Satellite direct-to-device: the characteristics of D2D constellations will limit SpaceX’s ability to dominate

Direct-to-device (D2D) communication services represent significant revenue potential for telecoms operators, but operators must understand the characteristics of D2D constellation deployments before they can understand system performance. This is especially true in relation to SpaceX, which is leading the race to provide commercial D2D services. D2D satellites can be placed in low-earth orbits (LEO) to minimise the signal path loss, but LEO D2D constellations are designed with fewer satellites than broadband constellations, resulting in varying network conditions where capacity is not always present or sufficient. Telecoms operators can use analytics software to assess the future impact of D2D satellite constellations in their territories, as T-Mobile is doing for the upcoming trial of its D2D constellation in partnership with SpaceX in the USA.

Telecoms operators are using analytics software to assess the D2D opportunity and establish partnerships with satellite players

Telecoms players are increasingly interested in D2D communication technology as an added element to their network and are focusing on evaluating network analytics and identifying partnerships. One example is SpaceX’s collaboration with T-Mobile in the USA, which plays a crucial role for the future of D2D. Since the Federal Communications Commission (FCC) granted experimental authorisation, SpaceX has launched over 100 satellites and tested speeds of 17Mbit/s, setting the stage for an accelerated launch schedule. The scale and momentum of the Starlink constellation, coupled with SpaceX’s launch cadence and economics, pave the way for the operator to extend its lead in the satellite broadband market to the satellite D2D market. The SpaceX–T-Mobile partnership was established in 2022 and multiple MNOs have signed deals with SpaceX since then, including Entel in Chile and Peru, KDDI in Japan, One NZ in New Zealand, Optus in Australia, Rogers in Canada and Salt in Switzerland.

SpaceX will not dominate the satellite D2D market but the company’s success is important for the future of the technology

This article focuses on the SpaceX D2D trial in the USA, but it must be emphasised that SpaceX is not poised to become the winner in a ‘winner-take-all’ market because of the complexities and dependencies surrounding regulation, mobile value chains and spectrum uses. Apple’s services delivered in partnership with Globalstar use MSS spectrum, as will Iridium’s 5G satellite services to standard phones. However, most other D2D players (including SpaceX) use MNOs’ spectrum, for which they need special permission. Lynk Global and AST SpaceMobile were first to validate D2D messaging and broadband respectively using mobile spectrum through their in-orbit prototype satellites. These players have conducted numerous trials successfully and signed strategic deals with telecoms operators including major MNOs such as AT&T, Verizon and Vodafone.

SpaceX announced in a letter to the FCC in May 2024 that it would launch D2D services during 4Q 2024. It is likely that SpaceX will phase the launch as it did with Starlink broadband and roll out services initially in northern regions. Michael Nicolls VP of Starlink Engineering announced in Musk’s X social network on 1 June 2024 that SpaceX launched 26 direct-to-cell satellites in May, representing over 8% of the satellites needed for initial direct-to-cell service. This prompted multiple industry observers to conclude that around 300 satellites would suffice, but simulations using Analysys Mason's Non-GEO Constellations Analysis Toolkit version 4.2 (NCAT4.2) illustrate that such a scenario would result in sporadic service across most of the USA. 300 satellites could provide continuous service in northern continental USA (Alaska excluded) but sporadic service in southern US regions.

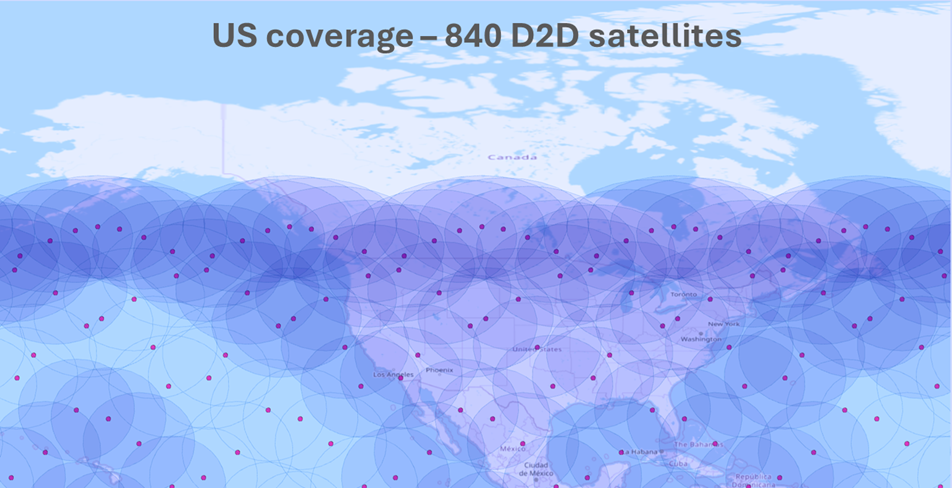

Starlink’s 840-satellite constellation will increase coverage

An initial constellation of 300 Starlink satellites is a starting point, but SpaceX plans to launch 800+ satellites, which will significantly increase coverage. As described in SpaceX’s experimental STA (special temporary authority), the goal is to launch 840 satellites (Figure 2) that will work with thousands of test devices to validate connectivity performance. Testing will cover two dozen US locations, including Los Angeles, California; Reston, Virginia; Redmond, Washington; and Dallas, Texas, with T-Mobile-controlled test devices connecting directly to Starlink satellites.

It is expected that the 840-satellite D2D network will have the following orbital characteristics:

- satellite altitude: 525km

- orbital inclination: 53 degrees

- number of orbital planes: 28

- satellites per plane: 30

- elevation angle for smartphones: 30 degrees or higher.

Figure 1: SpaceX’s D2D future network deployment

Source: Analysys Mason, NCAT4.2

Given such characteristics, the following metrics were calculated.

- Smartphone-satellite distance. Between 525km (at 90-degree look angle) and 951km (30-degree look angle).

- Connection round-trip delay. 7 to 16 milliseconds for single-hop communication between a smartphone and a Starlink gateway. This calculation considers propagation delay only, excluding additional latency from active equipment such as protocol packetisation and doppler-shift compensation.

- Visible satellites. Depending on location and time, visibility will vary. For instance, Dallas, Texas will have between 2 and 5 D2D satellites in line of sight, averaging 3. Redmond, Washington will have between 6 and 10 satellites in line of sight, averaging 7.

- Satellite pass time and handoff rate. The maximum satellite pass time assuming 30 degrees of minimum elevation for smartphones is 3 minutes and 20 seconds, resulting in a minimum handoff rate of 18 satellites per hour.

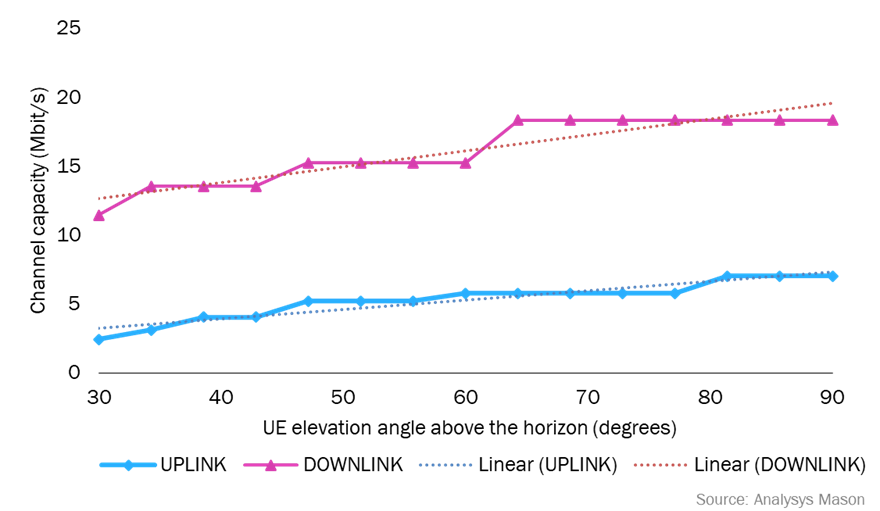

Given link distance, frequency band and look angles, NCAT4.2 calculates the mobile channel capacity, resulting in up to 18Mbit/s (downlink) and 7Mbit/s (uplink) of peak channel speed (shared by all user equipment in the beam area). Calculations in Figure 2 correspond to SpaceX’s Special Temporary Authority (STA) filing assuming 5MHz of transmitting and receiving channels in the PCS G block. Calculations assume user equipment with characteristics that are similar to Apple iPhones and the satellite transmitting and receiving technical characteristics in the filing.

Figure 2: Calculation of SpaceX's D2D channel capacity, Analysys Mason’s NCAT4.2

The analysis forecasts that in northern US locations, smartphones will generally be able to connect with better look angles, reducing signal path loss. The trial itself will provide validation, but this will result in superior connectivity performance compared to southern regions where the service may initially be sporadic.

The actual results of the upcoming trial will mark a significant step towards realising the full potential of D2D technology. The implications extend beyond convenience, offering solutions to one of the most pressing challenges in the telecoms industry: worldwide mobile coverage.

Article (PDF)

DownloadAuthor