Commercial players in the lunar market should focus on transportation and infrastructure missions

Activity in the lunar market has been increasing since the beginning of 2024 following launches of lunar landers by commercial players such as Intuitive Machines and Astrobotic. Although both these missions have resulted in partial failures, they provide valuable lessons and represent significant progress in human space exploration. Lunar landers will support the initial stages of lunar exploration and infrastructure, and as such, these missions represent an important step towards lunar colonisation. Commercial players such as iSpace expect there to be a strong market demand and are hoping to benefit from government initiatives (such as the JAXA/ NASA agreement for the Artemis programme), which will require commercial involvement to fulfil governments’ long-term exploration plans/goals. However, the lunar market is challenging to enter, especially for commercial players that initially need high levels of capital to meet the high costs associated with this market. Analysys Mason’s market analysis indicates that space companies that wish to enter the lunar market should focus on the transportation and infrastructure segments because these areas can provide long-term revenue opportunities.

Governments account for most of the revenue in the lunar market

Analysys Mason’s Lunar markets, 4th edition report forecasts that over 450 missions will be launched between 2023 and 2033, which will generate USD151 billion in revenue. The government sector accounts for most of this demand and will generate 75% of the lunar market’s total revenue during the forecast period, as governments look to create a sustainable lunar ecosystem in 2030s (see Figure 1). Large government programmes such as Artemis promote collaboration between the USA and its allies that have signed the Artemis Accords, while it also opens doors for involvement from the commercial sector.

NASA has delayed its Artemis 2 and 3 missions until September 2025 at the earliest, which will shift the timeline for Artemis’s entire programme, but the commercial sector still has reason to be confident that this market will be supported by government interests. For example, increased international collaboration between the USA (and its allies) for Artemis, as well as between China (and its allies) for the China-led International Lunar Research Station (ILRS), will lead to a rise in the number of technology demonstration missions, and more cargo delivery and infrastructure-focused missions to the lunar surface.

Figure 1: Revenue from missions, by operator, worldwide, 2023–2033

The transportation and infrastructure verticals are the main lunar opportunities for new market entrants

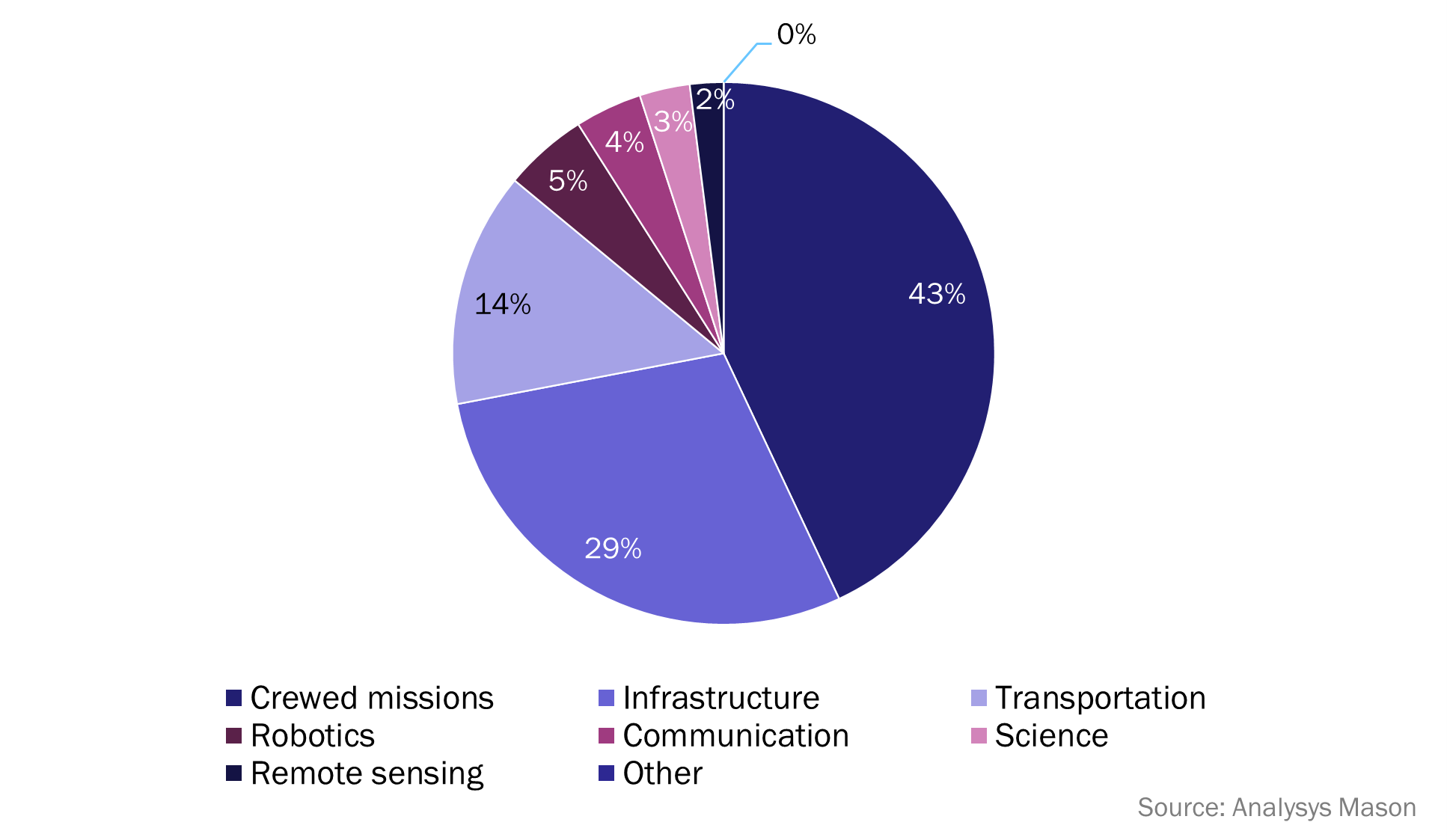

Crewed missions generate most revenue in the lunar market, followed by the infrastructure and transportation segments (see Figure 2).

Figure 2: Lunar market revenue by application, worldwide, 2023–2033

The crewed mission vertical is likely to be a less attractive revenue opportunity for new entrants. Competition is strong in this segment, where players such as SpaceX and Boeing dominate the market because they already benefit from the support of government agencies (for example, NASA) and they have a long track record in cargo or even crewed missions. Crewed missions carry additional risks and long demonstration periods due to the human safety factor, which are additional challenges for new players.

However, infrastructure applications could create significant revenue opportunities for medium-sized companies that wish to enter the lunar market because competition is relatively low and the demand for these types of missions is high.

Most infrastructure missions are expected to launch in the 2030s and will support long-term human presence, research and commercial efforts on the Moon. Furthermore, governments worldwide are planning for a sustainable lunar presence, and Analysys Mason therefore expects a high demand for these kinds of missions, including Lunar Gateway,1 moon habitats and cislunar orbit use cases. Indeed, manufacturers such as Airbus and Thales Alenia Space have already been awarded contracts for infrastructure missions. Unlike crewed missions, the infrastructure segment of the lunar market can accommodate space companies (such as suppliers and component manufacturers) to support the activities of the larger manufacturing players. Moreover, long-terms plans for a sustainable human presence on the Moon’s surface create new opportunities for these new entrants. They can bring alternative and innovative solutions to the Moon habitants element by targeting critical improvements such as mass reduction, power and electricity to the Moon’s surface and its overall utilisation.

Transportation applications represent another revenue opportunity for new players in the lunar market. Transportation demonstration missions have already started, forming the initial stages of the lunar market roadmap, but Analysys Mason expects the demand to remain high. For example, in 2022, iSpace became the first commercial company to attempt to land on the moon, which increased the commercial confidence in this market. In 2024, several companies attempted to land on the Moon and even though these missions did not fulfil all expectations, the government sector will continue to support them. In addition, NASA has awarded contracts to SpaceX and Boeing to develop crewed lunar landers, which will support future Artemis missions. Even though the commercial activities in the transportation vertical are already high, medium-sized companies can still benefit from the opportunities because the capacity of these transportation missions will increase, including the demand for transportation of small payloads, which is a market that new players can easily target.

Governments will continue to support commercial players in order to fulfil their long-term lunar plans

The lunar market presents new players with several challenges including the high cost of entry and the potential for mission failure. However, governments worldwide are making significant investments to fulfil their long-term lunar goals and will require the support from the commercial sector to do so, and the transportation and infrastructure segments will provide new players with early opportunities to generate revenue.

1 This is the space station around the Moon, part of the Artemis programme.

Article (PDF)

DownloadAuthor