The success of Open RAN will depend on a few large ecosystem builders

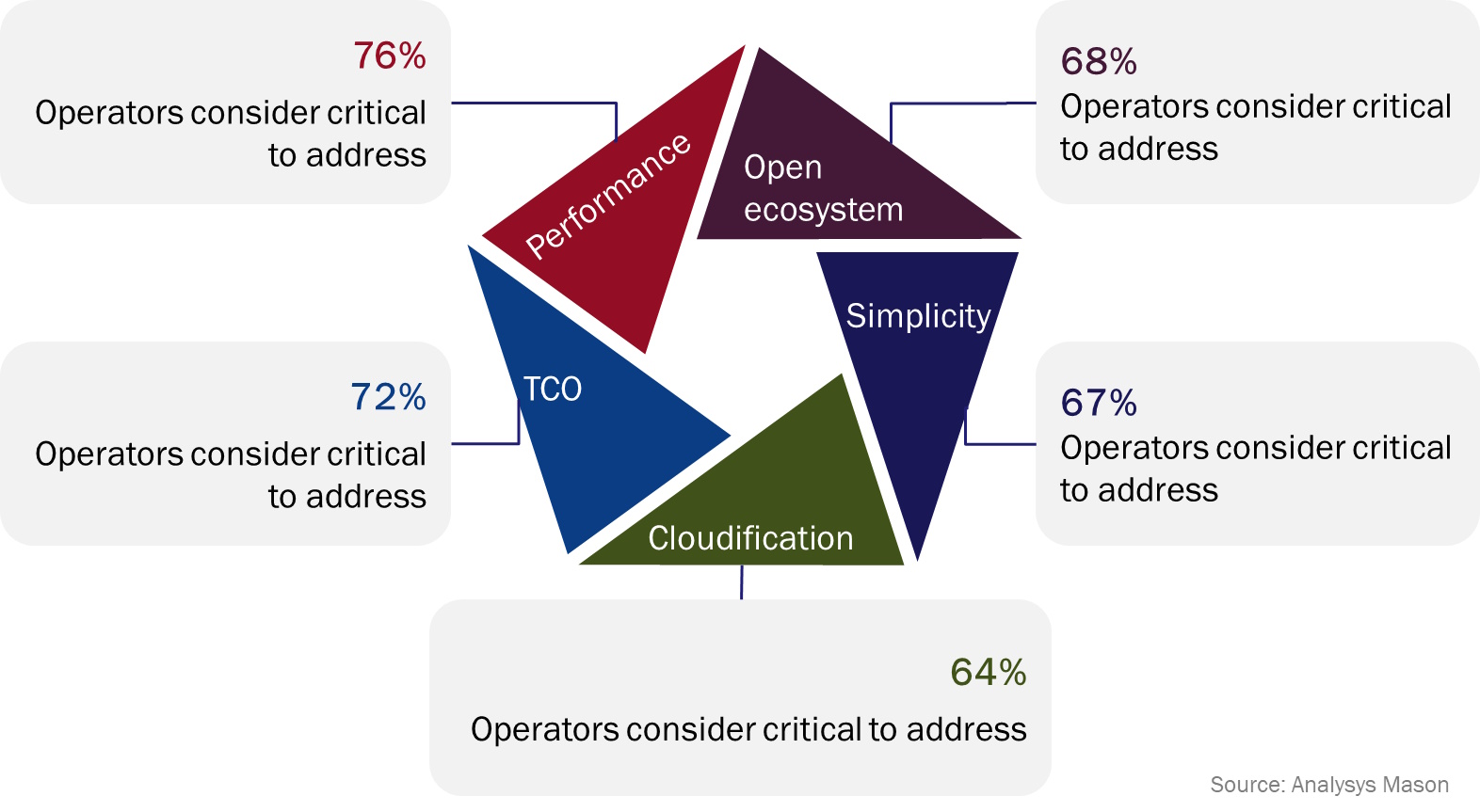

In May 2023, Caroline Gabriel and James Kirby of Analysys Mason hosted a webinar entitled Open RAN: translating the hype into revenue. This webinar identified five challenges that Open RAN needs to address before it will be deployed at scale in public networks, including performance improvements in cloud and RAN, simplified integration, TCO reduction, and an open yet robust ecosystem. This article will focus on the ecosystem challenge and will identify vendors that are well placed to create unified platforms that still remain open.

An open ecosystem and diverse supply chain are key operator goals for Open RAN

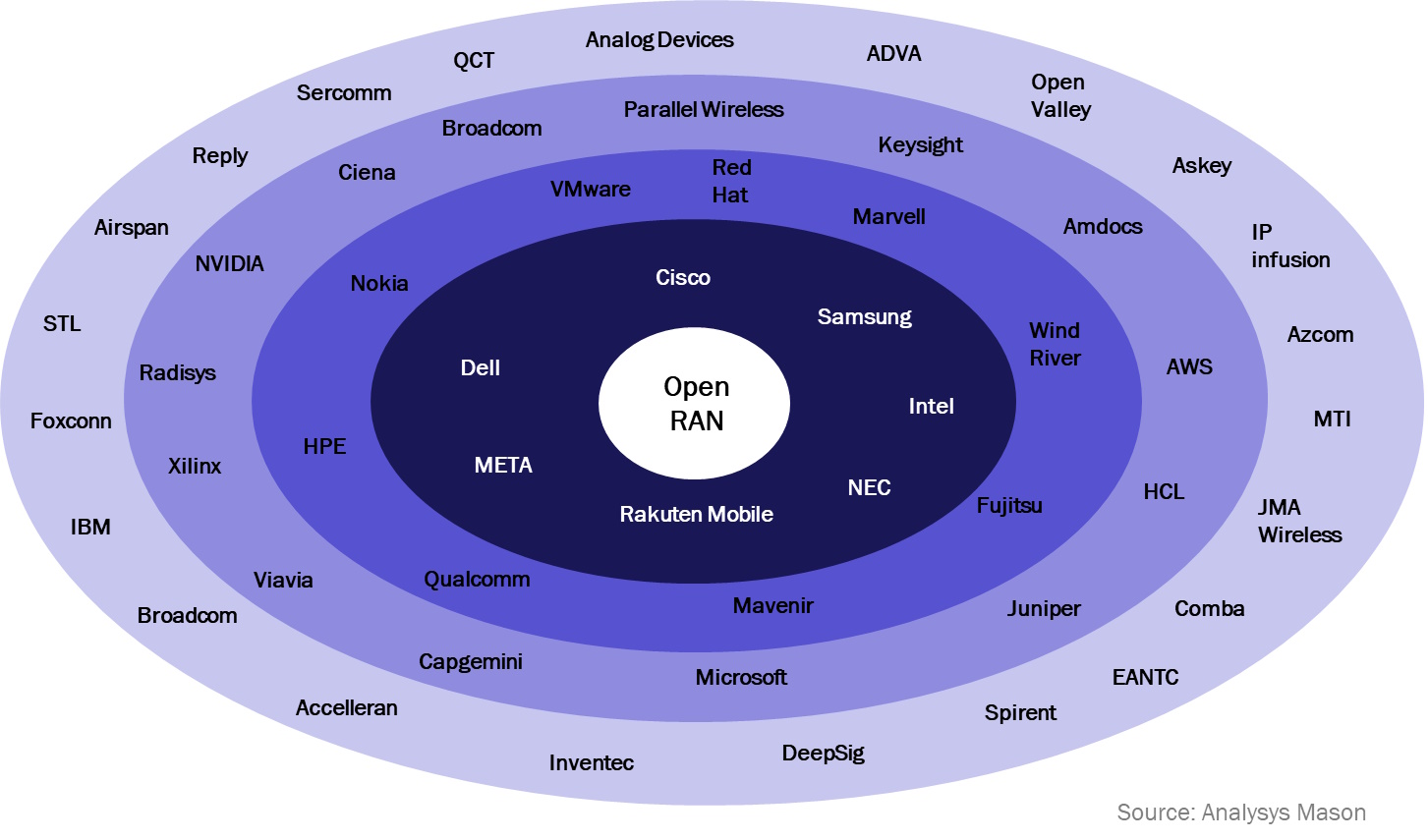

Open RAN specifies common interfaces that allow hardware and software elements from different suppliers to interoperate in a virtualised, disaggregated network. That potentially lowers barriers to entry for new vendors, including cloud and software specialists, and enables operators to deploy multi-vendor RANs. Diversifying the increasingly small base station supply chain is a key goal for many operators. In a survey of over 80 operators evaluating Open RAN, 68% said an open ecosystem was critical or very important. And, as Analysys Mason’s mapping of the Open RAN ecosystem shows, there is no shortage of companies developing new solutions for various aspects of the RAN. We have identified 209 product and service providers that are active in this segment.

However, if openness leads to fragmentation, operators will lose confidence in Open RAN’s commercial benefits

Some factors outweigh openness when it comes to large-scale commercial deployment. The survey indicated that increased performance and reduced total cost of ownership were even more important than a diverse supply chain as factors driving adoption of a new RAN architecture. If an open approach does not deliver cost and performance improvements, it will not be adopted.

Figure 1: Five Open RAN challenges and the percentage of operators that regard each as critical

The risk that accompanies any open platform is that of fragmentation. If the 209 vendors are not innovating within common frameworks, very few of their developments will achieve the scale to address cost and performance challenges convincingly. Common interfaces, such as O-RAN Alliance’s Open Fronthaul, provides a valuable set of foundations, but considerable innovation must take place on top to optimise performance and align the network with each operator’s needs. That is where fragmentation can set in, resulting in compromises to interoperability, failure to achieve economies of scale and the risk of technological dead ends. These risks would deter most operators from deploying Open RAN in commercial networks.

A few organisations are well placed to promote unity and scale, while also being motivated to keep the ecosystem open

Open initiatives of the past have succeeded where a few large companies were able to drive the creation of strong common platforms, without allowing these to become closed environments. Only a few companies have the resources and market weight to drive a new solution to the scale and robustness that a 5G RAN will require. However, the key to the success of Open RAN is for those leaders to have no commercial interest in restricting the ecosystem. Open computer operating systems based on Unix failed to be unified in the 1990s because they were developed by large computer hardware vendors with an interest in maintaining a proprietary platform. By contrast, Linux succeeded because it was a fully open-source platform, but it also had the support of several powerful suppliers, notably IBM, which by then saw the benefits of putting itself at the centre of a new open ecosystem.

In Open RAN, if established RAN vendors take the lead, there will always be conflicts of interest with their traditional closed model. But many Open RAN challengers are insufficiently powerful to attract broad partnerships and support. Analysys Mason has identified approximately 50 Open RAN suppliers, from the full list of 209, that we believe are contributing significantly to developing the platform. We then evaluated them against a diverse set of criteria, to establish those best placed to drive a platform that meets all the operators’ cost and performance requirements, but that remains founded on a broad and fully open ecosystem.

Figure 2 summarises the results and shows that these ecosystem builders may come from different backgrounds. Dell and Intel are leveraging their cloud expertise and ecosystem influence to build their Open RAN propositions but know they need partners to deliver many aspects of the solution, including radio units. Rakuten, through its Symphony arm, is basing its platform around its partners for its Japanese roll-out. Samsung and NEC are influential because they are challengers in the RAN space but have significant radio expertise and credibility with brownfield operators.

Figure 2: Summary of analysis of the most influential open ecosystem players in Open RAN

Open RAN is an immature market and the strategies of the vendors, and therefore our assessment of their ecosystem influence, will change. For instance, Samsung or NEC might achieve considerable success in Open RAN contracts, especially with the current trend for operators to deploy single-vendor Open RAN in the first phase. That might, in turn, make these two vendors less motivated to remain fully open or to work with large numbers of partners, and so their ranking might be reduced.

Conversely, Nokia, like IBM when it backed Linux in 2001, may recognise the opportunity to define a new platform and take a leadership position, even at the expense of its former control over its technologies and platforms. Of course, a few large operators are also very influential in deciding which platforms win out, and some are actively contributing to the unified framework, as Vodafone is doing with its 5G semiconductor lab in Spain.

It is important to the deployability of Open RAN in high-performance 5G networks that its ecosystem can unite quickly around just two or three platforms, in order to achieve three essential enablers of success – massive scale, the resources to address daunting performance challenges and full openness. Those factors are too often incompatible in technology markets, but with strong ecosystem leadership, it is possible that Open RAN could deliver them all within a few years.

Article (PDF)

Download

Discover our range of curated resources with all the latest data and analysis related to vRAN and Open RAN.

Author