Indonesia is a key target market for TMT investment opportunities, fuelled by new foreign investment rules

Listen to or download the associated podcast

Indonesia has been a prime market for telecoms, media and technology (TMT) investment opportunities over recent years, fuelled by its relatively underdeveloped infrastructure coupled with strong latent demand for connectivity. In addition, it is the fourth most populous country in the world and the largest economy in South-East Asia, which has made it of particular interest for investors looking to capture this sizeable untapped opportunity.

However, foreign investment has so far been constrained through the ‘Negative List’ that imposed foreign ownership restrictions across multiple sectors, including those within TMT.1 This has now changed through the new ‘Positive List’ which lifts restrictions on foreign investment across multiple TMT sectors while providing additional incentives to support investment.2 This looks set to serve as a catalyst for heightened investment activity in Indonesia’s TMT market to support the growth opportunity across multiple areas.

Indonesia’s TMT investment opportunity

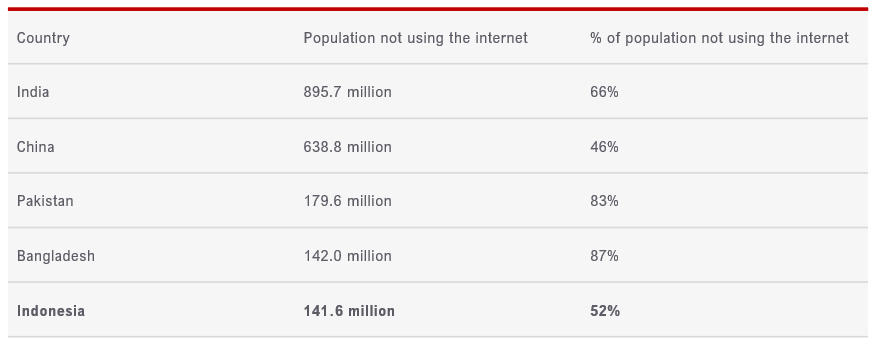

Indonesia is the largest archipelago in the world – this unique topography has made it challenging to enable widespread internet connectivity. Figure 1 below shows that Indonesia is the fifth largest country when it comes to the number of people not using the internet. At the same time, there is very strong intrinsic demand for internet connectivity, with Indonesia also amongst the top ten countries globally for the average time spent online by internet users.3 As a result, there are strong investment opportunities to not only support the significant connectivity needs, but also capture the growth from related sectors that will benefit from the increase in connectivity.

Figure 1: Countries with the largest no. of people not using the Internet [Source: World Bank, 2019]

Fixed broadband

Fixed broadband penetration remains low at 15.4% of households as of the third quarter of 2020, significantly behind the government’s targets from its five-year National Broadband Plan (2014–2019).4 Due to Indonesia’s topography, challengers to incumbent Telkom have been slow in deploying fibre, but the large number of unconnected households still provides a significant opportunity to address. Demand for enterprise connectivity is also expected to see strong growth, including demand from micro, small and medium enterprises (MSMEs) supported by the government’s “MSMEs Go Online” campaign. Because of this, there have been several new entrants in the fibre broadband space over the past few years – including XL Axiata, MyRepublic, and MNC Play.

Mobile

While smartphone adoption amongst mobile users is now widespread, the quality of mobile connectivity lags behind other markets as seen via its average mobile download speeds of 9.9Mbit/s in the first quarter of 2020.5 5G will improve this and accelerate increased data usage, but this requires the release of 5G spectrum by the regulator. With five major mobile network operators (MNOs), the Indonesian mobile market is relatively fragmented and may present an opportunity for consolidation – Ooredoo and CK Hutchison announced in December 2020 that they were exploring a merger of their Indonesian operations.

Tower companies

Over 80% of towers in Indonesia are now owned by tower companies (towercos), with MNOs continuing to divest towers, as seen via multiple tower transactions in 2020. This is likely to continue, particularly as MNOs seek to free up capital for 5G roll-out once 5G spectrum becomes available. Indonesian towercos have seen a steady growth in tenancy ratios due to continued coverage expansion from the MNOs, along with capacity deployments to support growing data traffic. In addition, towercos are increasingly investing in fibre to support the fibre backhaul needs of MNOs, which provides a secondary revenue stream to complement tower leasing.

Data centres / cloud

Demand for data centres is expected to boom in Indonesia, fuelled by the entry of hyperscalers and their large power requirements. Cloud providers have identified Indonesia as a key target for expansion – Google launched its Jakarta cloud region in 2020 while AWS and Microsoft have both announced plans to do the same. There has been strong interest from financial investors, which enabled the entry of new data-centre players such as SpaceDC (GIC-backed) and Princeton Digital Group (Warburg Pincus-backed). One of the major data-centre providers DCI Indonesia went public on the Indonesia Stock Exchange (IDX) in January 2021 as it looked to tap into rising investor interest to support their expansion plans.

Digital economy players

Indonesia has a large digital economy that is projected to grow in gross market value from USD44 billion in 2020 to USD124 billion by 2025.6 This has been supported by its vibrant start-up ecosystem that has seen the emergence of several local ‘unicorn’ companies, such as Gojek, Traveloka and Tokopedia.7 Due to this, Indonesia has become the second-largest venture capital market in South-East Asia (behind Singapore), with investment opportunities expected to grow further as increased internet penetration expands the addressable market and drives further innovation in the digital space.

New foreign investment rules

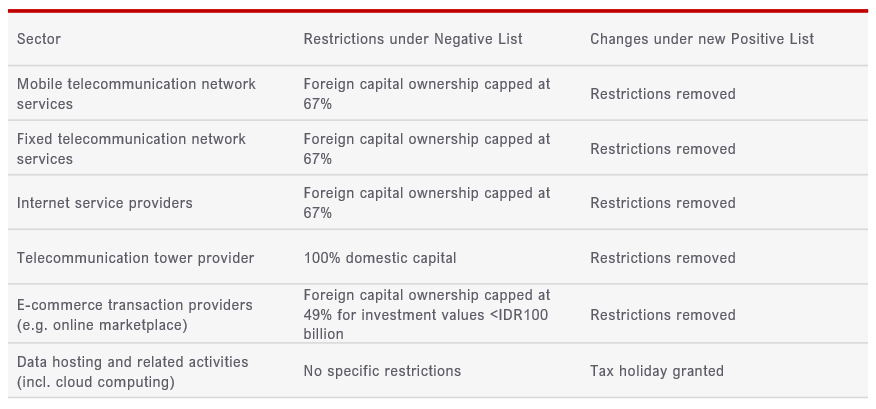

Although the TMT investment landscape has been favourable overall because of high untapped demand, foreign investors have been partly constrained in capturing this demand until now owing to the Negative List. This will now change as it is replaced by the new Positive List – which has taken effect from 4 March 2021. The Positive List lifts foreign investment restrictions across various TMT sectors and also provides additional incentives (e.g. tax holidays) in some areas. Examples of changes affecting key TMT sectors are shown in Figure 2 below.

Figure 2: Examples of changes in TMT-related investment restrictions from the new Positive List [Source: Presidential Regulation No. 44 of 2016 and Presidential Regulation No. 10 of 2021]8

Conclusion

Indonesia presents a strong opportunity for investment across various TMT sectors, particularly because there is strong intrinsic demand but underdeveloped infrastructure. The recent implementation of the Positive List is likely to serve as a catalyst for increased investor interest in the market as many foreign investment restrictions have now been lifted – it is thus crucial for investors to act quickly before competition increases. Industry players can also benefit from this by having access to a larger pool of buy-side investors and should act now to take advantage of the influx of investor interest.

Analysys Mason has conducted multiple buy-side and sell-side due diligence exercises as well as market studies covering various aspects of Indonesia’s TMT market. This includes assets such as fixed and mobile telcos, towercos, data centres, as well as digital economy players. For further information, please contact Jay Lee (Manager) at jay.lee@analysysmason.com or Lim Chuan Wei (Partner) at lim.chuan.wei@analysysmason.com.

1 The Negative List is defined via Presidential Regulation No. 44 of 2016.

2 The Positive List is defined via Presidential Regulation No. 10 of 2021.

3 Hootsuite & We Are Social (2021), Digital 2021 Global Digital Overview, Available at: https://datareportal.com/reports/digital-2021-global-overview-report

4 Liang, Q. and Pascal, R. (2020), Indonesia telecoms market report 2020, Analysys Mason.

5 Fenwick, S. and Khatri, H. (2020), The State of Mobile Network Experience 2020: One Year Into the 5G Era, Opensignal.

6 Google, Temasek and Bain (2020), e-Conomy SEA 2020.

7 A unicorn refers to private companies that have valuations >USD1 billion.

8 Note that this list is not exhaustive and does not represent legal advice.

Article (PDF)

DownloadAuthors

Jay Lee

Principal, expert in telecoms strategy and transaction support