Partnering with PCPs and becoming cloud-native will be key for data platform providers’ multi-cloud strategies

Partnerships between data platform providers and public cloud providers (PCPs) have increased over the previous 2 years. We expect these partnerships to continue in 2023 as they offer both vendor types solutions that appeal to their customers, including communications service providers (CSPs). Data platform providers should pursue cloud-native and cloud-agnostic strategies to ensure their solutions support multi- and hybrid-cloud deployments.

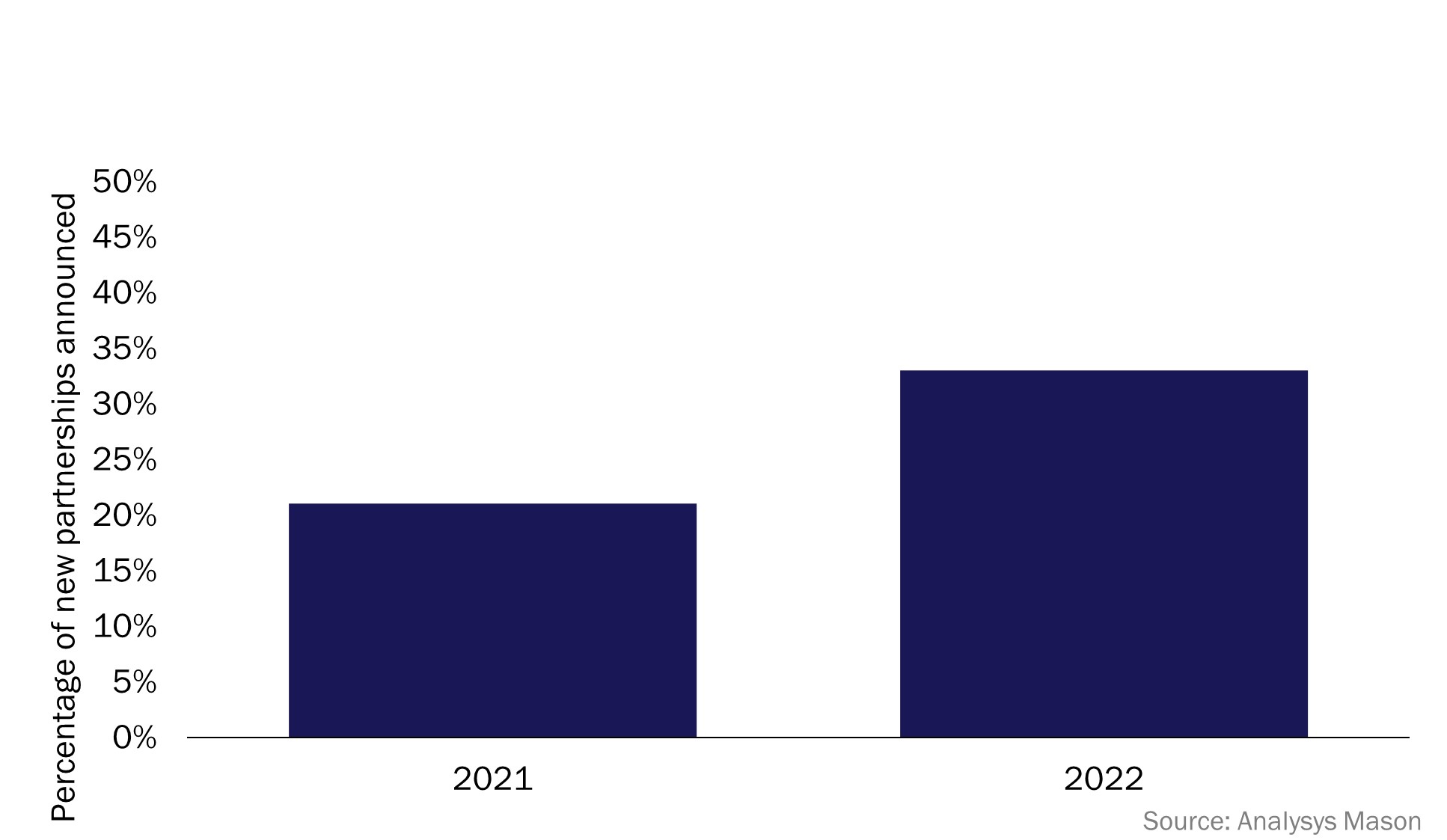

Figure 1: Percentage of public partnerships between PCPs and telco ISVs where the ISV is a data platform provider, 2021–2022

Partnerships between data platform providers and public cloud providers have increased over the previous 2 years

Partnerships between data platform providers and PCPs have increased in the last two 2 years, as identified by Analysys Mason in a recent data sample. The sample was collected in 1Q 2023 with data on partnerships between PCPs and independent software vendors (ISV) targeting the telecoms sector with data and AI/analytics solutions. Partnerships between PCPs and data platform providers accounted for 21% of new partnerships that were publicly announced in 2021, and 33% in 2022. Partnerships with PCPs enable data platform providers to consume infrastructure-as-a-service (IaaS) from PCPs to create a presence within the public cloud. More recently, data platform providers are actively partnering with PCPs to consume their platform services, especially AI and analytics services to improve their offerings and increase operational efficiency. These deals accounted for 45% of partnerships between PCPs and data platform providers.

Partnerships between data platform providers and PCPs often involve the integration of a data platform provider’s services into a PCP’s cloud platform. For example, in November 2022, AWS partnered with Informatica to embed the vendor’s Data Loader product directly within the Amazon RedShift console. In January 2022, AWS also partnered with TIBCO to embed the TIBCO Spotfire with Amazon SageMaker. Google Cloud and Azure have also partnered with Databricks to integrate its Lakehouse platform and architecture within their cloud platforms. These partnerships have all involved the integration of a data platform provider’s services into the cloud platform of a PCP.

PCPs and data platform providers pursue these partnerships to provide integrated services and increase their offerings for CSPs

Partnerships between PCPs and data platform providers create opportunities for both vendors to expand their service offerings to CSPs by integrating data and AI within the same environment. This is an effective way to attract CSPs that want to consume data platform services from both PCPs and data platform providers to support their digital transformation journeys. CSPs are drawn to the public cloud for its scalability, agility and integrated environment. However, some CSPs want to maintain access to data platforms offered by non-PCP data platform providers as they consider these platforms as solutions meeting their need. By partnering with these data platforms, PCPs can offer a wider range of native and third-party data platform services, making themselves more likely to attract and retain CSPs as customers. Data platform providers similarly benefit from this trend.

A useful example is the Microsoft Azure partnership with Databricks, announced in October 2022, which involves the integration of the Databricks Lakehouse platform with Microsoft’s Azure Synapse Analytics service. This integration will allow CSPs to unify their business intelligence, machine learning (ML), AI and other analytics investments using the Databricks Lakehouse as a common data foundation. Azure’s data, ML, AI and analytics platform services are included in this solution to provide intelligence-driven insights – all within a single, cloud environment. These insights can then be used by a CSP to enhance customer experience, improve business operations and optimise efficiency to save costs.

Data platform providers should pursue partnerships with PCPs to reduce costs associated with entering the AI/analytics market

Our research shows that data platform providers are increasing their use of AI/analytics services from PCPs. With access to these platform services, data platform providers enable their CSP users to create software within the same environment that increases automation, generates insights on business operations and improves customer experience. Consequently, data platform providers that partner with PCPs to consume their AI/analytics platform services gain faster time-to-market at reduced costs compared to entering the AI/analytics market themselves. This is because data platform providers can consume these services as part of their software ecosystem rather than investing time and resources into developing their own AI and analytical capabilities.

This benefit is best illustrated by the partnership between Teradata and AWS, announced in June 2022. AWS is integrating its Amazon SageMaker (an end-to-end ML platform service) with the Teradata Vantage platform (a multi-cloud data and analytics platform). This partnership extends the capabilities of the Teradata Vantage platform so that users, such as data scientists, can perform data, AI and analytics related tasks, all within Teradata’s environment. This will prove an attractive model for CSP customers and will allow Teradata to reduce the cost barrier associated with developing its own AI capabilities, whileimproving its customer experience and growing its customer base.

Data platform providers should become cloud-native and cloud-agnostic to develop an effective multi/hybrid cloud strategy

We expect that partnerships between data platform providers and PCPs will continue to increase in 2023, as CSPs will continue to pursue public cloud deployments across multiple public cloud environments. Consequently, data platform providers will pursue partnerships with more PCPs to support their multi/hybrid cloud strategy. These partnerships will ensure that CSPs gain access to their preferred data platforms and services within the public cloud of their choice.

To facilitate these partnerships, data platform providers should pursue cloud-native and cloud-agnostic strategies, as discussed in Analysys Mason’s Platform service consumers: how vendors can benefit from third-party platform services, to efficiently develop a multi- and hybrid cloud strategy. Data platform providers that are truly cloud-native and cloud-agnostic will avoid costly re-engineering processes as the microservices architecture facilitates deployments of their platforms across multiple public cloud environments. By adhering to the cloud native development principles as defined by the Cloud Native Computing Foundation (CNCF), data platform providers will position themselves to consume any data platform service from any public cloud infrastructure. Data platform providers could then attempt to consume these services to reduce costs, increase efficiency and ensure the availability of their services to more customers.

Article (PDF)

DownloadAuthors