Network-as-a-service (NaaS) providers will collectively generate USD14.7 billion from their offerings in 2029

18 June 2025 | Research and Insights

Article | PDF (3 pages) | NaaS Platforms and Infrastructure

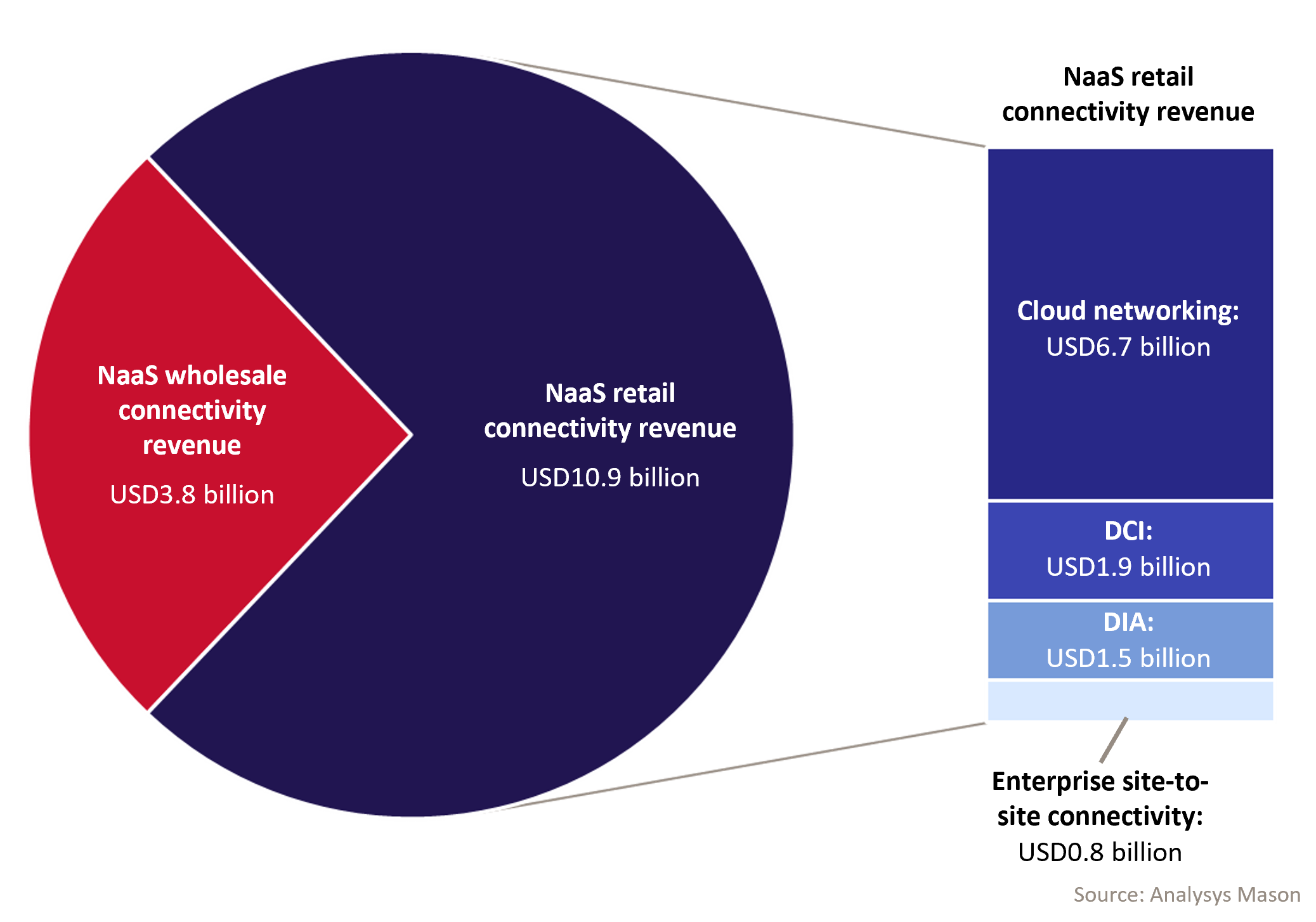

Analysys Mason’s Network as a service (NaaS): worldwide forecast 2025–2029 predicts that NaaS connectivity revenue worldwide, including revenue from both retail and wholesale connectivity, will grow at a CAGR of 42% between 2024 and 2029 to reach USD14.7 billion (Figure 1).

Figure 1: Breakdown of NaaS connectivity revenue, worldwide, 20291

NaaS solutions aim to address enterprises’ demand for simplified connectivity with cloud-like agility

The term ‘NaaS’ has been used to describe a range of concepts, but enterprises and service providers are now converging on the following definition: enterprise connectivity services that are available with rapid provisioning, that support pay-as-you-go models with minimal commitment periods and that enterprises can provision themselves and manage via portals and/or APIs.

NaaS can connect enterprises’ data centres, clouds, sites and users with reliable, secure and programmable connectivity. It allows enterprises to rapidly provision their networks, manage their connectivity using a self-service model and optimise their spending with service providers.

NaaS also allows service providers to differentiate their connectivity portfolios; even just knowing that NaaS will be available down the line can affect enterprises’ choice of service provider. NaaS can drive new, incremental revenue, but much of service providers’ NaaS revenue will be a substitution of existing traditional connectivity revenue. Nonetheless, offering NaaS will be instrumental in helping service providers to protect their fixed connectivity revenue from competitors.

Enterprise adoption of NaaS has been cautious so far, but strong growth in the NaaS market is expected over the next 4–5 years

The NaaS market is still nascent. NaaS adoption by enterprises has so far been constrained by enterprises’ unfamiliarity with NaaS and a reluctance to switch away from traditional (multi-year) connectivity contracts. Additionally, many enterprises are not set up organisationally to achieve maximal benefits from NaaS.

Many of the NaaS solutions that were adopted early on centred on cloud networking solutions offered by non-traditional telecoms operators (that is, co-location/internet exchange (IX) providers, software-defined cloud interconnect (SDCI) providers and multi-cloud SD-WAN managed service providers). Spending came predominately from North America due to the high multi-cloud adoption in the region.

These trends persist, but the growing number of traditional telecoms operators entering the NaaS market is causing a shift. For example, BT, Lumen, Orange, Singtel and Telefónica have all launched NaaS offerings since 2023. These launches should accelerate NaaS adoption because enterprises may prefer to continue to work with their existing connectivity providers. These traditional operators have a large bases of existing connectivity customers that can gradually be converted to NaaS. Many operators in Western Europe and Asia–Pacific are launching NaaS offerings, which should help to boost the share of NaaS spending that is generated by these regions.

Traditional telecoms operators often also offer NaaS DIA, which we forecast will be the fastest growing NaaS use case in terms of retail connectivity revenue (CAGR of 45% over the forecast period). This growth will be driven by the overall trend of enterprises shifting from Ethernet to DIA, as well as the cost and scalability advantages of NaaS DIA (compared to non-NaaS DIA).

The need to provide connectivity for AI workloads is another emerging driver of the NaaS market. Flexible NaaS connectivity solutions are well-suited to handle the bursty, intermittent traffic flows associated with transferring data between data stores and AI infrastructure for training AI models and fine-tuning workloads.

NaaS solutions can also help to address network security concerns for these workloads. For example, they allow enterprises to:

- consume overlay network security services via value-add services marketplaces

- address sovereignty concerns using deterministic routing that avoids certain geographies

- enhance security with on-demand encryption (and, going forward, quantum-safe networking) capabilities.

Operators should offer NaaS wholesale connectivity services to help to recoup their investments in NaaS

Wholesale connectivity will account for 26% of all NaaS connectivity revenue in 2029, up from 21% in 2024. In contrast, wholesale connectivity currently accounts for just 14% of all fixed connectivity revenue. This illustrates that there is a considerable wholesale NaaS connectivity opportunity, so service providers should consider how to increase their appeal to wholesale NaaS buyers. For example, Orange has launched its wholesale-only Click platform alongside its Evolution Platform NaaS offering for enterprise. Other service providers should consider whether they can take a similar step.

Similar to enterprise users of NaaS, service providers taking wholesale NaaS benefit from improve agility and cost effectiveness. Additionally, NaaS streamlines the wholesale connectivity buying journey for service providers because it enables network provisioning and management to be done via APIs. Consuming wholesale NaaS connectivity will become more straightforward going forward due to the increasing adoption of standardised MEF APIs and the growing number of partnerships between NaaS service providers for streamlining NaaS-to-NaaS interactions.

Service providers should ensure that their NaaS offerings are competitive and easy to adopt

Service providers must ensure that they can offer all the capabilities associated with NaaS in order to improve their chances of success in the increasingly crowded NaaS market. This includes offering self-service portals with strong network management, fault detection and response, observability and analytics capabilities. Additionally, they should strive to offer comprehensive marketplaces for Layer 3–7 overlay and other IT services, and should improve their support for proprietary and/or (preferably) standardised APIs to enable enterprises to manage their connectivity.

Service providers can also aim to facilitate a ‘walk-before-you-run’ approach to NaaS to ease adoption difficulties. This may involve supporting more-traditional, long-term contracts alongside pay-as-you-go pricing models for NaaS. Additionally, service providers can support both co-managed and fully-managed NaaS for enterprises that do not want the complexity of managing NaaS via a self-service model.

For more recommendations for service providers, see Analysys Mason’s Network as a service (NaaS): worldwide forecast 2025–2029 and Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions. For any other NaaS-related information, contact Joseph Attwood or Gorkem Yigit.

1 DCI stands for data-centre interconnect and DIA stands for direct internet access.

Article (PDF)

DownloadAuthor

Joseph Attwood

Senior AnalystRelated items

Podcast

Analysys Mason’s research topics for 2026

Article

Operators are accelerating quantum-technology adoption through expanded partnerships and early commercial deployments

Tracker

Network API activity tracker 4Q 2025