Balancing out performance vs cost, what is worth your money?

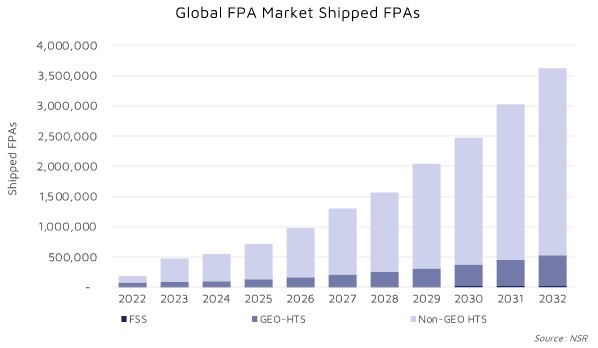

Flat panel antennas (FPAs) are experiencing rapid adoption across various industries and applications. In 2022, According to NSR’s Flat Panel Satellite Antenna 8th Edition report, over 180,000 FPA units were shipped, which was 6 times more, compared to the nearly 30,000 units shipped in the previous year. In the ever-evolving landscape of modern telecommunications and satellite communications, How can FPA manufacturers compete in this dynamic market?

While FPAs are showing positive adoption signs, most flat panel antennas have significant cost or performance drawbacks compared with traditional form factors, thereby limiting their market potential. In this article, we will be exploring the intricate dance between cost efficiency and performance of flat panel antennas, and how manufacturers are balancing the trade-offs.

The cost-performance Dilemma

Flat panel antennas represent a revolution in the world of satellite communication. While the advantages of flat panel antennas are undeniable, manufacturers face a critical challenge—how to maintain cost-effectiveness without compromising performance. This challenge arises from the intricate engineering required to ensure that these antennas deliver the high-quality, stable connections demanded by consumers and industries alike.

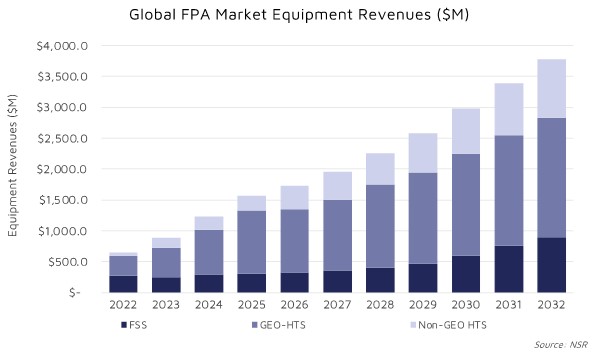

Flat panel antenna manufacturers are balancing trade-offs between cost and performance by adopting new technologies that allow for the manufacturing of next-generation precision flat panel antennas at a market-friendly price point. According to NSR’s latest FPA 8th Edition release, we predict that by 2032, the cumulative equipment revenues will be USD 23 billion. As more antennas are shipped and revenues continue to increase, per-unit price is on the decline – driving unit costs downward will increase the uptake of flat panel antennas throughout the satellite communications ecosystem.

Finding the sweet spot between price and performance

Last month, SpaceX announced that Starlink will no longer need to subsidize the price of its terminals as the company has crossed the bill of materials vs. consumer price threshold. Starlink is now not only un-subsidized, but radically cheaper than FPAs on the market. How then can the rest of the industry compete?

When it comes to the price conversation, “Is cheap all that matters?” Price matters most in consumer broadband markets, and is a key barrier of adoption for NGSO networks to quickly scale operations. However, in markets such as aeronautical IFC or government use-cases, price quickly falls lower in the requirement list. Instead, performance and capabilities take center stage. Not all market segments are purely price driven.

The Flat Panel Antenna market remains largely split along these two lines of low specification and low-priced consumer markets and higher specification and higher priced government and military opportunities. Antenna manufacturers must have scalable antenna technologies which can scale across a range of use-cases and price-points.

Manufacturers should therefore first figure out how to scale production volumes and optimize their supply chain before implementing cost-optimization. Antenna manufacturers that achieve the most success will utilize their fundamental technologies to adjust their scale according to market demands. Technology which can be tailored to the demands of the end-user markets can leverage the scale of mass market opportunities such as consumer broadband or fixed enterprise while still tapping into the higher-end (and higher willingness to pay) segments.

A crucial factor FPA manufacturers must consider in the unit-pricing dynamic is hardware vs software trades. While Field-Programmable Gate Arrays (FPGAs) are dynamic and versatile, Application-Specific Integrated Circuits (ASICs) provide the ultimate in performance and energy efficiency. Each architecture cater to different requirements in the digital hardware landscape. FPGAs are valuable when time-to-market and adaptability are crucial, enabling designers to reconfigure their logic on the fly. On the other hand, ASICs are custom-designed and optimized for specific tasks, offering unparalleled performance and power efficiency, making them the preferred choice for high-volume production and applications where speed and energy consumption are paramount. Understanding these trade-offs are critical for manufacturers to hit the right balance of unit-price, performance, and time to market.

ASICs have higher performance and lower power consumption than FPGAs, but also higher development costs and longer production times. FPGAs are suitable for rapid prototyping, design iterations, and low-to-medium volume applications, while ASICs are ideal for high-performance, high-volume, and cost-sensitive applications. FPGAs have hardware components that can be programmed using software tools. ASICs excel in terms of hardware performance and energy efficiency. Traditionally, the path to market has been low-volume FPGA-based architectures moving towards higher-volume ASIC technologies. In this Starlink era, that mindset must be reconsidered and applied conservatively.

The right technology for the right markets at the right price will win. For certain customers, the affordability of FPAs will be a significant advantage during service trials. However, in markets with substantial switching costs, such as the aerospace industry, factors like performance, size, and functionality become more critical than simply seeking the lowest cost.

The Bottom Line

Manufacturers are always working to balance cost considerations while delivering optimal performance to users. As equipment manufacturers grapple with this delicate balance, they not only shape the future of connectivity but also face the challenge of meeting diverse and demanding consumer needs.

Author