In the Race to the Moon, where is China?

Since China’s lunar program formally received approval in 2004, CNSA - its space agency - successfully launched the Chang’e 1 to Chang’e 5 missions in just over a decade. The country recently outlined the next phase of its lunar program while also expanding its Wenchang spaceport to put astronauts on the Moon by 2030. China's lunar exploration program features similar goals as NASA's Artemis program, namely, establishing a scientific facility and a sustained human presence on the Moon. So, with more nations looking to add lunar as a destination to their roadmap, it is worth asking: “What’s the effect of China’s lunar ambitions on other nations?”

Partnerships and Political Hurdles

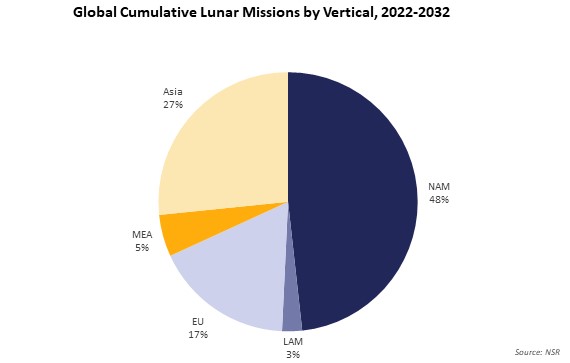

NSR’s Lunar Markets Report, 3rd Edition forecasts that North America will dominate the lunar market, accounting for 48% of the total missions by 2032, driven by NASA’s Artemis program. Asia is projected to conduct 27% of the missions, with China and Japan leading most of them.

China has been trying to form partnerships for its International Lunar Research Station (ILRS) and future space projects. Although the ILRS initiative is intended to involve multiple international collaborators, progress in forming such partnerships has been slow, with currently only Russia and Venezuela on the list.

Otherwise, China’s future partnerships mostly involve hosting scientific payloads on future Chang’e missions. However, China recently lost a partnership with the UAE as a consequence of ITAR restrictions. In addition, Western nations are less likely to partner with China’s ILRS because of the political sensitivity of indirectly working with ROSCOMOS, as well as concerns regarding the transfer of technologies, and other U.S. sanctions. Thus, the program starts on the international front finds itself weakened by political hurdles and a mix of commercial regulations.

A Silk Road in Space

One way China could engage emerging (space) nations more with IRLS is through its Space Silk Road program, which is part of China’s broader Belt and Road initiative (BRI) aimed at developing infrastructure projects in emerging nations. Last year, China invested $67B in 147 countries as part of the BRI, with, among others, Huawei building 70% of Africa's 4G infrastructure network. The country made a cumulative BRI engagement of $962 billion since 2013. This level of investment suggests that China has the potential to mobilize a lot of funding for other projects such as lunar missions, which are costing in the tens of $B over the next decade.

China has already established partnerships for its Space Silk Road Program with several countries. Its success in its lunar endeavors has shown how fast a country can evolve into a space power. This can inspire other nations to develop their own program and participate with China’s ILRS, extending BRI partnerships from Earth to the Moon.

However, there are several African and Asian nations claiming they have fallen into “debt trap diplomacy” after accepting loans from China with unfavorable terms. This, in combination with a lack of transparency, and a civilian and military space program being blended, may have caused some nations to be more cautious about collaborating with China for the IRLS. Some countries emphasized on the possibility to receive financial aid or loans from Japan with far better terms.

The Bottom Line

Although the effect of China’s lunar ambitions on other nations are currently minimal, China’s lunar aspirations and its potential should not be underestimated. The country’s advancements in cislunar space, over a short period of time, have been noteworthy. If China succeeds in offering better incentives for cooperation on the ILRS compared to those of the Artemis program, becomes more transparent about its civilian and military objectives, and finds a backdoor to avoid ITAR restrictions, its presence and impact on the lunar market could shift the balance of power in space exploration.

Author

Dallas Kasaboski

Principal Analyst, expert in space infrastructureRelated items

Podcast

The maritime satcom market is facing challenges as incumbents navigate a challenging ARPU landscape

Article

Europe should bridge the gap between various international lunar efforts

Forecast report

Civil government satellite communications: trends and forecasts 2024–2034