There is not yet a clear winner among vendors of cloud stacks for vRANs and MEC

Our assessment framework shows that there is not yet a clear winner among vendors of cloud stacks for vRANs and MEC

Operators require specialised cloud stacks to support the highly distributed nature of virtualised radio access networks (vRANs) and multi-access edge computing (MEC) so that they can benefit from capex/opex savings and new enterprise revenue streams; cloud stacks developed for centralised cloud computing are not sufficient. Analysys Mason has developed a framework to enable operators to evaluate the new set of requirements for enabling efficient performance across a distributed environment and has applied it to eight cloud stack vendors that are targeting vRANs.

The nascent market for vRANs and MEC is attracting greenfield vendors as well as established cloud stack providers that are re-engineering their existing products. We have assessed these vendors across six key categories, including the strength of their edge-native automation and management capabilities, which has emerged as the key technical differentiator between vendors. No vendor dominates this market yet, so each operator should assess its own vRAN and MEC requirements and telco cloud positioning when choosing whether to stay with an existing cloud stack provider or to opt for a new edge-native cloud stack from a new market entrant.

Operators must consider a range of capabilities when choosing a cloud stack vendor for vRANs and MEC

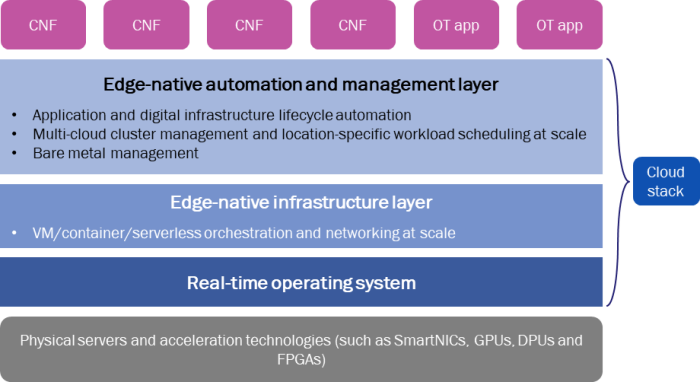

Operators will increasingly need many more cloud computing locations to support virtualised, distributed network functions such as the vRAN and 5G standalone (SA) core. Cloud stacks that were developed to support centralised private and public cloud computing and network function virtualisation (NFV) do not have the right properties to support computing across tens of thousands of nodes at the network edge. Edge-native cloud infrastructure is location-sensitive, space-constrained and highly distributed by definition. This means that operators will need to implement an edge-native cloud stack, as defined in Figure 1, with features that can deal with thousands of microservices-based application instances distributed across potentially remote locations in order to support MEC use cases as well as the vRAN. The features required include the ability to manage heterogeneous hardware and clusters at scale with a high level of autonomy; this is more important than elasticity, which is the key feature of a central, cloud-native cloud.

Figure 1: Technical architecture of an edge computing node

Source: Analysys Mason, 2021

We have proposed an assessment framework to help operators to identify the key capabilities that they should consider when evaluating cloud stack vendors. The framework is made up of six assessment categories; three are technical and three evaluate cloud stack vendors’ commercial traction in the vRAN and edge markets. The specific capabilities that we considered in the technical categories mirror the layers in the cloud stack and are as follows.

- Edge-native automation and management is critical given the number of edge nodes that operators will need to support in a vRAN. We considered the ability of this layer to automate the management of both edge hardware and software (cloud infrastructure and applications) and to cope with scale and location-awareness. Edge-native automation and management that can support any CaaS/IaaS and bare metal hardware is given additional credit because it provides operators with ultimate flexibility over what they deploy in their own edge data centres (DCs), and potentially enables them to also deploy across third-party/partner edge clouds.

- Edge-native cloud infrastructure must be highly optimised to take up as few server resources as possible due to the footprint constraints at the edge. We expect that edge workloads will run across non-homogeneous edge DCs, so we assessed the ability of vendors’ edge-native infrastructure to support multiple virtualisation approaches and different hardware form factors and types.

- Real-time operating systems are needed to support the stringent performance requirements of vRANs and the low-latency requirements of enterprise applications. Vendors are divided on the need for a real-time operating system (RTOS) to support current mid-band vRAN deployments, but we believe that it will be increasingly important as vRAN components become more distributed and antenna and spectrum requirements become more demanding.

We also looked at three important commercial criteria that affect the traction that vendors can gain for their edge cloud stacks. It is vital that vendors attract a critical mass of developers to their platforms to enable operators to use large application ecosystems to monetise 5G and their edge cloud estates. Another measure of commercial success is the number and variety of vendors in the ecosystem that edge cloud stack companies can bring to an operator; being able to provide operators with a choice of 5G network function providers is important. Finally, a vendor with one or more live deployments of its edge cloud stack has clearly had early commercial success, and this is acknowledged in our assessment.

Operators should be aware of the trade-offs involved in implementing vendor solutions at this early stage of market development

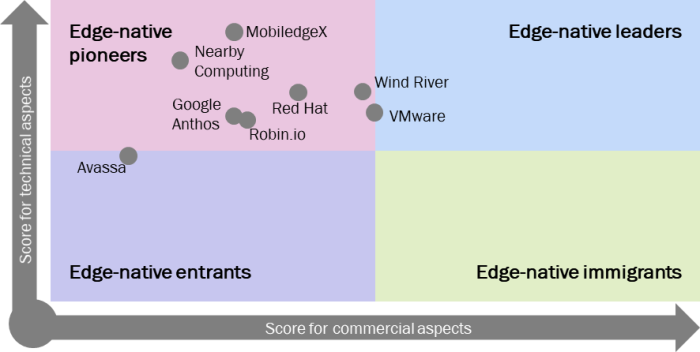

Figure 2 shows the positioning of the eight vendors that we assessed in our report, Benchmarking edge-native cloud stacks for vRAN and MEC: analysis and profiles. It is clear that the edge-native cloud stack market is still in its infancy, and no clear edge-native leader has emerged.

Figure 2: Overview of the scores of vendors in our report according to our framework

Source: Analysys Mason, 2021

The benchmarked vendors include start-up companies, a public cloud provider and established vendors that are evolving their cloud stacks that were originally designed for centralised cloud. Only a few vendors, mainly existing stack providers, offer all three layers of the edge-native cloud stack. New entrants are more likely to focus on an edge-native management and automation layer that is agnostic to the cloud infrastructure layer (CaaS) and RTOS below it. They score highly from a technical standpoint because they have designed their products to be edge-native from inception. However, full-stack vendors are ahead in terms of commercial aspects because they have existing relationships with network function vendors and developers.

Operators should consider what is important to them when choosing a vendor. Deploying with an established vendor with a full cloud stack may be easier, and operators that extend their relationship with an existing cloud stack provider can maintain continuity in the vRAN and for MEC. However, a new-entrant vendor that has optimised its cloud stack for edge-native use cases may offer specialist capabilities, such as a fresh focus on the edge-native management and automation layer, that better suit an operator’s edge-native roadmap. The outcome of operators’ decisions will affect the performance and operating costs of the vRAN, as well their future ability to monetise enterprise applications.

Article (PDF)

DownloadAuthor

Ameer Gaili

Senior AnalystRelated items

Article

NVIDIA GTC Paris 2025: digital twins and sovereign AI signal a new era for telecoms infrastructure

Article

GenAI in the network: who is making real progress, and what is driving it?

Article

Operators are set to invest USD77 billion cumulatively in AI cloud infrastructure between 2025 and 2030