CSPs’ spending on OSS/BSS software and services worldwide will exceed USD70 billion in 2027

Communications service providers’ (CSPs’) spending on OSS/BSS software and services grew by 2.5% year-on-year in 2021 due to challenges with capital and operational efficiency. We expect that this growth will continue in the long term because vendors are developing new propositions to support 5G standalone (SA) deployments and emerging use cases. As such, CSPs will continue to modernise their OSS/BSS to enable the next level of automation and customer experience that is required for 5G. CSPs are also expected to increase their investments in edge cloud infrastructure, thereby driving growth in SaaS-related OSS/BSS revenue.

CSPs’ spending on OSS/BSS software and services will grow at CAGR of 3.5% between 2021 and 2027 to exceed USD70 billion

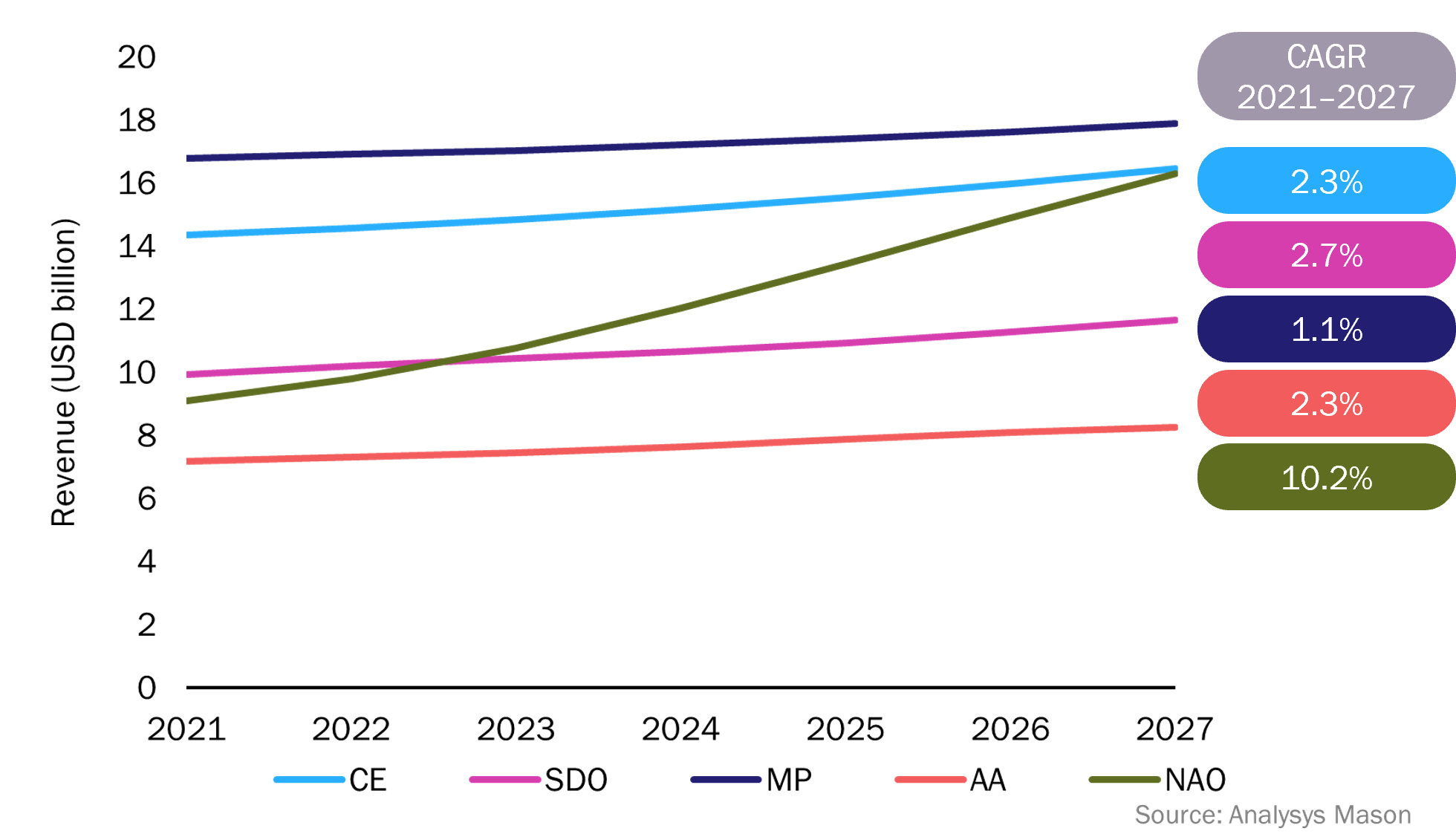

Figure 1 shows CSPs’ actual spend on OSS/BSS software and services in 2021, as well as the forecast for spending for 2022–2027. The data is split into five segments: automated assurance (AA), customer engagement (CE), monetisation platforms (MP), network automation and orchestration (NAO) and service design and orchestration (SDO).

Figure 1: OSS/BSS software and services revenue by segment, worldwide, 2021–2027

5G, SaaS and cloudification will be the main drivers of growth in CSPs’ spending on OSS/BSS software and services

5G, as well as a broader range of enterprise services based on network function virtualisation and software-defined networking (NFV/SDN), will accelerate CSPs’ spending on OSS/BSS software and services during the forecast period due to the associated migration away from traditional software solutions. SaaS-based solutions will help CSPs to reduce the time to market for new deployments, boost internal IT efficiency and invest in new cloud-based systems.

- 5G. The number of 5G SA installations will continue to rise in 2022 and 2023. Many of these deployments will include advanced orchestration software because 5G SA depends more heavily on cloud and SDN technologies than prior network generations. CSPs will need to spend extensively on software and services to automate and optimise their systems in the 5G era in order to assure efficiency and meet the performance demands of newly enabled services.

- SaaS. CSPs are beginning to use SaaS-based deployment strategies, and SaaS is projected to become the primary deployment option in the BSS space. We anticipate that CSPs’ spending will grow strongly in both the BSS and OSS segments, though spending on OSS is expected to lag behind that on BSS due to security, latency and viability concerns. SaaS will account for 23% of CSPs’ total spend on OSS/BSS by 2027.

- Cloudification. CSPs’ cloud-related investments will grow as the number of cloudification and modernisation projects increases. CSPs that deploy 5G SA will need to invest in new cloud-based OSS/BSS in order to reduce the cost and opex associated with new services. Spending will go towards supporting 5G SA RAN and transport network roll-outs, as well as IT and network cloudification and CI/CD projects.

These three drivers will lead to particularly strong spending growth in the NAO and SDO segments. Indeed, NAO is set to become one of the largest segments in the OSS/BSS market in terms of spending. The growth in the NAO segment is largely due to the roll-out of 5G SA, which will require a new generation of control, management and orchestration technologies, as well as strong growth in the automation of the WAN (including SD-WAN). The mix of spending in other segments will also change; CSPs will place a higher priority on products and services that support the three drivers identified above.

A number of other trends have emerged from our analysis of the OSS/BSS market.

- CSPs’ spending on OSS/BSS products will grow at a CAGR of 5.6% during the forecast period, thereby closing the gap with spending on professional services. This will primarily be due to CSPs shifting their capex from hardware to software to support the virtualisation and cloudification of their networks.

- CSPs’ total spending on OSS/BSS software and services will grow at a CAGR of 3.5% worldwide between 2021 and 2027. Spending in Latin America (LATAM), Sub-Saharan Africa (SSA) and emerging Asia–Pacific (EMAP) will grow more quickly than the worldwide average. The high growth rates in SSA and EMAP will be driven by spending in all OSS/BSS segments, while growth in LATAM will primarily be driven by the NAO market. Our forecast has been adjusted to account for the ongoing conflict in Central and Eastern Europe (CEE), and we expect that spending in the region will grow at a CAGR of 1.8% during the forecast period.

- Enabling enterprise services such as SD-WAN is becoming one of the most important areas of CSP investment, as well as one of the primary drivers in the NAO market. SD-WAN will continue to be crucial to CSPs as they seek to lower transport network opex, and automation will be a top objective in order for CSPs to respond rapidly to customer demands and network conditions.

Analysys Mason’s forecast reports provide high-quality market analysis

Our report, OSS/BSS software and services: worldwide forecast 2022–2027, provides data on CSPs’ actual spending on OSS/BSS software and services in 2021, as well as a forecast for spending between 2022 and 2027, with a detailed evaluation of product and professional services revenue and specific regional developments. It analyses the business environment and regional dynamics that influence the OSS/BSS market and provides key recommendations for vendors and operators, as well as the top-level outlook for five market segments.

Article (PDF)

DownloadAuthor