.

The strategic imperative for CSD firms is clear: to position themselves on the winning side for the new demands of their clients through the fundamental transformation of strategy, skills and delivery models. With growing demand for more sophisticated AI applications, AI-enabled CSD players can embrace the opportunity, while legacy systems will face price competition and margin compression.

- Workforce transformation. The archetypal developer role is shifting from a ‘coder’ to an ‘AI orchestrator’ or ‘AI architect’. The future CSD firm will be defined not by the size of its workforce, but by the extent to which teams effectively exploit AI to improve efficiency and quality by reskilling the existing workforce.

- New development and delivery models. The traditional, large development team is being replaced by small, agile and hyper-efficient ‘AI-augmented pods’. This model drives immense capital efficiency, and allows for outcome-based pricing, instead of the current hourly-based pricing model.

AI introduces a new investment thesis for private equity

For private-equity investors, the CSD value creation playbook must evolve from ‘buy-and-build’ to ‘buy-and-transform’. The competitive moat is no longer the scale of a firm’s headcount. Instead, it is the strength of its proprietary AI-driven processes, its AI tool/bot stack and custom prompt libraries as well as its intellectual property in harnessing AI to solve specific industry challenges.

Due diligence must now prioritise a target’s level of AI enablement, a future-fit technology stack as well as AI developer quality over traditional labour-based metrics. AI and technology assessments need to be an integrated part of CSD transactions with a close look at the future viability of the business model. An integrated view on value creation initiatives is becoming more important in order to transform CSD business and delivery models accordingly.

Businesses must recognise the inflection point and seize the opportunity

The CSD market is evolving quickly. The robust growth trajectory remains intact, but the sources of value and the rules of competition are being redefined by AI. The firms that thrive in new market landscapes will be those that recognise this inflection point and act decisively. They will transform their workforces, re-engineer/reimagine their delivery models and reposition their value proposition to become strategic partners in building the next generation of intelligent software. For business leaders and investors, the challenge and, simultaneously, the opportunity is to look beyond the disruption and invest in the transformation.

Analysys Mason has successfully been supporting major custom software development transactions as well as strategy and value creation initiatives. Get in touch with Christian Fischer to prepare for the change.

The author thanks Mehrdad Ahkami and Oliver Dean for their support in providing research for this article.

Article (PDF)

DownloadAuthor

Christian Fischer

Partner, expert in B2B strategy and value creationRelated items

Client project

Building a corporate strategy to achieve over 20% revenue growth, diversify the portfolio beyond core telecoms and harness AI-driven value creation

Client project

Developing a go-to-market strategy and a first-of-its-kind business case for an Asian telecoms operator’s entry into the GPUaaS market

Podcast

TMT predictions 2026: operators are at a crossroads