USD310 billion and growing: the data-centre supply chain is a major growth opportunity for creative investors

Recent years have seen an explosion of activity around data centres, but opportunities to invest directly in infrastructure have become increasingly competitive. This is leading many investors to find more creative ways to capitalise on growth in the sector. For investors with the right risk profile and the courage to take innovative positions, the data-centre supply chain offers extensive investment opportunities.

Investors are exploring alternative ways to capitalise on the surge in demand for data centres as opportunities to invest directly in infrastructure become increasingly competitive.

The construction, fit-out and operation of a data centre requires specialist technical knowledge, hardware and software to ensure the facility can meet the specification its users require. Rising demand for compute capacity driven by artificial intelligence (AI) and more sophisticated end-user applications has led to further demand for new data centres, and improved power, networking and cooling solutions.

Along with the growing need for the services offered by the data centres themselves, there is similarly burgeoning growth in demand for services that support data centres. Data-centre service providers with the requisite capabilities to build and maintain data centres have created a market that Analysys Mason values at over USD310 billion now, with further growth projected at an impressive 16% CAGR to 2028.

Establishing the data-centre supply chain

The successful deployment and operation of a data centre involves a number of critical phases and services:

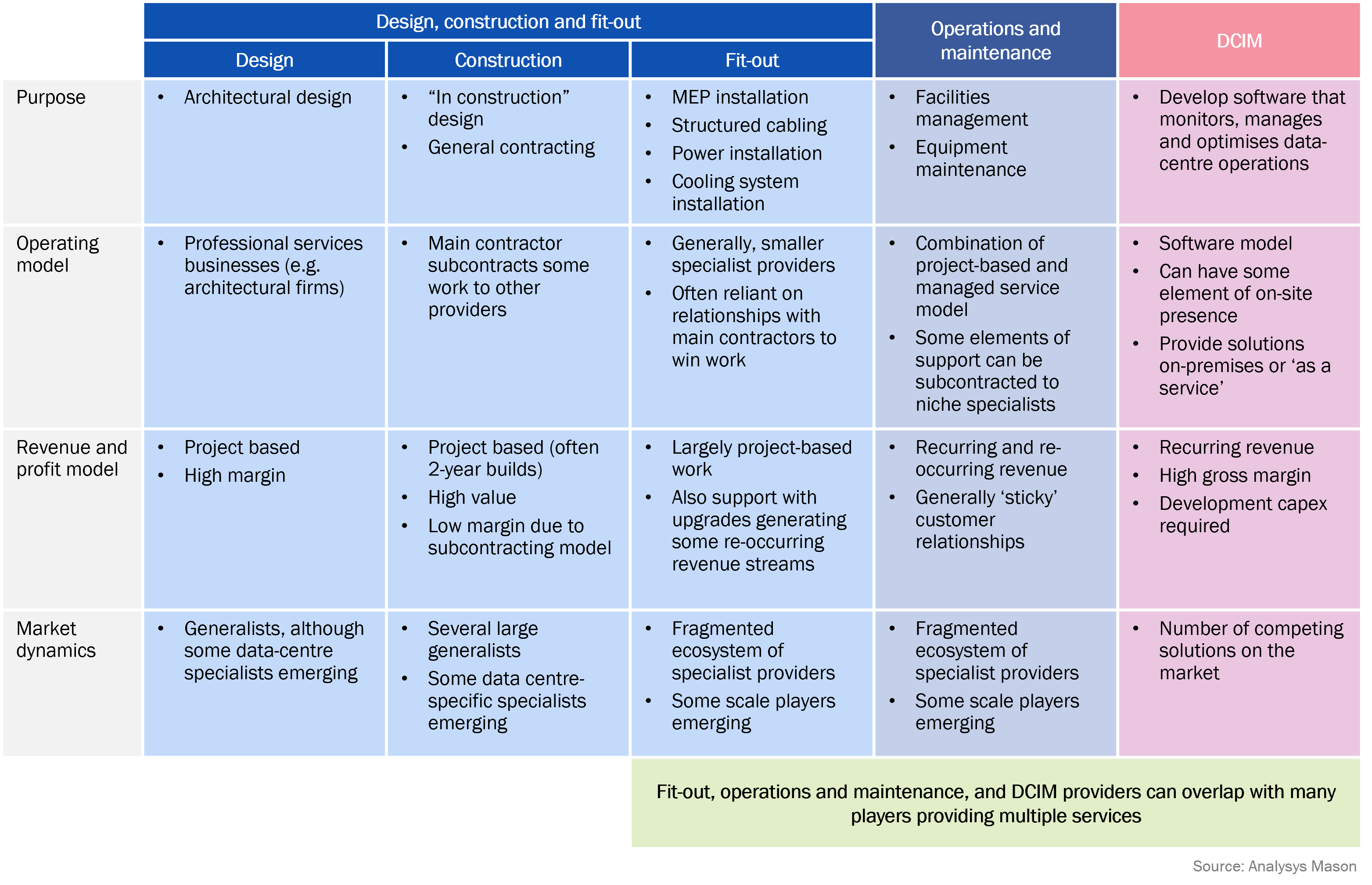

Design, construction and fit-out: this segment includes design services, shell construction, and mechanical, electrical and plumbing (MEP) fit-out. While larger generalist firms typically handle shell construction, a fragmented ecosystem of smaller specialists often provides fit-out and commissioning services. Specific expertise in power, networking and cooling systems is required to ensure the data-centre fit-out meets the operators’ required specifications.

Operations and maintenance: servers, storage devices and networking equipment form the core of data-centre hardware. This equipment requires ongoing maintenance to ensure its performance is not compromised to allow data-centre operators to meet increasingly stringent service-level agreements (SLAs). As noted above, the technically complex nature of power, cooling and security infrastructure requires specialists to operate and maintain the various systems. Responsibilities for this operation and maintenance activity may therefore fall across a combination of generalist facilities management firms and specialists that service the active hardware.

Data-centre infrastructure management (DCIM): DCIM providers develop software solutions that create digital twins of a data centre to support the optimisation of thermal and energy performance. Sensors can be deployed at various points in a data centre to measure key metrics such as temperature, peak load and bandwidth. This provides valuable information which allows the operator, or service partner, to manage its data-centre inventory and undertake predictive maintenance.

Figure 1: Summary of data-centre services, 2025

Market outlook

The 16% CAGR of the global data-centre services market over the next few years significantly outpaces the growth rate of other infrastructure service sub-sectors such as connectivity and utilities. Growth drivers include:

- Continued deployment of data-centre capacity for hyperscale and enterprise use: we estimate 40 000MW of data-centre capacity will be deployed across the next 3 years, with some of this growth already under construction.

- High service-level requirements: stringent SLAs means demand for good service providers is likely to continue to grow.

- Technical complexity of data-centre operations: increasingly technical solutions (such as advanced liquid cooling), rack densities and time-constrained manufacturer equipment warranties mean increasing demand for maintenance providers.

Investment attractiveness

Investors are attracted to the data-centre services sector for several reasons beyond the solid underlying growth expected across the market. These include:

- Mission-critical infrastructure: data-centre operators prioritise high-quality service, and are willing to pay a premium for maintenance to meet customer requirements.

- Reliable customer base: data-centre operators are well funded and often prefer to outsource services to specialists.

- Stable revenue streams: many data-centre service businesses benefit from recurring revenue (for instance ongoing contracts) and re-occurring revenues (such as periodic tasks).

- Customer ‘stickiness’: operators’ reluctance to change suppliers to prevent service deterioration during the transition helps to reduce churn and build long-term relationships.

Investment trends

The data-centre supply chain offers investment opportunities for various types of investors:

- Private equity: some investors are drawn to the fragmented nature of the market, potential for buy-and-build strategies, and high levels of re-occurring or recurring revenue.

- Infrastructure funds: these investors are exploring opportunities for vertical integration if they own a data-centre platform, or looking for investments with infrastructure-like characteristics (that include low churn, barriers to entry such as technical expertise, and recurring revenue sometimes associated with the data-centre maintenance sector).

- Strategic investors: these are industry players seeking service or geographical expansion through acquisitions with potential for synergies.

We are confident that the combination of a large and growing market, strong market fundamentals and increasing investor appetite will lead to an increasing number of transactions across the data-centre supply chain. Analysys Mason is actively supporting investors assessing opportunities in the sector. We can support through providing a combination of commercial due diligence, technical due diligence, and value creation advice to both financial sponsor and strategic investors evaluating their investment options.

For further discussion or information on Analysys Mason’s expertise on the data-centre ecosystem and other digital infrastructure, get in touch with Harmeet Chana or Richard Morgan.

USD310 billion and growing: the data-centre supply chain is a major growth opportunity for creative investors

Author

Harmeet Chana

Principal, expert in growth strategy and transaction supportRelated items

Client project

Developing a go-to-market strategy and a first-of-its-kind business case for an Asian telecoms operator’s entry into the GPUaaS market

Podcast

TMT predictions 2026: operators are at a crossroads

Predictions

GPUaaS revenue will quadruple in the next 5 years, powering new data-centre investment opportunities