Operators need a bolder plan to stop the slowdown in IoT revenue growth

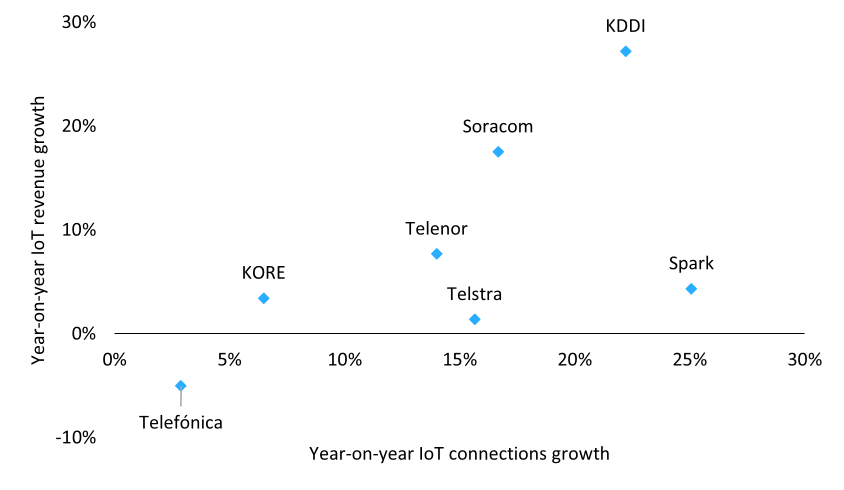

Most operators continue to see healthy growth in IoT connections, often at a rate of above 10% year-on-year. IoT revenue tells a different story: growth is slowing and typically falls below 10% year-on-year (Figure 1). Some operators have been ambitious in seeking to reverse this trend. Others have made only incremental moves. However, they may need to take a more radical approach. Operators that continue with business as usual risk further stunting IoT revenue growth.

Figure 1: Year-on-year growth in IoT connections and revenue, 2024

Source: reporting providers1

The core challenges operators face in IoT have remained largely unchanged for several years: intense price competition in connectivity; the degree to which they should focus on vertical solutions; and uncertainty in the revenue potential and timelines of new technologies, such as eSIM/iSIM and 5G RedCap. More proactive operators have met these challenges with ambitious new strategies.

We explore IoT providers’ revenue growth strategies in detail in two case studies reports: volume I, which focuses on operators, and volume II, which focuses on connectivity disruptors.

Operators are restructuring, expanding their sales channels and/or increasing their geographical reach to grow IoT revenue

Several trends have emerged in IoT providers’ growth strategies.

- Some operators are exploring new organisational structures. Vodafone and Deutsche Telekom, among others, have moved their IoT operations into dedicated companies: each has increased autonomy to source connectivity outside of its parent footprint (acting like an MVNO) and to steer investment decisions. We expect that other operators will make similar moves (and should consider doing so) to separate IoT from a wider business division where it contributes relatively little revenue.

- Most providers have moved away from end-to-end solutions, but some are focusing more on hardware. A small number of operators, including AT&T, Telefónica and Verizon, are still trying to provide complete solutions across multiple verticals. However, several operators have increased their focus on hardware. Telenor and Deutsche Telekom have developed integrated module and connectivity solutions to target device manufacturers. Meanwhile, BICS, Orange and Verizon are working more closely with customers in the pre-deployment stage to provide device testing and optimisation services. Hardware-related services rarely generate significant revenue, but they can bolster the connectivity business by minimising hardware-related issues.

- There is renewed interest in digital channels and a focus on developing indirect sales channels. Operators have experimented with online sales channels over the years. Interest has grown recently: Deutsche Telekom and KORE launched online stores to sell connectivity and hardware, and several other operators intend to make greater use of digital channels. Beyond this, many operators are expanding their indirect sales channels. Telefónica and AT&T have updated their IoT partner programmes to attract more business through service providers and resellers. Other players, such as BICS and Wireless Logic, are partnering with module manufacturers. Diverse sales channels are increasingly important to maintain connection growth while controlling costs.

- Operators are looking to expand geographically to increase connection volumes. Some operators are building partnerships to expand outside of their core geography. Verizon established its Global IoT Orchestration programme to enable the use of local eSIM profiles and unified connectivity management platforms (CMPs) for international customers; programme partners include Telenor, Bell and Singtel. Deutsche Telekom became the first European member of the Bridge Alliance (comprised primarily of Asia–Pacific-based operators) and expects it to become a significant channel for providing European connectivity to Asia–Pacific customers. The imminent arrival of SGP.32, the IoT eSIM specification, will likely drive a shift from traditional roaming towards localised, eSIM-based connectivity. We expect this to increase the importance of inter-operator partnerships or partnerships with MVNOs/MVNEs, which enable operators to leverage disruptors’ global connectivity capabilities, as AT&T recently did with Eseye.

Operators can strengthen their IoT business by drawing on the strategies of disruptors

Connectivity disruptors benefit from an undiluted focus on IoT and are often more willing to take risks on product development and to explore new growth opportunities. Many lack scale and are unprofitable, and so will be acquired or exit the market. However, survivors will pose an increasing threat to operators.

- Disruptors are often more willing to experiment with value-added services. Several operators offer value-added services such as security, data analytics and managed services, but these features are now fairly standard across providers. Disruptors tend to be more innovative in developing differentiated features. Soracom has developed a suite of GenAI tools on its platform to enable data analytics and help customers build AI applications, and Wireless Logic has had success upselling mapping2 and security solutions to charge a premium above basic connectivity.

- Several disruptors are exploring growth areas adjacent to IoT. Examples include eSIM-based enterprise mobility, fixed-wireless access and travel eSIMs. These use cases can generate higher data rates than typical IoT applications and help to boost disruptors’ average revenue per connection. Operators should be wary of this trend; it could diversify disruptors’ revenue and put them in a stronger position to negotiate more favourable wholesale terms and to offer more competitive IoT pricing.

Operators that remain cautious in IoT risk being outpaced by agile disruptors

Competition in the IoT connectivity market remains intense. Various operators are scaling back their ambitions and shifting their focus to wholesale opportunities, which may be the best course of action for some. Operators that remain committed to IoT will need a more creative approach. This could mean experimenting with new pricing models and routes to market or adopting more flexible organisational structures.

Operators could also consider forming closer relationships with disruptors. A few are doing so already: AT&T joined MTN and Telus in white-labelling Eseye’s CMP and eSIM connectivity solution, and Singtel formed a similar partnership with floLIVE. Only a couple of operators have acquired disruptors; yet others should consider this option to boost revenue by gaining scale or acquiring capabilities that they currently lack, such as eSIM or value-added services.

1 Telefónica’s revenue comes from Telefónica Tech only. Growth is impacted by the divestment of Telefónica’s operations in several Latin American countries.

2 See Wireless Logic’s vehicle mapping and geo-location solutions for M2M/IoT devices.

Analysys Mason brings extensive experience in IoT, gained through research and customer projects. This expertise positions us to support stakeholders in understanding how to capture revenue growth opportunities in IoT. For further information, get in touch with Ibraheem Kasujee, the head of our IoT Services programme.

Article (PDF)

DownloadAuthor