Open RAN vendors have an opportunity with private networks, regardless of their success with public 5G

28 April 2022 | Research

Article | PDF (3 pages) | Private Networks| Wireless Technologies

Emerging Open RAN platforms promise to provide a standards-based way to implement virtualised, multi-vendor mobile networks. This could open up the close-knit RAN supply chain and provide operators with a wider choice of vendors, architecture and price points. In this article, we examine the first markets in which Open RAN is likely to gain large-scale adoption, and explain why the biggest near-term opportunities lie in the private wireless space.

Open RAN promises to provide a path to virtualised networks and could also end vendor lock-in

Organisations such as the O-RAN Alliance have defined the Open RAN architecture to provide a unified way for operators to deploy disaggregated networks. In these networks, the tightly integrated base station is broken apart. Digital baseband functions are run in software, which is disaggregated from the underlying hardware. The baseband is also disaggregated from the radio/antenna equipment; this equipment remains on the cell site, while the baseband can be located remotely and can be further split into a centralised unit in the cloud and a distributed unit that handles low-latency functions.

In Open RAN, the interfaces between all these different elements are standardised. This means that hardware and software from different suppliers can interoperate and that operators can select the best solution for each individual function.

This could enable a wide variety of hardware and software suppliers to enter the mobile infrastructure market for the first time, thereby releasing operators from vendor lock-ins and easing their path to the agile cloud-native RANs that can support the diversity of 5G use cases. However, the disaggregation of network functions increases complexity in areas such as performance validation and assurance testing, which are currently exacerbated by the immaturity of solutions.

Open RAN-related challenges in 5G macro networks will take years to address

Open RAN architecture is very immature, so there are several reasons why it will not be widely adopted in mobile operators’ macro networks for at least 3–4 years.

- Most commercially available solutions currently focus on one interface only: the open fronthaul connection between the radio unit and the baseband. Solutions that can support the full architecture without significant customisation or integration are limited in number, and most operators will wait for greater choice.

- Many operators have only recently invested in conventional 4G network expansion or 5G network roll-outs. This reduces their motivation to invest rapidly in Open RAN, especially because interworking with conventional RANs remains challenging.

- Several technical challenges need to be addressed before the Open RAN will be able to support the most-demanding 5G use cases without significant systems integration effort and cost. For instance, the processor-intensive Layer 1 functions of the network are very difficult to implement on standard open servers.

Open RAN vendors will find near-term opportunities in private cellular deployments, and may create their own ecosystem

Some operators (mainly greenfield operators such as Rakuten Mobile) are prepared to invest significantly in a customised solution in the short term. However, these operators are not sufficient in number to enable all the vendors targeting Open RAN to build strong revenue streams. There is therefore a risk that many smaller innovators will not survive the wait for the platform to catch up with the needs of other large MNOs, which is a further risk to future adoption.

As such, most Open RAN vendors will focus on areas where there is pent-up demand, and where first-generation Open RAN solutions will be capable of supporting most of the use cases. These include rural coverage projects and, more significantly in terms of commercial potential, private cellular deployments. Doing this can also mitigate the risk identified above of smaller innovators leaving the market before the challenges of wider adoption are addressed.

Our private LTE/5G networks forecast highlights the revenue growth potential in the enterprise 4G and 5G space. Open RAN, especially when combined with shared or industrial spectrum, can help to enable a diversity of private wireless deployers, which will be important to meet the varying use cases and roll-out scenarios of different enterprises. Open RAN deployment in private networks also promises to make private cellular networks more easily deployable and manageable due to open reference designs that are akin to those used in enterprise Wi-Fi. Opening up the ecosystem to new vendors means that a wide range of solutions can emerge that are optimised for various price points, physical environments and use cases, so those deploying networks can select the best price/performance characteristics for their customers.

Open RAN solutions for private networks may be ready for commercial deployment in 2022, rather than 2025 or later. Nearly all enterprise networks have lower and more predictable traffic loads than 5G urban public networks, and are geographically constrained. The network is critical to enterprises’ business, but it will rarely need to support the same density of devices using high-bandwidth applications in a given location as a public network would, so the processing burden on the platform will be considerably lower than that in the macro RAN.

The private cellular network market, then, provides two advantages for Open RAN developers.

- There are signs of rising demand for cellular networks from organisations that will want a lower-cost, simpler solution than the more complex and customised private networks commissioned by the largest enterprises, which could be addressed by Open RAN. Assuming this demand materialises, it will provide a greenfield market with no incumbency for traditional cellular equipment vendors.

- Most of the current performance requirements for private cellular networks can be met by first-generation Open RAN designs, thereby generating near-term revenue for new Open RAN players.

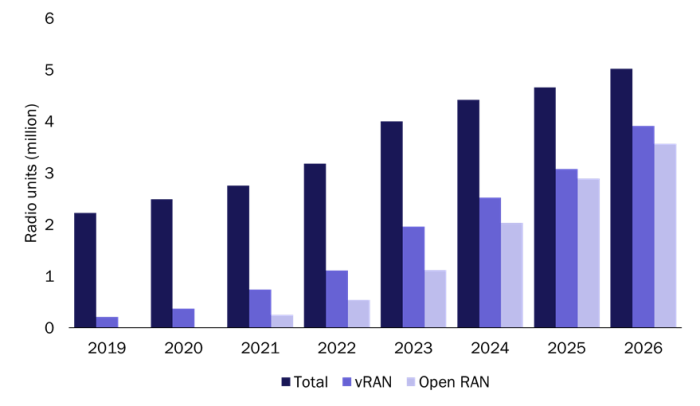

The private cellular opportunity mitigates the risk for vendors that Open RAN will miss its chance entirely in the macro network market (either because performance and other challenges take too long to address, or because most MNOs feel safer with their established vendors). Some alternative suppliers could build a profitable business in the private cellular sector alone. Indeed, we forecast that Open RAN will account for 71% of all small cells deployed in the private enterprise sector in 2026, and 91% of the virtualised small cells (Figure 1). There is no particular reason why the private enterprise network market and the public macro network market should share the same architecture and ecosystems, given their contrasting requirements and economics. Open RAN, regardless of its fortunes in non-greenfield public 5G networks, may prove to be the catalyst for a parallel ecosystem to emerge to support private cellular platforms and operators, which may bear a stronger resemblance to the Wi-Fi industry than to the conventional 5G RAN ecosystem.

Figure 1: Forecast deployment of radio units in private enterprise networks by network architecture, worldwide, 2019–2026

Source: Analysys Mason, 2022

Analysys Mason offers consulting and research on the wireless market, including Open RAN. Please contact Caroline Gabriel, Principal Analyst, or Janette Stewart, Partner.

Article (PDF)

DownloadAuthor