Operators must lead 6G R&D to ensure technologies generate new revenue streams and enable cost savings

Stakeholders within the telecoms industry are beginning to present their visions for 6G and research new 6G network technologies. Vendors, research organisations, academic institutions, operators and governments are actively mapping key technologies, use cases and KPIs for 6G.

Vendors are currently the most active participants within 6G research and development (R&D) projects as they attempt to ensure that eventual standards are a good fit for their own emerging technologies. Operators should follow this example and become more involved within the 6G ecosystem to ensure that 6G technologies can provide real commercial value.

6G R&D has begun, with initial standardisation expected in 2028 and commercial launch of 6G networks anticipated from 2030

5G networks are not yet ubiquitous across the world and 5G standalone (SA) roll-outs are only just beginning, but stakeholders within the telecoms industry are beginning to consider the next generation of mobile networks: 6G. Before 6G emerges, 5G Advanced will be the next step for cellular networks, aiming to deliver technologically-driven optimisation of the 5G network from 2025. 6G networks will then build upon the foundation of 5G Advanced to deliver a high-performance, sensory network that is AI-native and increasingly sustainable.

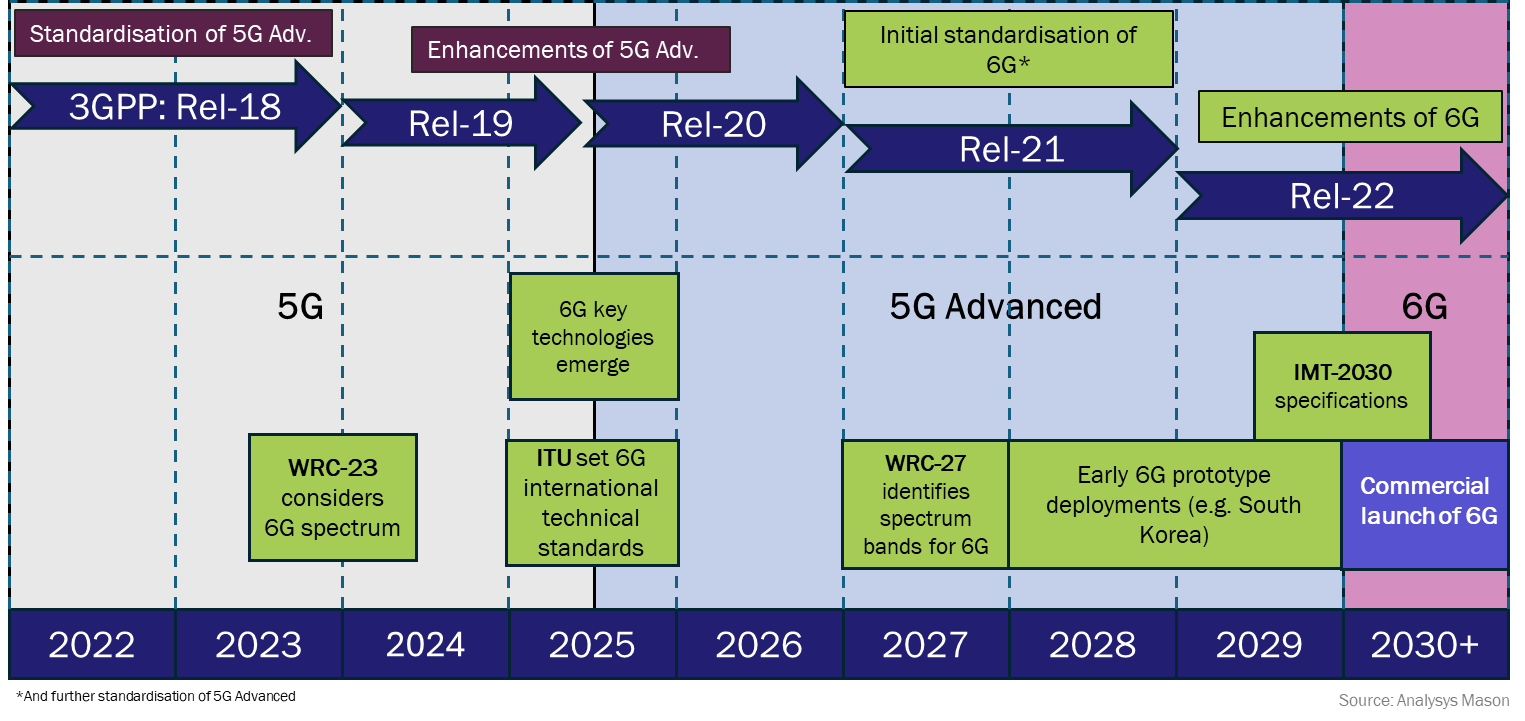

Standardisation for 6G will not begin until 3GPP’s Release 21, which is expected to be finalised at the end of 2028 (Figure 1). Before this, the ITU will release international technical standards in 2025 that identify the key technologies of 6G. Following the finalisation of the initial standards in 2028, early 6G prototype deployments are expected to precede the full commercial launch of 6G networks from 2030.

A wide range of organisations are already involved in 6G R&D, including vendors, research organisations, academic institutions and operators. Governments are publishing their 6G visions and roadmaps to ensure that their countries are well placed to take advantage of the economic opportunities that 6G could offer. Research organisations, vendors and academic institutions are outlining key drivers and trends for 6G networks, and are beginning early-stage tests for 6G technologies and materials, including reconfigurable intelligent surfaces (RIS), photonic technology and AI enabled air interfaces (AI-AI). Analysys Mason is tracking 6G R&D developments encompassing involvement from 398 organisations across 162 entries.

Figure 1: Timeline for 6G network launches

Operators are underrepresented in 6G R&D compared to vendors, which are already heavily involved in the 6G ecosystem

Vendors are currently the most active stakeholders within 6G R&D, with research focused on technologies, use cases and key KPIs. Vendors are involved in 56% of all entries in our tracker, with 130 different vendors (including SMEs) involved across 90 projects. This early involvement in the 6G R&D ecosystem enables vendors to ensure their technologies are central to standardisation, and that their equipment and patents will be integral to initial 6G network deployments and throughout the 6G era.

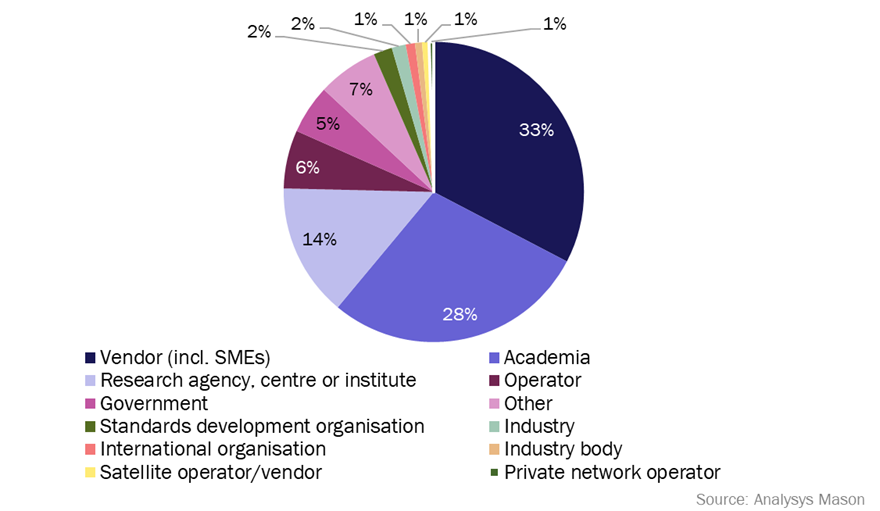

Operator participation in 6G R&D has so far been outmatched by vendors, academic institutions and research organisations, with operators only accounting for 7% of all participants within 6G R&D (Figure 2). So far, 25 operators have been tracked as actively involved within 6G R&D, focused mostly upon new technologies. Key technologies of operator 6G R&D include the following.

- AI/ML. As 6G will be an AI native network, AI/ML is unsurprisingly the main focus of operators. AI/ML applications across network layers including the core, transport layer, and physical layer can deliver a more efficient, high-performance network.

- RAN enhancements. Operators are involved in multiple R&D projects to enhance the RAN. Key areas of focus have included a unified RAN, mMIMO operating in mmWave and Terahertz bands, and multi-constraint RANs.

- Security. Operators are involved in numerous projects to meet the increased security required for 6G networks, necessitated by the increased attack surface area of the network and the high-level of personable data collected by enhanced localisation and positioning.

By focusing on these technologies, operators can contribute to delivering a resilient and secure 6G network which enables cost saving through enhanced efficiency, while also providing a platform to deliver a range of new use cases across communication, entertainment, mobility and industry sectors.

Figure 2: Organisations that are involved in more than one 6G R&D project

Operators must become increasingly involved with 6G R&D to ensure that 6G technologies can deliver real commercial value

Operators are relatively underrepresented in the 6G R&D ecosystem as a whole. They are active across only 28% of all 6G R&D projects captured in Analysys Mason’s 6G R&D Tracker. Operators should follow the example of vendors and become more actively involved in 6G R&D and play a leading role in the conceptualisation and development of 6G technologies. Through direct involvement, operators can guide vendors and standards bodies towards technologies that ecosystem partners and customers will want to use. This will help avoid investment in technologies or services that ultimately fail to generate increased demand for operators’ services.

A number of potential 6G use cases bear a striking resemblance to the use cases that were initially outlined for 5G, such as mobility (including self-driving cars and drones), healthcare (including e-health and remote surgery), and new means of communication (including holographic calls and telepresence). Some operators have struggled to justify 5G SA deployment based on the communications revenues such applications might deliver. If the same pattern is to be avoided for 6G, operators must ensure that 6G technologies will truly meet the future needs of their customers. Operators have an opportunity to direct 6G R&D to ensure that 6G networks provide a foundational platform that operators, their partners and customers can use to innovate and generate new revenue and monetisation opportunities. The alternative is that 6G must deliver such enhanced network efficiency that potential cost-savings will ultimately outweigh and justify initial investment costs.

Article (PDF)

DownloadAuthor