New thinking on spectrum valuation is needed for upper mid-band frequencies

Mobile spectrum has traditionally been awarded to operators in many markets via nationwide exclusive licences. Relatively few markets have used regional licences to date, and the markets that have tend to be ones with large geographical footprints. However, 6G networks look set to be deployed in a very different spectral configuration, and the old conventions of national vs. regional licensing may well not apply.

The evolution of radio access networks towards 6G technologies (and the data traffic they will support) is prompting international debate on future mobile spectrum resources. Additional upper mid-band spectrum, particularly in the range 6–8GHz, is attracting particular attention. The substantial increase in additional capacity this would offer might be most useful in the busiest locations in mobile networks, but if these bands are only deployed in dense urban areas, regulators will need to consider how spectrum should be licensed. The unique spectrum needs of 6G technology may prompt regulators to rethink the entire model for spectrum licensing.

Spectrum valuation is often calculated via historical benchmarks, but they may not be a reliable reflection of future value

Spectrum valuation methodologies tend to rely on one of two main approaches: using a business plan approach to estimate the value of the spectrum being offered over the network footprint (national or regional), or using benchmarks of prices paid per MHz per head of population from previous auctions of similar types of spectrum. Regulators often attach coverage obligations to nationwide licences, which must be factored into any valuation of the spectrum offered.

Analysys Mason’s Spectrum Auction Tracker (SAT) records auction prices for each mobile band and market worldwide. From our SAT, we can derive benchmarks of auction prices, normalising for bandwidth offered, market populations, licence durations and the effects of any licence conditions (such as annual licence fees or coverage obligations).

However, the 6–8GHz bands for evolution of 5G and introduction of 6G are unlikely to be a simple continuation of historical precedents. The spectrum is expected to be used specifically to target capacity-constrained locations in a network, and in some cases (e.g. the UK) the bands themselves look set to be assigned on a non-exclusive basis to MNOs. The value of upper mid-band spectrum is also affected by the fact that 6–8GHz spectrum is already widely used by other wireless services, which may remain in the band in some form, creating geographical exclusion zones. The non-exclusivity and lack of contiguous geographical footprint has significant implications for the valuation approach and how benchmarks from previous spectrum auctions (that have awarded exclusive-use licences) are applied.

Valuing future mid-band spectrum using 3.5GHz benchmarks

The closest previously auctioned spectrum to upper mid-band spectrum (in terms of capacity, coverage and propagation characteristics) is the 3.5GHz band, which has been widely used to date for 5G.

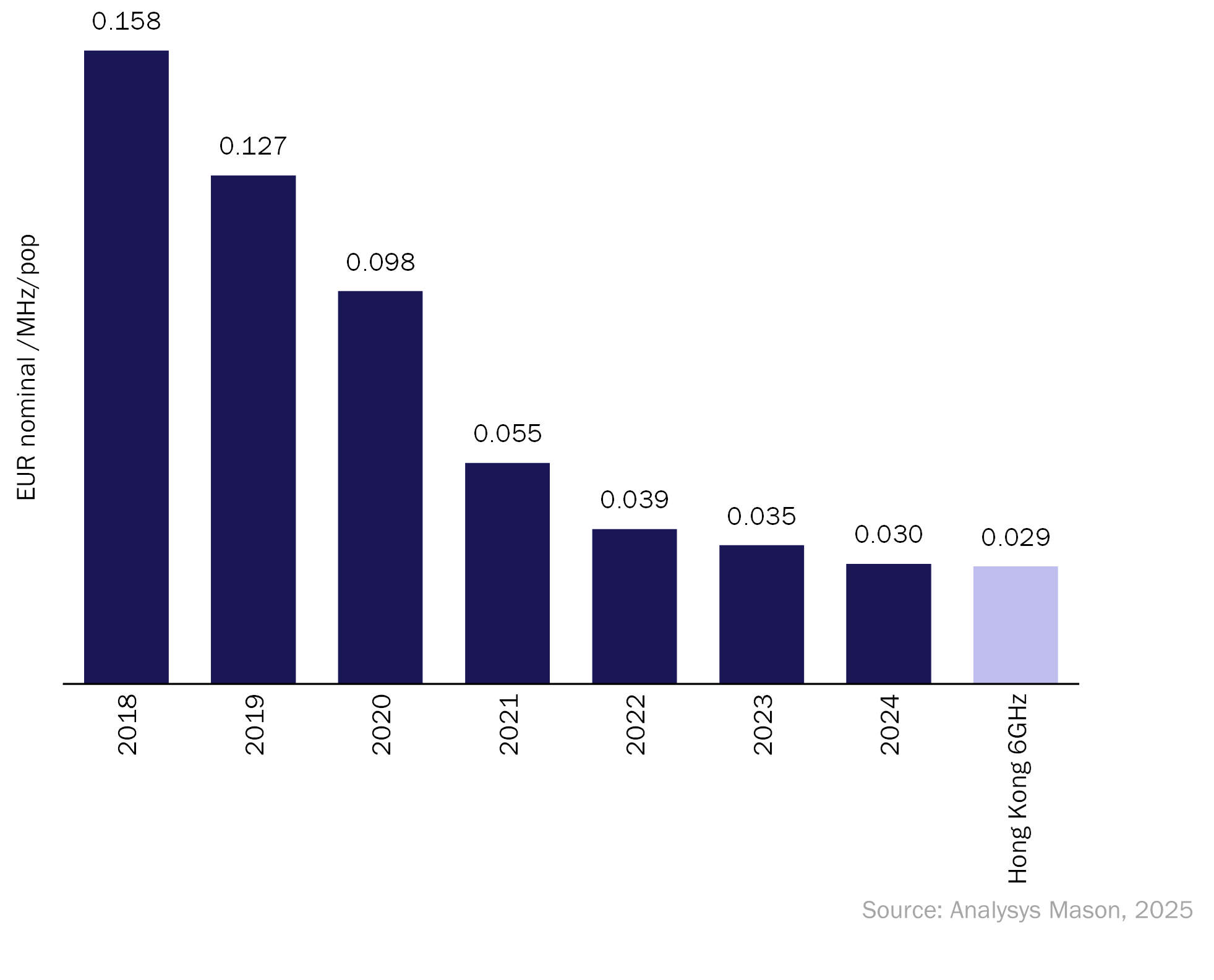

From 49 non-combinatorial national auctions of spectrum in the 3.5GHz band (3.3–3.9GHz) which took place between 2018 and 2024, we can estimate an average price of EUR0.067/MHz/pop, normalised to a 20-year term.

The spectrum in the 3.3–3.9GHz range has typically been assigned to MNOs on the basis of nationwide licences. In a minority of markets, some forms of sub-licensing have been used to improve the efficiency of spectrum use: if the 3.5GHz spectrum is not deployed in a location by the licensed MNO, it can be used for another purpose (e.g. a local licence).

In future, if MNOs find that additional upper mid-band spectrum is only valuable for deployment in selected, high-traffic locations, traditional methodologies comparing previous mid-band spectrum auctions (valued against nominal nationwide deployments) may not yield accurate valuations.

Benchmarks from auctions are necessarily based on previous market conditions, and will not capture current or future market conditions and trends. They will not, for example, reflect the fact that operators may not need additional spectrum for capacity reasons in the short term (because of reduced rates of growth in mobile traffic).

The business planning approach to spectrum valuation typically looks at how mobile traffic will grow over the licence period, shaped by the assumption that mobile traffic would continue to grow in line with historical growth rates. This growth has typically been of the order of c.30% per annum. It is now less clear whether mobile traffic will continue to grow at historical levels, and there are diverging views. Some contend that there will be near-zero traffic growth in the next few years; others point to the growth potential of emerging applications, such as AI tools, but these applications will potentially intensify the pattern of growth in hotspots, rather than nationwide.

The evolution of prices paid for spectrum in the 3.3–3.9GHz range over the period 2018–2024 already shows a declining trend, possibly reflecting declining levels of traffic growth in recent years (see Figure 1).

Figure 1: Average price paid for 3.3–3.9GHz TDD spectrum in non-combinatorial, national auctions between 2018–2024, adjusted to account for different licence terms, compared to Hong Kong’s 6GHz auction

Evolutions in technology create new demands in relation to spectrum resources

Demand for new mobile spectrum bands tends to follow mobile technology generation cycles, and new generations can have quite specific needs. Channel bandwidths have changed significantly as mobile technologies have evolved. 5G’s new radio RAN uses 100MHz channels, whereas 4G’s LTE RAN used channel widths up to 20MHz. Currently the only band that can provide multiple-100MHz channels is the 3.5GHz band. Demand for wider channels is also one of the drivers of future spectrum demand for mobile, if for example the optimal deployment of 6G RAN requires 200MHz channels.

This suggests that traditional approaches to valuing spectrum might need to be adapted for future 6–8GHz mobile licensing. The deployment concentrating on high-capacity locations, the uncertainty over traffic growth, and the potential for shared usage all indicate that the value of this spectrum should be carefully considered. The only auction in this range so far (Hong Kong) saw the spectrum sold for a similar price to that of more recent mid-band spectrum. It is early days, but this could be a positive indicator for the potential relevance of appropriately selected benchmarks.

For further advice on mid-band spectrum, spectrum valuation and benchmarking, please reach out to Janette Stewart or Julia Allford.

Author

Julia Allford

ManagerRelated items

Predictions

Satellite D2D will benefit early adopter MNOs in 2026

Article

A changing spectrum landscape offers new opportunities for creative financial sponsors

Article

Why spectrum renewal policy matters for network investment and service quality