SBS is helping US telecoms operators raise capital, and European operators should be ready to follow suit

17 October 2025 | Transaction Support

Alessandro Ravagnolo | Janette Stewart

Article | PDF (4 pages) | Raising finance

Asset-backed securitisation (ABS) is a financial process in which pools of income-generating assets are packaged together and converted into marketable securities that are sold to investors. ABS is well established as a financing technique across the global technology, media and telecoms (TMT) industry and lenders are broadly supportive. But anyone operating outside the USA might be less familiar with one of its variants: spectrum-backed securitisation (SBS).

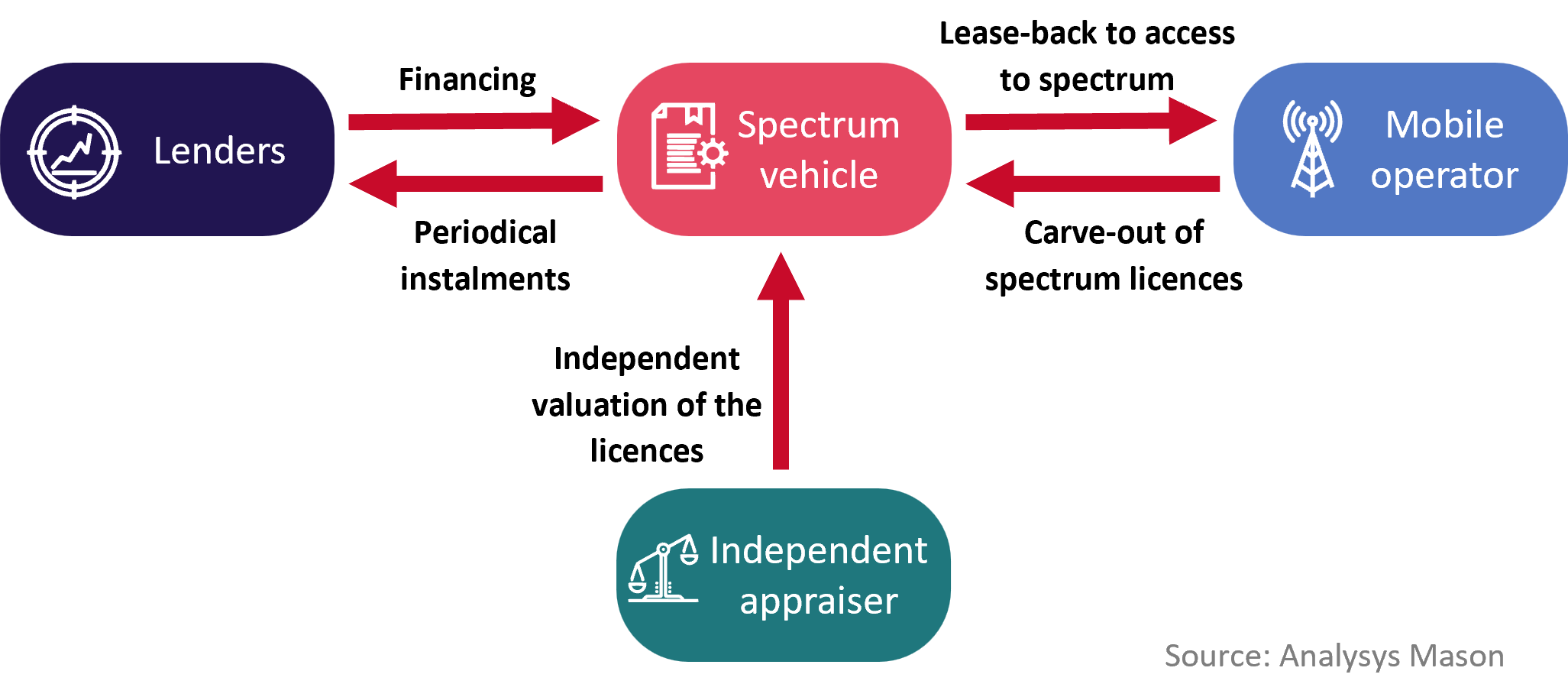

Figure 1: Simplified SBS process, 2025

Analysys Mason is the commercial and technical advisor of choice of corporate, lenders and financial sponsors in TMT, having played a key role in over 1100 deals since 2020. We are experts in spectrum valuation and have advised on the valuation of spectrum used for mobile communications around the globe, using valuation approaches including discounted cashflow and price-per-MHz-per-pop benchmarking. Our independence allows us to offer long-term and unbiased views on the evolution of the TMT industry, and on spectrum value trends and the factors influencing them, with particular benefit for long-term financial investors in digital infrastructure. We have a unique understanding of the commercial dynamics underpinning mobile and wireless network deployment ecosystems and businesses. This understanding, coupled with our deep expertise in technology, makes us the ideal partner for lenders needing independent and quantitatively robust support on spectrum-based deals. For further details, please contact Alessandro Ravagnolo and Janette Stewart.

SBS is helping US telecoms operators raise capital, and European operators should follow suit

Authors

Alessandro Ravagnolo

Partner, expert in transaction services

Janette Stewart

Partner, expert in spectrum policy, pricing and valuationRelated items

Article

CFO interview: Orange Concessions’s Anne Loussouarn and Adrien Ollivier talk about FTTH financing in France

Article

CFO interview: du's CFO Kais Ben Hamida explains how to navigate financing in the Middle East

Article

CFO interview: Open Fiber CFO Andrea Crenna on raising capital and managing a consortium of 34 lenders