Operators in developed Asia–Pacific will struggle to increase service revenue in line with inflation

31 October 2023 | Research

Article | PDF (3 pages) | Developed Asia–Pacific Metrics and Forecasts

Telecoms service revenue in most countries in developed Asia–Pacific (DVAP) will return to continuous year-on-year growth from 2023 after a few years of decline caused by the COVID-19 pandemic. Meanwhile, inflation has been elevated in the region since 2020, putting further pressure on operators. Inflation, which peaked in the region in 2022, is forecast to decline from 2023 and reach levels of around 2% by 2025. However, even if economies recover, most telecoms operators will struggle to increase service revenue in line with inflation throughout the forecast period.

This article presents a summary of the findings from Analysys Mason’s Developed Asia–Pacific telecoms market: trends and forecasts.

Operators in DVAP will not be able to increase service revenue in line with inflation

DVAP, like most of the world, has had increased levels of inflation since the start of the Covid-19 pandemic in 2020. The countries in the region which were most affected were Australia, New Zealand and Singapore, all of which recorded consumer price index (CPI) growth of more than 6% in 2022.1 National economies have started to recover, and CPI growth has declined slightly in 2023. It is forecast that CPI growth will return to around 2% in DVAP from 2025.2

Most countries in the region had a negative mobile service revenue CAGR between 2017–2022, mainly due to the pandemic and the related travel restrictions and lockdowns. However, mobile service revenue returned to growth in 2022 as operators made inflation-related price increases to their plans and travel and lockdown restrictions eased. Furthermore, indications from South Korea suggest that ARPU has increased, although very slightly, after the introduction and rapid take-up of 5G. However, we are yet to see similar effects of 5G in other countries in the region.

In the fixed segment, service revenue has been increasing historically as consumers are migrating from DSL and cable plans to more expensive fibre-to-the-premises (FTTP) and fixed–wireless access (FWA) plans.

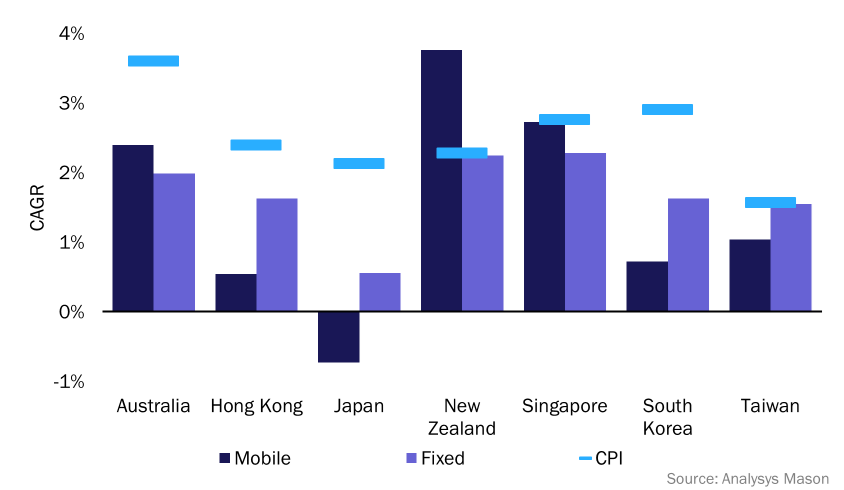

Figure 1: Mobile and fixed service revenue CAGR and CPI, DVAP, 2022–2028

Figure 1 shows the compound annual growth rates (CAGR) for service revenue in the fixed and mobile segments, as well as the CPI CAGR in the forecast period. Most countries will see increasing service revenue in both the fixed and mobile segment.3 However, due to the highly developed telecoms market in the region and strong competition, price increases and 5G and FTTP migration will not be enough to keep service revenue growth in line with inflation.

Value-added services will be crucial to keep mobile service revenue increasing

Operators have not been able to significantly increase ARPU through the migration to 5G and FTTP, and the current macroeconomic situation is also not helping. This increases the importance of value-added services (VAS). Mobile VAS refers to services such as video streaming, sports broadcasting and gaming that are included in mobile plans as added features. In recent years, these bundles have emerged as a way for operators to increase service revenue even if price competition has been tense for traditional telecoms services.

DVAP is a leading region in this space; we estimate that the share of VAS handset data revenue compared to total data revenue was 12% in 2022 which is significantly higher than regions like Western Europe (7%) and North America (3%). To keep increasing service revenue, it will be crucial for operators in DVAP to increase the adoption of VAS further. We forecast that VAS revenue in DVAP will grow at a CAGR of 6% and reach USD10.4 billion by 2028.

Operators will accelerate cost-cutting measures if the challenge to increase service revenue proves to be too difficult

While operators will be relieved that service revenue has returned to growth after a few years of decline, they will still face the challenge of increasing service revenue in line with inflation. Leveraging new technologies like 5G and FTTP will not be enough to do so, putting added pressure on operators to find alternative ways to increase ARPUs. While, improving VAS offerings will play a big part in operator strategies, it is likely that operators in DVAP will also accelerate cost-cutting schemes to improve profitability.

1 The countries in DVAP that we model individually are: Australia, Hong Kong, Japan, New Zealand, Singapore, South Korean and Taiwan.

2 Source: International Monetary Fund.

3 The only outlier being Japan where the entrance of a new MNO, Rakuten, has forced other MNOs to offer discounts and decrease prices.

Article (PDF)

DownloadAuthor

Erik Ottosson

AnalystRelated items

Country report

South Korea: state of the telecoms market 2025

Article

Telecoms operators are hoping to defend ASPU by bundling in AI products such as ChatGPT and Perplexity

Article

Developed Asia–Pacific market update 4Q 2024: New Zealand utility operators cross-sell to increase revenue