MNOs must choose satellite D2D partners based on their constellation strategies and level of development

Mobile network operators’ (MNOs’) network reach is limited in rural and sparsely populated areas, which is restricting their market penetration and, consequently, their ability to generate new revenue. Satellite direct-to-device (D2D) technology has the potential to provide ubiquitous coverage to mobile devices (including mobile and IoT devices) in areas where terrestrial services are unavailable. MNOs that provide satellite D2D services to previously unconnected populations can capture a share of this highly lucrative market: Analysys Mason’s Satellite direct-to-device market, 4th edition report forecasts that satellite D2D service revenue will approach USD48.6 billion by 2032. To succeed in this market, MNOs will need to select the partners’ whose strategies best align with their own objectives and have reached an advanced stage of technology development.

The D2D ecosystem is evolving rapidly

In January 2024, SpaceX's launched its first batch of six Starlink satellites that feature satellite D2D capabilities. This launch signals that the race to secure a share of this multi-billion-US-dollar market opportunity is intensifying. Momentum has been rapidly building in all areas of this nascent ecosystem including technological advancements, funding activities, testing, service initiatives and emerging partnerships among ecosystem members.

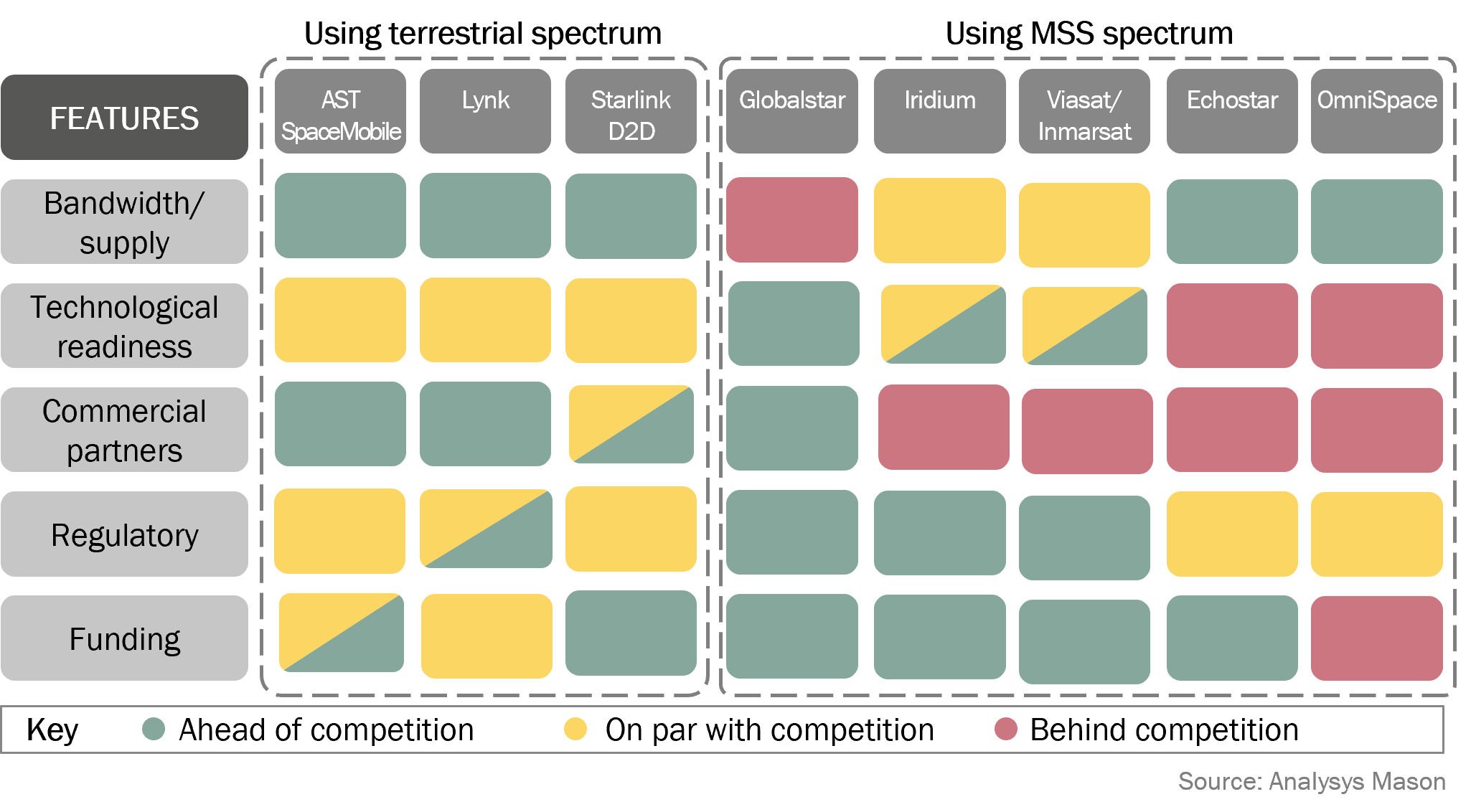

Analysys Mason has recently published a series of reports in its Satellite Strategies for Telcos research programme profiling the progress of major D2D players, which can help MNOs to navigate this dynamic market. These profiles provide details about these players’ D2D strategies, the progress that they have made with developing their constellations, funding, partnerships, regulatory information and analysis of the strengths and weaknesses. This information will help MNOs to screen ecosystem partners better.

To inform MNOs’ own strategies for success in this market, we have outlined the strategies that the D2D players have adopted and provide a current view of their progress towards deploying their constellations and services.

An MNO’s choice of D2D partner will be informed by the spectrum and infrastructure strategies being pursued by the D2D player

Spectrum strategies

For spectrum strategies, D2D players have a choice between terrestrial spectrum and mobile satellite service (MSS) spectrum. Players such as AST SpaceMobile, Lynk Global and SpaceX are using MNOs’ terrestrial spectrum. This allows them to access terrestrial frequency bands, but this approach hugely increases regulatory uncertainty because they need special approval in each country to use terrestrial bands from space. The use of such spectrum also leads to higher levels of technical complexity.

Other players (including Globalstar, Iridium and Viasat/Inmarsat) are using MSS frequencies. These players benefit from the regulatory certainty that is afforded by the licenses to use this spectrum. However, this spectrum strategy will require modification to the devices, and therefore the accelerated delivery of services using MSS frequencies will take longer because players will need to persuade phone manufacturers to integrate satellite-enabled services into their phones and users will need to upgrade their current phones to these newer generations.

Infrastructure

In terms of infrastructure for D2D services, players either plan to use existing infrastructure or are building new constellations. Currently available infrastructure (such as Globalstar, Viasat/Inmarsat and Iridium) will only be able to serve narrowband applications. Services will be limited to basic emergency alerts and messaging services due to the limited system capacity.

Other players are dedicatedly raising funds and building satellite constellations that are capable of supporting higher bandwidth applications such as voice and data services. For example, AST SpaceMobile recently secured strategic investment from AT&T, Google and Vodafone, and it is working on its BlueBird satellites constellation with the aim of launching an initial commercial service in 2024. Lynk is also hoping to go public through a special purpose acquisition company (SPAC) and it plans to launch 1000 satellites by 2025 to offer continuous global coverage. SpaceX is launching new Starlink Gen2 satellites to support D2D services, which are expected to be in service in 2024.

Players are navigating the satellite D2D market at their own pace but some have already launched commercial services

Figure 1: Overview of the stages of development of players’ satellite D2D constellations

Some of the first-movers into the D2D market already offer commercial services. For example, Globalstar launched emergency SOS messaging services in partnership with Apple in 2023. Lynk is working with multiple MNOs and has launched D2D satellite services in several regions, including Palau, the Cook Islands and the Solomon Islands. Other players are actively testing their technology and connections. AST SpaceMobile claimed to have established a successful 5G broadband connection between its prototype satellite and an unmodified smartphone in 2023. Finally, SpaceX announced that a test in March 2023 achieved a download speed of 17Mbit/s with an unmodified phone.

To capture a share of this potentially enormous market opportunity, MNOs should begin by considering the best ways to achieve better synergies between D2D technologies and their own networks. Their success will also depend on understanding how various players are formulating their D2D strategies and on having a clear picture of their progress in terms of constellation development.

Article (PDF)

DownloadAuthor