HAPs – Fitting in a rapidly evolving industry

Recently, the UK space agency made a commitment to invest in HAPs (High Altitude Platforms) with over $25M to improve connectivity & technology. Additionally, several companies such as Mira Aerospace (JV between UAVOS & Bayanat) & BAE Systems achieved testing milestones, while Chinese ALifecom is addressing interoperability of HAPs architecture with other NTN systems. These milestones are contributing to address mobile connectivity, Earth Observation, and disaster management, among other markets. However, HAPs also introduce unique challenges that need to be overcome for widespread acceptance and we must ask ourselves: “How do HAPs fit into the fabric of existing Non-Terrestrial Networks, and why is it a solution despite slow technological progress?”

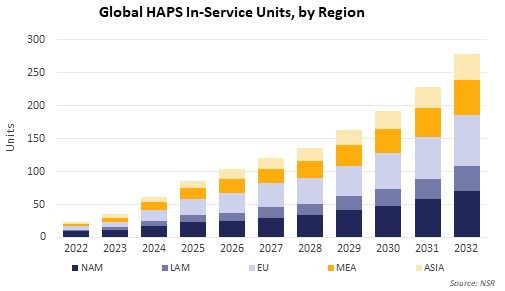

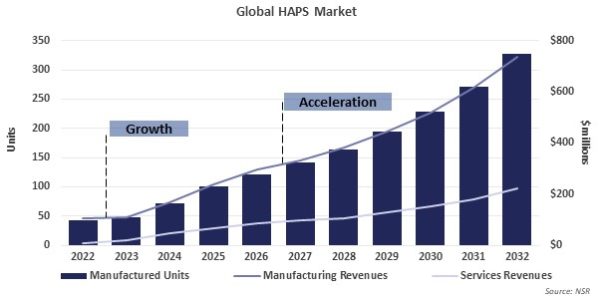

NSR’s High Altitude Platform, 5th Edition report forecasts that HAPs will create a $3.9B market opportunity through manufacturing for communications, remote sensing, and other applications. On top of that, the market opportunity through services is expected to generate $1.1B cumulatively over the same period. Overall, the number of in-service units is expected to grow steadily globally, with the largest number expected to be deployed in EU and NAM reaching a total of 773 units cumulatively. These highlight a unique concept of operations driven by improvements and innovation for operators and manufacturers and they move from deploying units into commercialized architectures.

Challenges: Innovation and Collaboration

Despite a rapid growth path in the satellite industry, the challenge of connectivity remains unsolved, with the latest reported data revealing 2.9 billion people still unconnected with 94% of them residing in low- and medium-income countries, primarily in sub-Saharan Africa and the Indian subcontinent. HAPs have been touted as a solution by the ITU for these regions, but the technology adoption is fraught with hurdles. With a limited number of companies making progress beyond critical-testing milestones, the operational environment, coupled with the need for seamless integration with ground-based systems pose substantial technical, regulatory, and operational challenges.

Crucially, the safe and efficient functioning of HAPS necessitates continued R&D in fields such as communication links. And, integration of HAPS into the existing Non-Terrestrial Networks (NTN) infrastructure poses an additional challenge. Successful integration requires a nuanced understanding of wireless communication systems and comprehensive system integration experience, to harmonize the use of HAPS with current networks.

Moving the Market Readiness

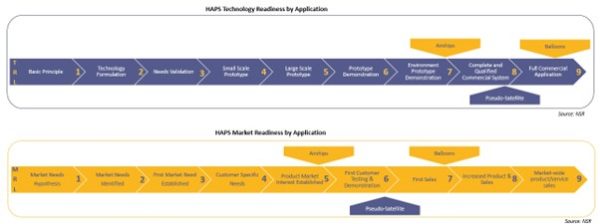

But the TRL level of different HAPS are not at the same level. Indeed, if we look at it realistically, the market readiness suffers delays to reach commercial viability for all types of platforms. With TRL 5 for Airships, TRL 6-7 for Pseudo-satellite and TRL-7 for balloon, the adoption is ‘not there yet’.

Fortunately, the industry is not short of innovators determined to overcome these obstacles. Successful trials like ApusDuo by Mira Aerospace, and PHASA-35 by BAE Systems, underscore the progress in HAPS technology. The planned 2024 service launch of Zephyr, another HAPS platform, also raises the level of confidence in the industry's capacity to tackle these challenges.

Moreover, strategic collaborations like the recently inked Memorandum of Understanding (MoU) between start-up Paradise Mobile and Aalto HAPS, highlight the industry's commitment to pooling resources to further HAPS technology. These partnerships are promising indicators of HAPS technology's potential to revolutionize communication, particularly in remote and underserved areas.

Unveiling the Benefits of HAPS Technology

Looking at satellite connectivity again, NSR’s Global Satellite Capacity and Demand, 20th Edition report sees a global demand for swift, reliable, and affordable communication solutions. HAPs have a potential for lower latency than satellites, expanding the coverage capacity, and faster deployment times to tackle the connectivity needs in remote intermediate density areas. It is thus good to note that in-service units within LAM & MEA are expected to grow at CAGRs of 28.9% & 29.5% which is driven by the capabilities of making HAPs to be a viable alternative to traditional satellite and terrestrial communication systems in these regions where these areas are numerous. HAPs are a potential linchpin to a global connectivity transformation and an optimization of the communication infrastructure by addressing greenfield opportunities, and reducing white spots.

Additionally, the versatility of HAPS allows for connectivity in remote locations, disaster-stricken regions, and maritime environments for short-wave emergency broadcasting, restoring calls. Overall, the HAPs deployment could lead to a realization of $927M in revenues through communications and remote sensing verticals. Additionally, with HAPs rapid deployment capabilities, they can generate valuable data on weather patterns, track glacial movements, detect forest fires, and monitor the health of crops and forests. Significant recent advancements in high-altitude technology such as R2Home (an autonomous recovery system to ensure the safe return of payloads) to holistically service the HAPs market for astronomical observations, and payload recovery, are improving the scientific and technological landscape. Addressing these opportunities could lead to a market potential of $181M over the next decade. Additionally, improvements in solar panel technology and energy storage systems have enhanced the performance and efficiency of these platforms, rendering them more environmentally-friendly and practical for a variety of industries, including telecommunications, surveillance, and weather monitoring. These platforms, capable of staying in the stratosphere also offer a clearer view of distant celestial objects, free from atmospheric blurring effects. HAPs have the potential to be an additional affordable solution for astronomical observations, accessible to a broader range of research institutions. Recently, after extensive development since 2021, the R2Home system recently demonstrated its maturity with a successful high-altitude test flight, delivering a radiosonde payload and landing within 5m of the launch point.

Although the industry has seen some successes, it is important to note that these are isolated in a wider field still replete with challenges. The imminent launch of Zephyr might inspire confidence in the industry's capacity to overcome these hurdles, but it remains to be seen if this will translate to widespread deployment and utilization of HAPS.

The Bottom Line

HAPS introduce unique challenges due to their nascent stage of commercialization and the complexity of integration with existing NTN, and their potential to support the goals of achieving global connectivity and facilitate sustainable management of Earth's resources is considerable. However, the journey towards their large-scale adoption remains steeped in complexities. The slow but successful deployment of HAPs necessitates considerable investment in research and development, and strategic partnerships. The industry's readiness to pool resources and tackle these challenges head-on, as seen in the collaboration suggests a bright future. Yet, it remains crucial for all stakeholders to balance the optimism surrounding HAPS technology with a sober understanding of the challenges ahead.

Author

Claude Rousseau

Research Director, expert in space and satelliteRelated items

Podcast

The maritime satcom market is facing challenges as incumbents navigate a challenging ARPU landscape

Article

Europe should bridge the gap between various international lunar efforts

Forecast report

Civil government satellite communications: trends and forecasts 2024–2034