Private network solution providers should think beyond the network to capture future revenue growth opportunities

Private network solution providers can take advantage of the successful commercialisation and widespread adoption of applications to unlock significant revenue opportunities. Analysys Mason forecasts that enterprise spend on applications and edge for private networks will reach USD2.6 billion worldwide in 2026.

Overall spend on private networks is relatively small but it will grow rapidly to USD7.6 billion by 2026, including network capex and opex. It will therefore represent an important revenue growth driver for solution providers. However, they will need to do more than just provide the network in order to make the most of the private network opportunity and to improve margins.

This article is based on Analysys Mason’s recently published forecast report Applications and edge computing for private LTE/5G networks: worldwide forecast 2021–2030, which provides forecasts by region and by vertical market.

Enterprise spending on applications and edge computing will increase rapidly from a small base to USD2.6 billion in 2026

Many businesses are exploring how to get more value from their investments in private networks (beyond connectivity) by deploying communication services such as push-to-talk and group messaging. A growing number of businesses is also experimenting with more-advanced use cases, such as automated guided vehicles (AGVs), as well as augmented reality (AR) and virtual reality (VR). It is essential that such applications are enabled to justify the investment in private networks.

The network alone, even if upgraded to 5G, cannot satisfy the requirements of the more-sophisticated applications that have low-latency or high processing requirements, for example, to support operational processes such as tracking inventory in a warehouse, remotely controlling cranes in ports or using VR visualisation to train maintenance staff. For these use cases to be implemented, an edge compute unit is needed to provide the additional processing and storage capabilities close to the source of the data.

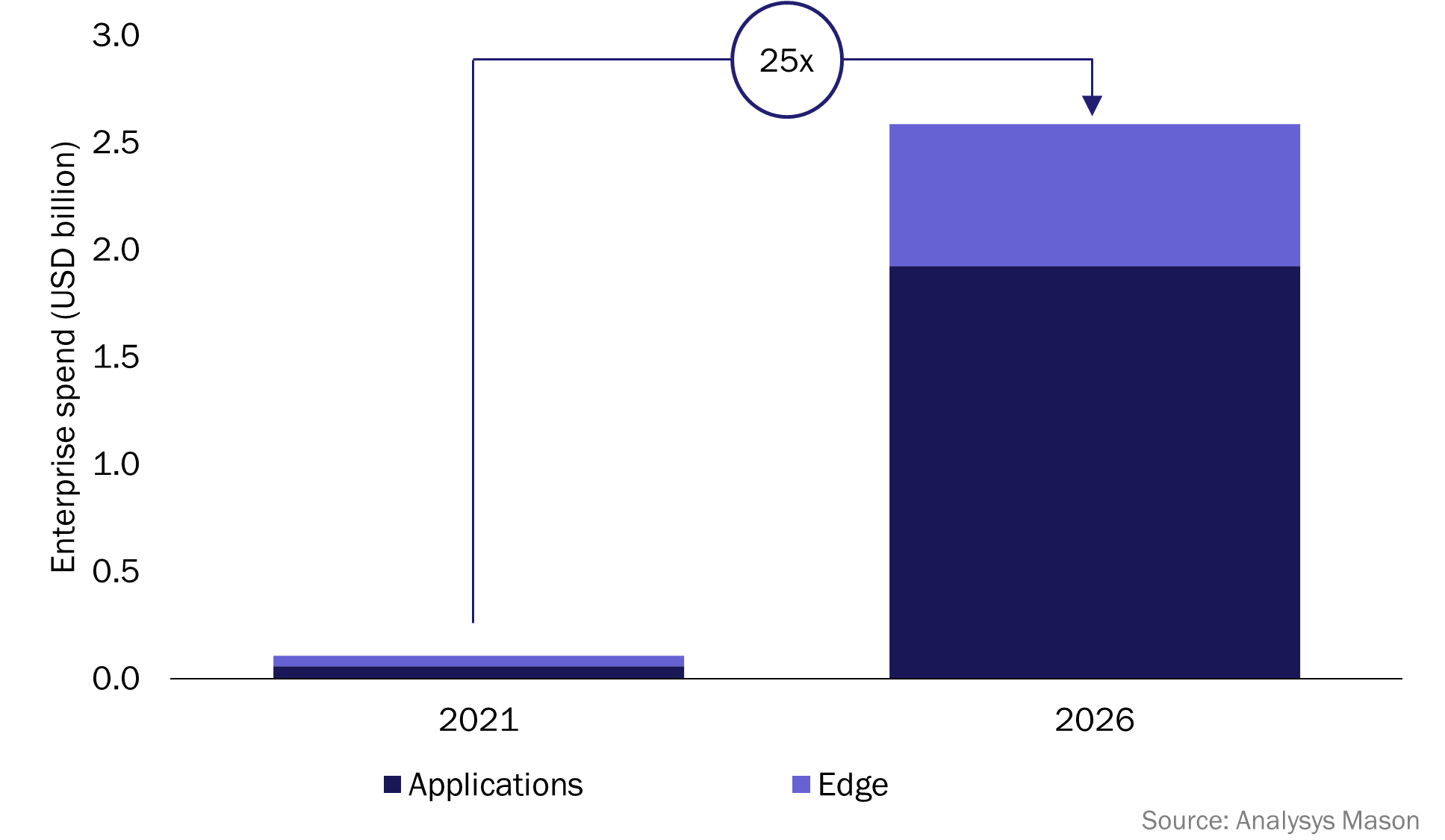

Combining edge with private networks is a relatively new concept, but we expect this approach to grow in popularity as the business case for edge and the applications that depend on it strengthens. We forecast that enterprise new spend on applications and edge compute solutions for private networks will increase from around USD105 million in 2021 to USD2.6 billion in 2026 (see Figure 1).

Figure 1: Enterprise spending on applications and edge computing solutions for private networks, worldwide, 2021 and 2026

The forecast captures two cost elements:

- Applications for communication and operational support, regardless of whether they require edge or not. We include opex only, that is, spending on new software licences and application management services. We exclude spending on devices and hardware (such as cameras), as well as simple use cases such as private mobile data access on mobile devices.

- Edge compute solutions dedicated to running (or supporting) private network applications.1 We include capex (such as spending on server hardware) and opex (such as spending on software licences and maintenance). We consider both customer edge (that is, deployed on-premises) and network edge (hosted by telecoms operators).

The market for applications and edge solutions for private networks is still in the early phases of development, but current trends suggest that enterprises in the following three key sectors have the highest levels of interest and acceptance.

- The manufacturing sector has a considerable number of proofs of concepts (PoCs) deployed. For example, Bosch deployed AGVs in one of its plants in Germany, and Schneider Electric has carried out trials for an AR application to support machine inspection and maintenance in France.

- Enterprises in the mining and oil and gas industries are also set to benefit from better operational data analysis, increased automation and precision, improved safety and less downtime enabled by the applications. For example, Yangquan Coal built a 5G private network for HD audio-visual communications and remote control in one of its mines in China.

- Many of the current application trials in the transport sector are based on the use of video analysis to detect intrusion, monitor security, guide AGVs, control cranes and track passengers and personnel. However, the application domain is rapidly expanding. For example, technicians at Hamburg Airport are using AR to increase the precision of aircraft maintenance.

Solution providers should work with other partners in the value chain to capture future growth opportunities

By combining private networks with applications and edge solutions, solution providers have an opportunity to increase their share of enterprises’ spending on private networks and improve their margins (because a large chunk of current spend is on the network build and hardware, which have relatively low margins). Their integrated solutions will also be more likely to appeal to enterprises because this reduces the number of suppliers that they need to deal with.

A few solution providers are engaging with different players along the value chain to co-develop vertical-specific solutions and to bring their expertise in edge and application development.

- Operators. Telefónica and Vodafone have been working with hyperscalers, notably AWS and Microsoft, to incorporate their edge solutions into the hyperscalers’ private network offerings and to tap into their extensive developer ecosystems.

- Network equipment vendors. Huawei incorporates Bosch’s domain expertise in remote control in manufacturing in its own solutions. Nokia, which has its own applications portfolio, also works with partners (such as PTC) to onboard their applications.

- System integrators. Tech Mahindra works with Verizon to identify use cases and co-develop applications for private networks across the financial, manufacturing and healthcare sectors. T-Systems is working with AGV vendors and ISVs to develop use cases that use computer vision in manufacturing.

The private network ecosystem is still evolving. This presents solution providers with an opportunity to establish partnerships and share IP to identify, test and develop applications that address enterprises’ current and future requirements. As the value of the private network shifts from the network to the applications, it is important for solutions providers to think beyond connectivity to capture future growth opportunities.

1 Edge solutions can also be used to power the private network. Forecasts for the capital and operating costs associated with that are included in Analysys Mason’s Private LTE/5G networks: worldwide trends and forecasts 2021–2026.

Article (PDF)

Download