Spectrum choices dictate the launch and evolution of D2D services

Indications are that the mobile ecosystem is readying itself for widespread use of direct-to-device (D2D) communication. At the 2025 Mobile World Congress (MWC 2025), discussions revolved around the ramifications of satellite systems’ growing capability to communicate directly with mobile handsets. Recent 3GPP deliberations on 6G radio access networks (RANs) point strongly towards D2D integration with terrestrial systems for wide-area coverage from the very beginning of 6G roll-out. Spectrum is essential to the D2D proposition.

There is more to D2D than just connecting unconnected areas

D2D may have previously been associated with specialist usage for areas that lack any terrestrial mobile network coverage, but the prospect of new mobile technology from space has broader appeal as a way of keeping users connected as they move within network coverage, as well as when they are completely outside of terrestrial footprints.

Poor coverage quality is often cited as a key reason for customers choosing to switch networks. Integrating D2D to improve coverage offers a commercial upside for mobile operators, helping with customer retention and offering differentiated connectivity.1

The market opportunity for D2D is potentially significant. Analysys Mason’s Research and Insights forecasts that consumer D2D service revenues will reach USD36 billion globally in 2033. This is built on expectations that satellite D2D capacity will serve consumer voice and data demand as well as messaging, and that consumers will pay a premium for these services.2

Identifying the right spectrum for D2D presents complex choices

One of the critical factors that dictates a constellation’s capability to provide coverage, and the capacity within that coverage, is the spectrum used. Each operator’s selection of spectrum for satellite communications will be an individual choice that reflects the specific operator and market.

Satellite communications have to fit in with an already complex landscape of terrestrial spectrum usage. Most terrestrial mobile markets have around four competing mobile networks, each offering consumer services with different coverage, though often sharing some network infrastructure or spectrum. This creates a complex picture in terms of how spectrum is distributed and deployed, and how network performance varies. Any given operator may have disparate spectrum holdings that reflect historical developments as well as customer need, and each network has its own unique coverage footprint of ‘hotspots’ and ‘notspots’. These spectrum holdings and network deployments will influence how each mobile network operator (MNO) uses D2D. The right approach for an MNO with a smaller number of users and a limited coverage footprint will differ from that of an MNO with a larger user base and a wider footprint.

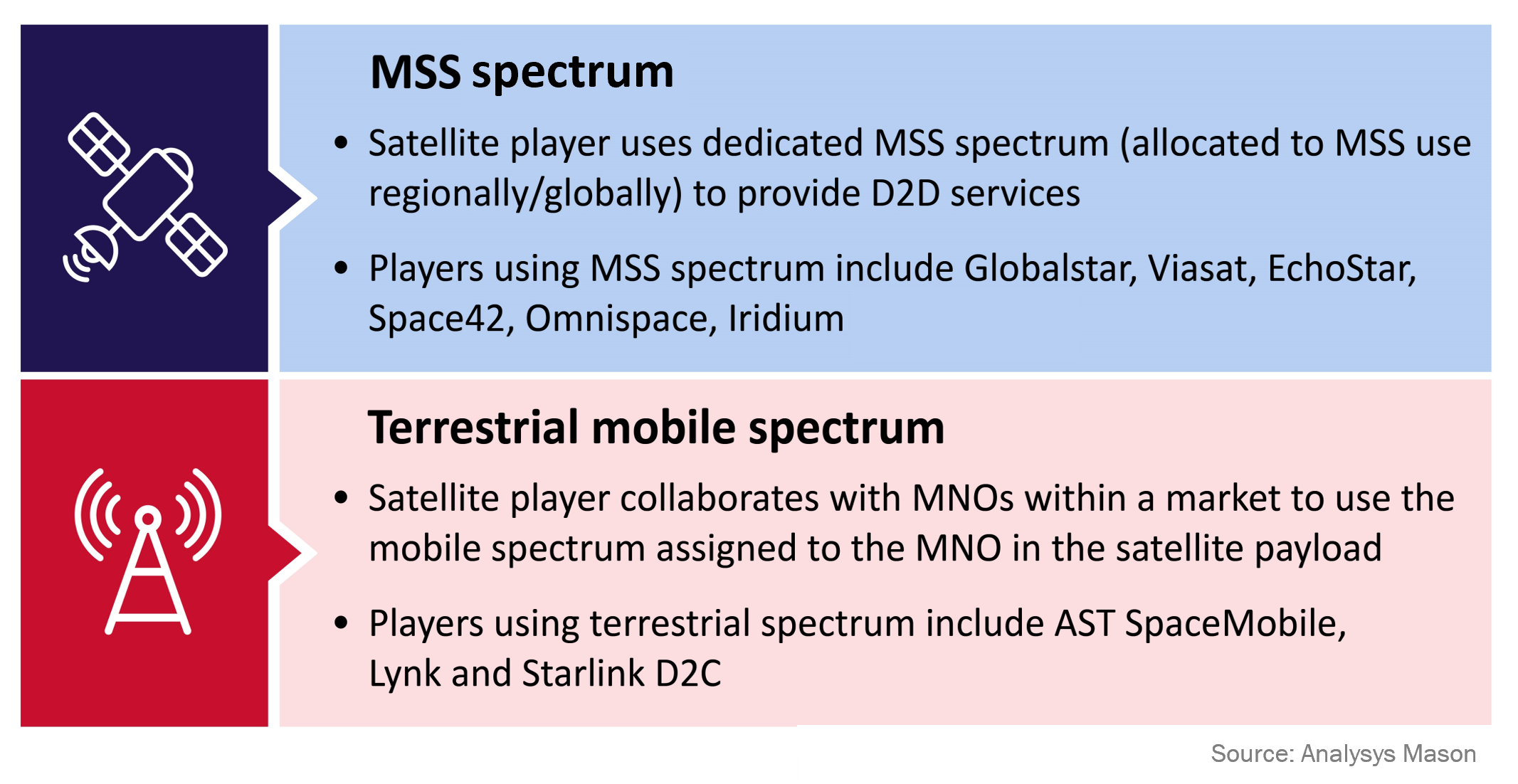

D2D services can be offered via two different spectrum types:

- reuse of spectrum allocated for terrestrial mobile use – i.e. frequencies that an MNO is licensed to use

- use of spectrum that is allocated to mobile satellite services (MSS) – i.e. frequencies that satellite operators typically have authorisations to use.

Both approaches are being pursued currently in different forms and by different players, for example.

Figure 1: MSS and terrestrial mobile spectrum

Each option raises its own questions in terms of device support, partnering options, deployment choices and licensing approaches. In regions where multiple countries share land borders, interference management and cross-border coordination may be especially challenging.

Transmitting the satellite uplinks and downlinks via the spectrum assigned for terrestrial mobile use requires the MNO and satellite operator to trade off various choices as to which of the MNO’s existing spectrum holdings to dedicate for D2D services.

For MSS use, L-band and S-band spectrum has already been allocated in most markets worldwide and is authorised for use by various satellite players in different markets. The capacity on MSS spectrum is already heavily utilised for maritime, aviation, military, satellite IoT and dedicated sat-phone connectivity.

| Example: terrestrial MNO spectrum |

The T-Mobile/Starlink service in the USA uses 2×5MHz of T-Mobile’s 1900MHz personal communications service (PCS) spectrum. Elsewhere, Starlink has had to use other frequencies (e.g. 2×5MHz of 1800MHz spectrum in Switzerland, with Salt Mobile). To facilitate T-Mobile’s approach, the Federal Communications Commission (FCC) granted regulatory authorisation for terrestrial spectrum to be used in satellites under its ‘supplemental coverage from space’ (SCS) rules, adopted in the USA in 2024. These rules specify geographical restrictions to minimise interference with other terrestrial mobile networks. The exclusion zones between space and terrestrial coverage may mean a user moving in and out of terrestrial coverage cannot maintain a seamless connection. Whilst some other regulators are proposing regulations like the FCC’s SCS, other regulators are considering different approaches that are optimised to the specific needs of the market, noting that current terrestrial mobile spectrum is not fully harmonised across all world regions. |

|

| Example: MSS spectrum | The partnership between Viasat and Skylo Technologies uses Viasat’s satellites and L-band spectrum. It is expected to evolve beyond its initial IoT offering to support similar D2D smartphone services to those of T-Mobile/Starlink. The L-band spectrum authorisations being used by Skylo were already held by Viasat (through its subsidiary Inmarsat). | |

Because MSS spectrum uses different spectrum to the terrestrial network, users moving in and out of terrestrial coverage experience seamless connectivity. However, this requires MSS-capable smartphones that support L-band and/or S-band frequencies, which are not yet widely available within the smartphone ecosystem.

At an international level, spectrum for MSS use will be explored at the ITU World Radiocommunications Conference in 2027 (WRC-27), under agenda item 1.13, with a view to considering if additional spectrum might be needed in future for MSS use.

The right approach will be market- and operator-specific

For MNOs, the best spectrum choice will be dictated by how they value D2D, as a complement to mobile data plans and through its potential to reduce customer churn. In the USA, T-Mobile has chosen to include its initial D2D offer at no extra cost with its higher priced plans (subject to the user having a compatible device). Customers on other plans can subscribe to D2D for a cost of USD15 per month.

For satellite operators, the choice of spectrum used for D2D influences the capacity and services that can be offered, as well as the design and cost of the constellation. There are indications of satellite operators looking to enhance the initial D2D capacity and services by acquiring further spectrum in key markets – AST SpaceMobile’s proposed acquisition of Ligado’s L-band spectrum holdings in the USA being one example.

As D2D gathers momentum, we expect increased activity from MNOs and satellite companies to identify and secure spectrum for this growing market segment.

For further advice on D2D spectrum frameworks, contact Janette Stewart. For advice on Analysys Mason’s work in the space and satellite sectors, contact Lluc Palerm-Serra and Antoine Grenier.

1 Analysys Mason’s recent D2D messaging consumer survey suggests that of the consumers surveyed, 8% were considering switching to another provider for coverage reasons, and of those 8%, over 80% would be interested in D2D messaging services as a means of improving connectivity.

2 Analysys Mason’s published global forecast is here.

Article (PDF)

DownloadAuthor

Janette Stewart

Partner, expert in spectrum policy, pricing and valuationRelated items

Predictions

Satellite D2D will benefit early adopter MNOs in 2026

Article

A changing spectrum landscape offers new opportunities for creative financial sponsors

Article

New thinking on spectrum valuation is needed for upper mid-band frequencies