Robotaxis and AR: technological progress is (finally) unlocking new commercial opportunities for MNOs

Mobile network operators (MNOs) have been unable to generate additional revenue from emerging wireless technologies so far, despite a clear position in the market.

5G, for example, has seen steady adoption growth since its launch, but has failed to live up to its original promise to unlock new revenue streams for MNOs. The latest upgrade to 5G, 5G-advanced (5G-A), boasts new technical capabilities that support previously impossible use cases and business models. Additionally, though generative AI (GenAI) has been the media focus, breakthroughs in other technologies are changing the picture for MNOs. Smart glasses and driverless cars are two key examples: commercial deployments have begun and their success heavily depends on supporting infrastructure and regulation. This combination of new 5G-A capabilities and maturing technologies offers exciting incremental revenue streams for MNOs who can capitalise on the opportunity.

Smart glasses – from consumer tech novelty to mainstream electronics

The launch of Google Glasses in 2013 was not a roaring success, but it transformed public awareness of consumer ‘wearables’ that support extended reality (XR) experiences, and there was a brief flurry of XR headsets, notably Meta’s Pro Quest and Apple’s Vision Pro. However, the large form factor, demanding computing needs and short battery life all prevented widespread adoption in daily settings where mobility and navigation are vital.

After a decade of reassessment and technological progress, smart glasses have returned to the fore of XR discussions with promises of greater convenience, subtlety and style. Meta and Xiaomi are the first major technology companies to capitalise on this growing interest, and other technology giants like Google, Apple and Snap are quickly following suit. Momentum is gathering, with potentially substantial ramifications for MNOs.

Smart glasses historically relied upon either wired connection or wireless tethering via technologies such as Wi-Fi or Bluetooth, limiting their practical usability:

- Wired connections inherently constrain the mobility of users, who need to carry around a wired parent device (such as a smartphone)

- Wireless tethering generally offers greater physical freedom, but less reliable connectivity. Quality of experience is constrained by the lower data uplink capabilities and greater network latency, especially when the lag reaches the threshold of human perception (generally <20ms).

Cellular connectivity offers greater mobility, convenience and performance. Technical improvements (particularly 5G-A) have dissolved previous bottlenecks and allow smart glasses to be used in a greater variety of settings and functions. Examples of cellular-enabled smart glasses are starting to emerge, especially in the industrial segment (for example, Rokid X-Craft), where devices run on managed connectivity or private network contracts.

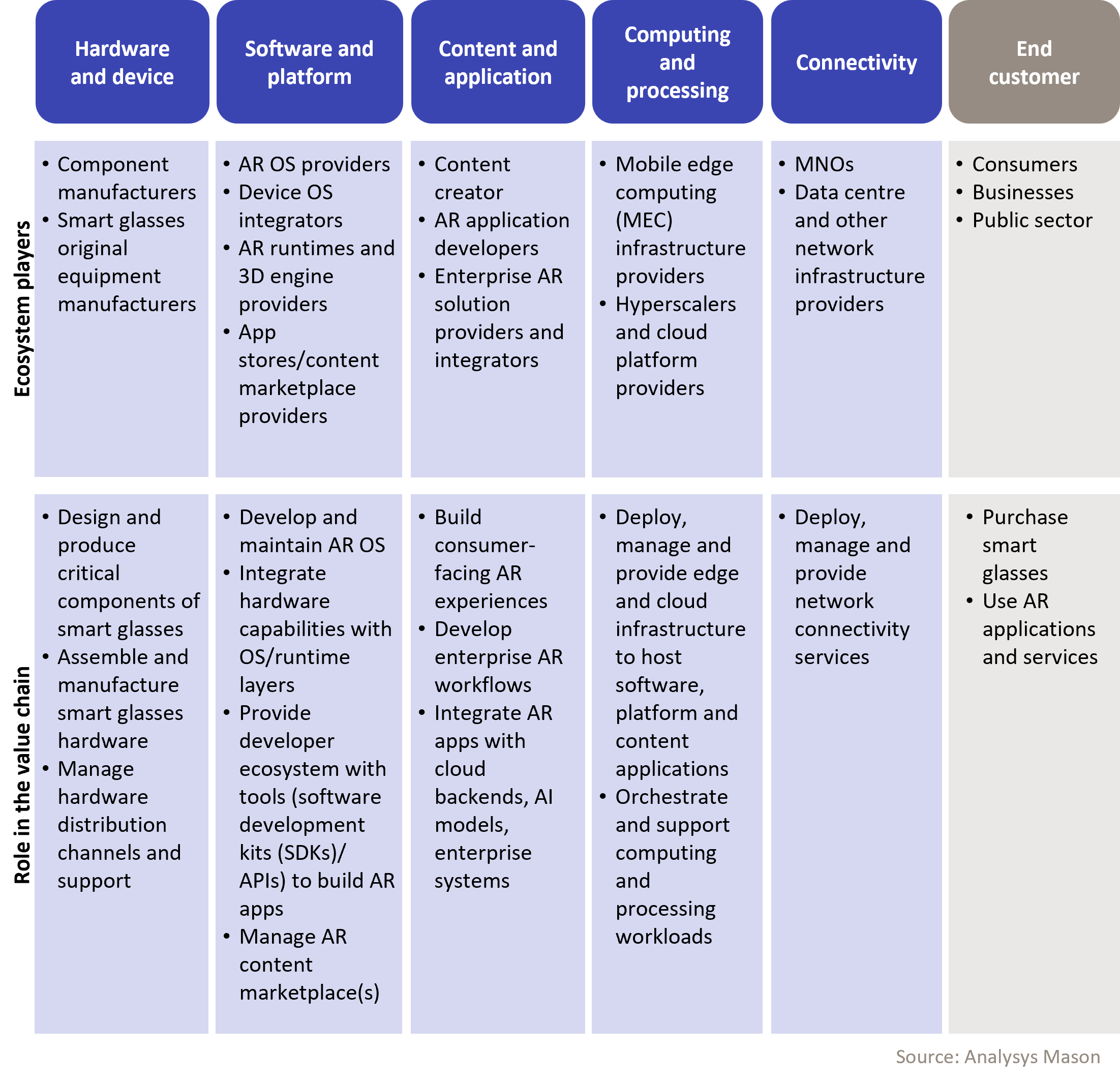

Figure 1: Value chain for smart glasses

Analysys Mason believes that the smart-glasses connectivity opportunity could amount to USD350 million worldwide by 2030, but there are additional potential roles for MNOs:

- Distributing smart glasses bundled with connectivity services (via existing sales channels for mobile device handsets)

- Developing edge data centres to host cloud stack and offering computing services for XR applications

- Providing service enablement, carrier billing system and device-management services

- Offering end-to-end network security and encryption.

MNOs will need to cultivate partnerships with ecosystem players such as smart glasses manufacturers, cloud platform and MEC providers, XR platform developers, XR content creators/application developers and system integrators. The bulk of the operational changes needed for MNOs to realise these roles are in operations (deterministic scheduling, admission control, policy and QoS enforcement), with some changes also expected for customer and partner onboarding (service profile definition, device capability validation) and billing (pricing model adjustments, customer communication and care).

Robotaxis – from aspirational moonshot to everyday reality

Autonomous vehicles (AV) are also set for a breakthrough, following years of status as the ‘next big revolution’ after the disruptions of ride-hailing and electrification. AV technology promises greater passenger and pedestrian safety and less traffic congestion while freeing drivers to engage in other activities. The AV roll-out has been close, but persistently out of reach. Technical challenges, regulatory considerations and public acceptance have all created obstacles both to its technological development and its practical implementation.

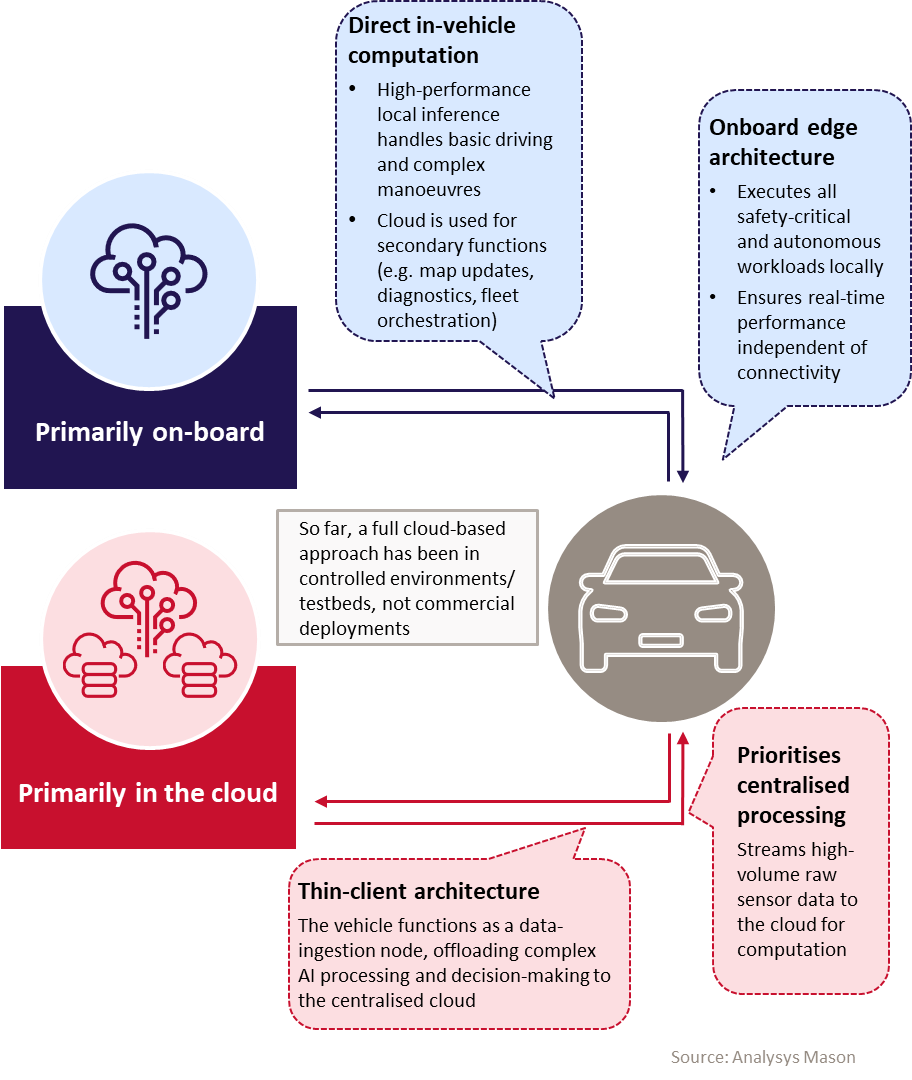

Figure 2: Illustrative approaches to autonomous driving computing

The bright spot in the sector is ‘robotaxis’: AVs are beginning to be used in earnest as on-demand taxi services in locations that have the necessary physical and regulatory infrastructure to ensure safe deployment. After a stuttering start, it looks to have reached a critical inflexion point as industry is now responding to demand. Commercial deployments are underway in key markets in the USA and China and are already being extended; other markets across Europe (for example, the UK) and Asia–Pacific (for example, Australia, Japan, Hong Kong) are set to see implementations in the very near future.

Analysys Mason believes that MNOs could generate over USD80 million in incremental connectivity revenue from robotaxis by 2030, but their deployment and adoption is likely to continue beyond 2030. There are various additional roles for MNOs elsewhere in the robotaxi value chain:

- Deploying multi-edge computing infrastructure (independently or in partnership with hyperscalers) to support low-latency workloads

- Providing connectivity, hosting and/or maintenance for roadside units (sensors, cameras) deployed by transport authorities

- Offering network-level security services

- Providing localisation services, combining network positioning and global navigation satellite systems (GNSS) correction

- Using SIM-based identities to authenticate passenger identity.

MNOs would need to establish partnerships with ecosystem players such as automotive manufacturers, AV system developers, robotaxi fleet operators and potentially connectivity aggregators. The bulk of the changes needed for MNOs to realise these roles lie in operations (mobility optimisation, monitoring and assurance, resilience and redundancy), with some changes also expected for customer and partner onboarding, as well as for billing.

New technologies create opportunity for MNOs

A range of new commercial opportunities are emerging for MNOs across new technologies, such as XR/AR and autonomous mobility. While the delivery of reliable, high-performance connectivity will remain the entry point for most MNOs, capturing a greater share of value will depend on their ability to form deeper partnerships across the technology ecosystem and to build new capabilities in areas such as edge computing, security, data exposure and application enablement. Analysys Mason expects there to be ongoing growth in these markets, which MNOs can capitalise on rather than simply support.

Analysys Mason has a long history of supporting MNOs in identifying areas where their network propositions best align with emerging technologies. We have helped operators to explore new possibilities adjacent to telecoms value chains by formulating go-to-market strategies. We have also helped to develop the partnerships needed to bring compelling offerings to market, and built business cases for network investments.

To discuss the issues raised in the article further or understand more about our proposition and how we can help, please contact our subject matter experts Hugues Antoine Lacour (Principal) and Johnson Chiu (Manager).

Article (PDF)

DownloadAuthors

Johnson Chiu

Manager

Hugues-Antoine Lacour

PrincipalRelated items

Client project

Building a corporate strategy to achieve over 20% revenue growth, diversify the portfolio beyond core telecoms and harness AI-driven value creation

Client project

Developing a go-to-market strategy and a first-of-its-kind business case for an Asian telecoms operator’s entry into the GPUaaS market

Client project

Building the business case for a major 5G launch in South Asia, unlocking 250 million users and 10% 5G-driven ARPU growth in 3 years