5G deployment numbers are accelerating and operators are focusing on standalone architecture

The number of operator deployments of 5G mobile networks grew considerably in 2021 and many more launches are scheduled for 2022, some of which are expected to be standalone (SA) architecture deployments.

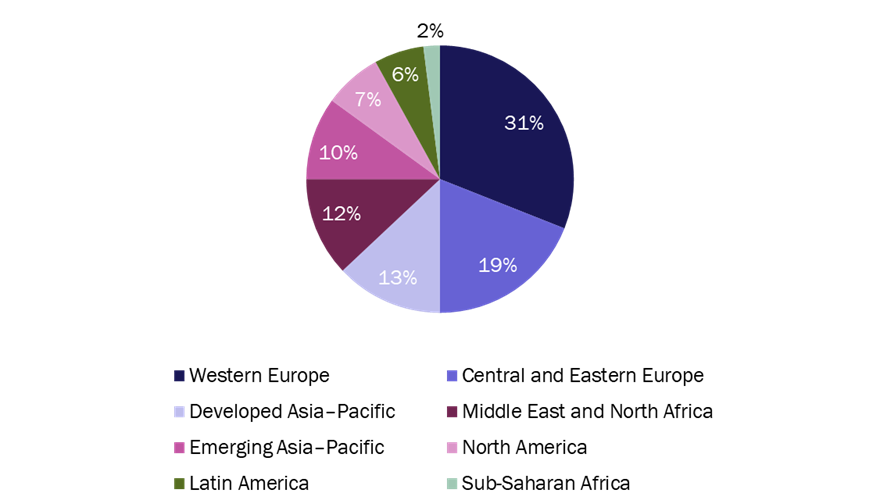

The number of deployments grew from 138 worldwide in February 2021 to 180 at the end of October 2021, according to the latest version of Analysys Mason’s 5G deployment tracker. Europe has the largest number of networks, but operators in emerging Asia–Pacific, Latin America and sub-Saharan Africa have made progress too; the three regions accounted for 18% of operational deployments worldwide at the end of October 2021, up from 14% in February 2021 (Figure 1).

Figure 1: Commercial launches of 5G networks, by region

Source: Analysys Mason

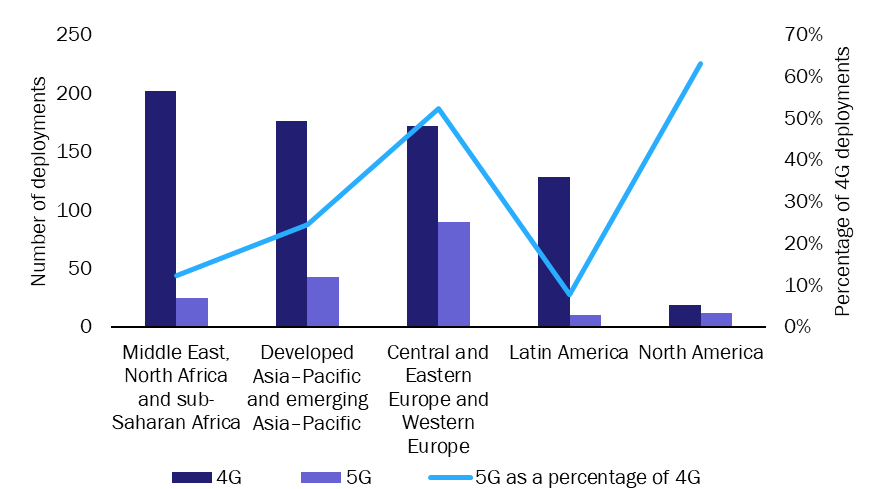

The regional pattern of deployment is different when the status of 4G and 5G networks are compared. In North America, the number of 5G deployments is more than 60% of the number of 4G networks deployed to date, whereas in LATAM, the number of 5G deployments is only 8% of the number of 4G deployments (Figure 2).

Figure 2: Network deployments by type, and 5G deployments as a percentage of 4G deployments, by region

Source: Analysys Mason

We expect to see a different picture in the next version of the 5G deployment tracker because new deployments in LATAM have been announced recently.

- Entel, Movistar and WOM activated 5G networks in Chile in December 2021, 10 months after the operators won spectrum in the February 2021 auction.

- Algar Telecom announced the launch of its commercial 5G network in Brazil in December 2021. 5G services are delivered using non-standalone technology in the 2.3GHz band and are offered in around 40 districts of Uberlandia, Uberaba and Sao Paulo.

- América Móvil launched 5G services in 18 cities in Mexico in February 2022. The operator plans to invest USD1.8 billion in rolling out its 5G network and to cover 120 cities by the end of the year.

In Europe, progress has been made even in countries that so far have been slow to deploy 5G. Portugal’s first commercial 5G networks were activated in November 2021, after a long auction process that concluded in October 2021. Telia Lietuva launched 5G services in Lithuania using the 2.1GHz band and, together with its competitors, is waiting for the regulator to auction some 5G-friendly spectrum.

Operators in the USA have switched on their C-band 5G networks after some delays

AT&T and Verizon announced the activation of 5G networks in their C-Band spectrum in January 2022. The launches were initially due on 5 December 2021 but were delayed by the Federal Aviation Administration (FAA), which raised concerns in October about the potential interference of 5G signals with the ground radar altimeters on aircraft. The operators voluntarily agreed to limit their 5G networks around airports and announced the launch of their networks on 19 January 2022.

Both operators were big spenders in the FCC’s C-band auction, which raised USD81 billion. Verizon paid USD45.5 billion, and AT&T paid USD23.4 billion for C-band licences. Verizon and AT&T will have access to 60MHz and 40MHz, respectively, of their new C-band spectrum by the end of 2022 but will have to wait until the end of 2023 to use the rest. Their need to buy the spectrum was intensified by the competitive threat of T-Mobile, which has an extensive mid-band 5G network in the 2.5GHz band. T-Mobile’s network, mainly in the 600MHz and 2.5GHz bands, covered 200 million people nationwide at the end of 2021, and is expected to reach 250 million by the end of 2022 and nearly 285 million by the end of 2023. T-Mobile paid USD9 billion for C-band spectrum and is far less affected by the FAA directives and other issues around C-band.

5G standalone networks are starting to go live

Operators are increasingly keen to showcase their credentials in terms of both the coverage and the architecture of the network that they are deploying. As the need to deliver a fully 5G experience to end users becomes more compelling, operators are accelerating their shift to SA networks, which support the full range of 5G capabilities because they have a 5G core. Many operators launched 5G SA networks in 2021.

- Vodafone Germany launched a 5G SA network in April 2021, with 1000 antennas in 170 cities and municipalities. The operator plans to deploy a fully-SA network by 2023.

- Telia launched its 5G SA core network in Finland in November 2021. The network, which was deployed by Nokia, was initially available to selected users in around 20 geographical areas across Finland.

- TPG Telecom launched its 5G SA network in November 2021, becoming the second 5G SA operator to do so in Australia after Telstra, which announced it in May 2020.

Many others are planning to launch 5G SA networks in 2022.

- Optus is planning to launch its network commercially in Australia in 2022, having switched on its trial in November 2021.

- Telenor Denmark plans to launch a 5G SA network in 2022.

- Orange selected Nokia as its technology partner in February 2022 for its 5G SA networks in Europe, which are expected to launch in 2023.

- Vodafone Spain, together with Ericsson, started deploying 5G core SA for pre-commercial operation in July 2021.

- Vodafone UK launched a commercial pilot trial of 5G SA service in Cardiff, London and Manchester in June 2021.

A few operators are also experimenting with Open RAN deployment initiatives. Telefónica, which is one of five major European operators that signed a memorandum of understanding to support Open RAN in January 2021, has a target of reaching 50% radio network growth based on Open RAN by 2025. Telefónica announced in September 2021 its plan to conduct Open RAN pre-commercial trials with NEC in Telefónica’s four core countries: Brazil, Germany, Spain and the UK.

KDDI and Vodafone UK have also been active in the Open RAN space. KDDI deployed a commercial 5G SA Open RAN in the Japanese city of Kawasaki in in February 2022, and Vodafone UK switched on its first 5G Open RAN site in the UK in January 2022.

Author