IPOs versus take-private: a look back at 120 deals in the telecoms and digital infrastructure sector

27 August 2025 | Transaction Support

Article | PDF (2 pages) | Data centres | Digital infrastructure

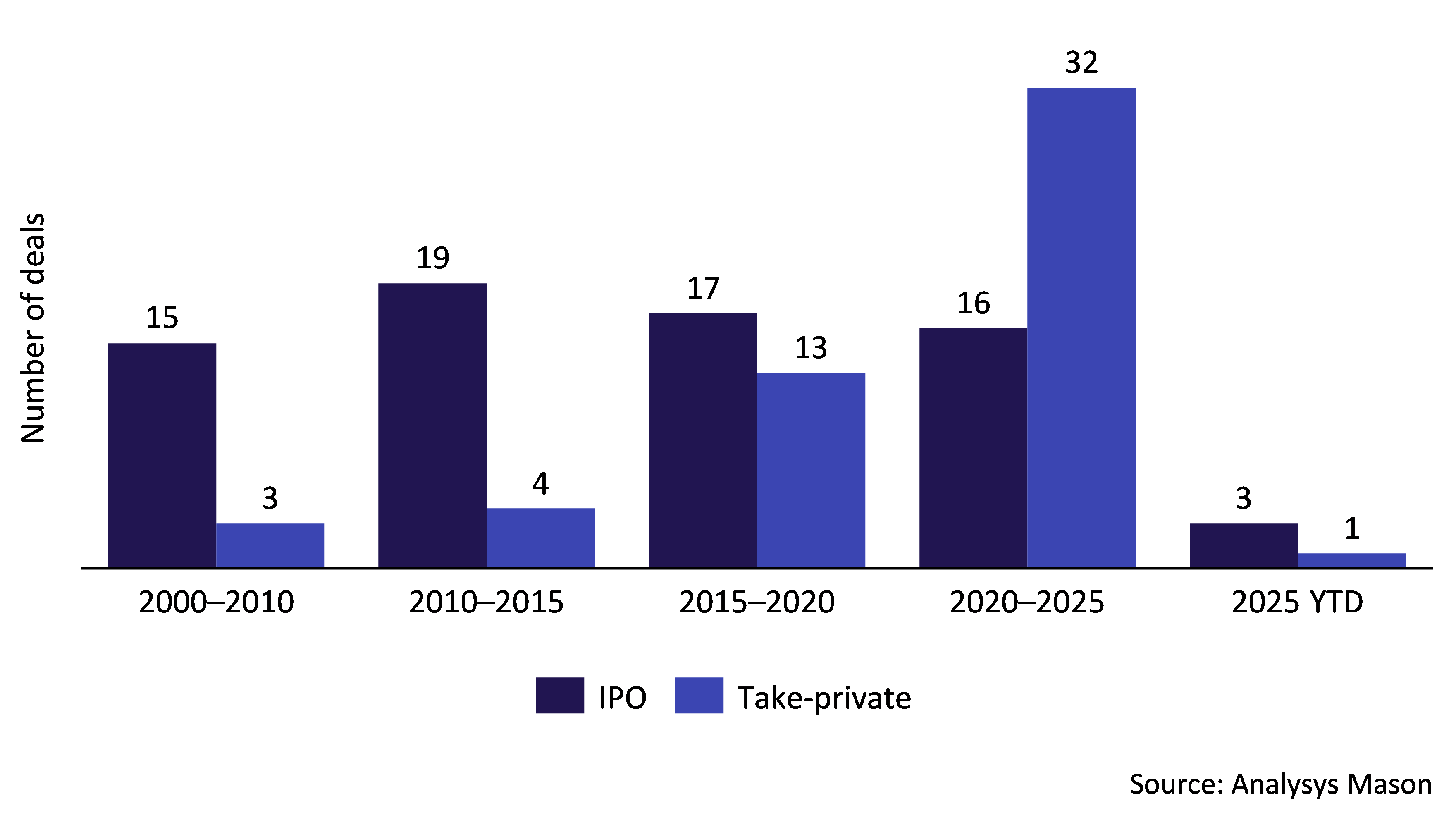

Initial public offerings (IPOs) are usually looked at as a possible exit strategy for telecoms and digital infrastructure investments, but in recent years they have been seen as less attractive to the public market, which favours short-term returns. This is largely due to the capital-intensive nature and long-term investment cycles of these sectors. As a result, ‘take-private’ deals have become much more commonplace, and have dwarfed IPO deal numbers over the last 5 years.

Figure 1: Number of deals in the telecoms and digital infrastructure market (based on a selection of deals)

The details of over 120 deals can be found here. Is there a deal you want us to add to the database? Get in touch!

It is hard to see this trend being reversed in the near future – any significant change will first need public markets to become much more accustomed to assessing long-term investments. Financial sponsors will look to IPOs as an important exit avenue for some of their (unprecedentedly large) investments in AI infrastructure. Analysys Mason is interested in how this will develop in the future.

Our list of 120 deals across the telecoms, digital infrastructure and space sectors around the world shows the ebb and flow of deal types since 2000. Five conclusions can be discerned:

- Since 2020, there have been twice as many take-private deals as IPOs.

- The recent wave of take-private deals has largely focussed on digital infrastructure platforms.

- The majority of take-private deals were led by financial sponsors rather than strategic players driving consolidation in the market.

- Since 2008, 40 digital infracos have undergone an IPO listing; of these, 15 were subsequently taken back into private hands. (In addition, Kcom and Manx Telecom, which effectively traded as infrastructure-like players, were also taken private.)

- Since 2010, 13 data-centre platforms have taken the IPO route; of these, 6 have been taken back into private ownership.

What can we expect to see in the coming years? In 2025, three IPOs and one take-private deal have been recorded. We understand the need for financial sponsors to recycle capital, and there is reason to believe that there could be renaissance of IPOs if they can find sufficient appetite at the right valuation in public markets.

Analysys Mason is proud to continue supporting private investors with deploying capital as well as exit strategies in these critical sectors.

Learn more about our transaction support services here: Transaction support for telecoms, media and technology (TMT)

Article (PDF)

DownloadHow take-private deals exceeded the number of IPOs since 2000

Author

Alessandro Ravagnolo

Partner, expert in transaction servicesRelated items

Critical Communications

Client project

Developing a go-to-market strategy and a first-of-its-kind business case for an Asian telecoms operator’s entry into the GPUaaS market

Podcast

TMT predictions 2026: operators are at a crossroads