Executing satellite backhaul growth plans

Satellite is a ‘cool’ technology again, but there is still a lot of work to be done.

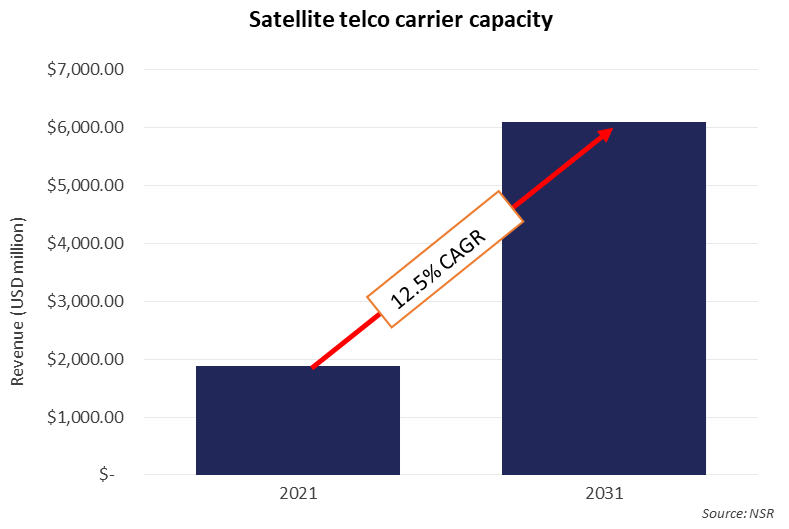

By way of background, despite recent significant improvements in satellite backhaul fundamentals, specifically throughput, capacity prices, ground segment, and cheaper RAN (among others), the industry was struggling to change MNOs’ mindsets because satellite was still perceived as an expensive, low-performance and difficult to implement technology. The good news is this is rapidly changing with the help of personalities like Elon Musk and Jeff Bezos, as well as the focus that is shifting away from educating MNOs towards executing growth plans. NSR’s Wireless Backhaul via Satellite, 16th Edition report forecasts that the telco carrier business will consolidate as a key satcom growth driver expanding capacity revenue at 12.5% CAGR in the next 10 years. However, the vertical will experience challenges, as discussed in this article by Northern Sky Research (NSR) (an Analysys Mason company).

Satellite backhaul is just scratching the surface of the addressable market with years of growth ahead. There are now thousands of sites under contract or in RFP phase, driving sizable industry prospects for the coming years. However, many of these deployments get delayed or even cancelled along the way due to bad planning and execution. What are the critical challenges and how can the industry mitigate them to materialize the opportunities in backhaul?

Funding the ‘infrastructure-as-a-service’ business model

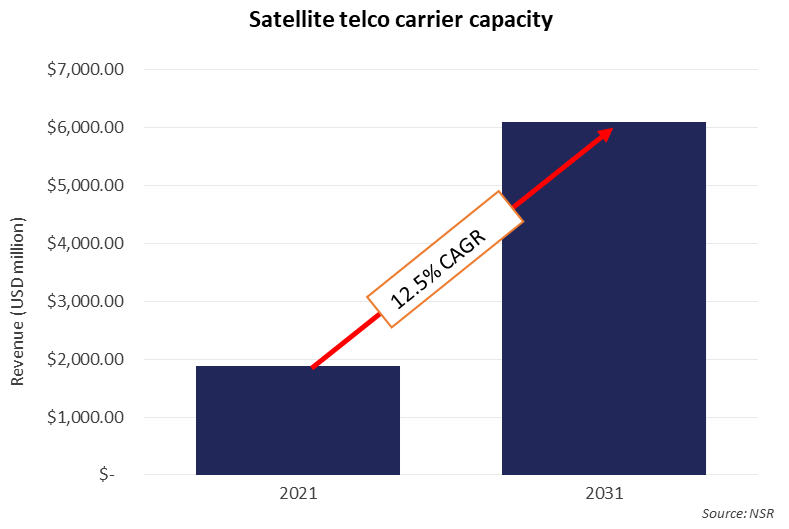

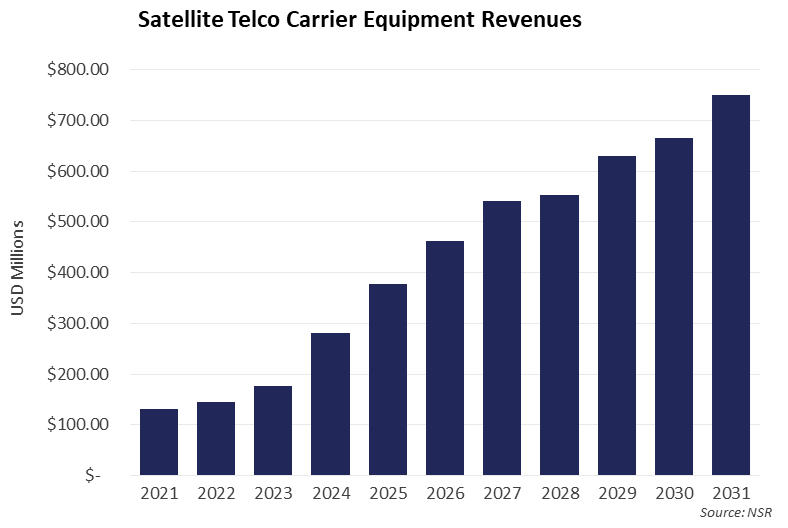

Business models in the backhaul segment are evolving rapidly. It is now very common that large RFPs in the segment incorporate ‘network-as-a-service’ requirements where the MNO outsources the entire management of the rural network including installation, equipment lease, energy, maintenance and operations to an integrator. On one hand, this is great news for the industry because the size of the deals has grown (see the graph below) showing how the contribution to revenue of wholesale capacity is significantly lower than other service-oriented elements. On the other hand, complexities, risks and financial requirements including RAN equipment, energy sources and operations among others have also scaled. In fact, there are thousands of committed sites to be deployed following the ‘infrastructure-as-a-service’ model that are on hold due to challenges in accessing funding.

Given the nature of deployments – short track record of projects and risks – integrators have had difficulties accessing project finance loans despite having closed the deal with MNOs with good cash-flow visibility. Consequently, integrators had to seek less optimal alternatives like private equity (AXESS-COFIDES-ALANTRA). Additionally, some satellite operators have seen an opportunity for getting closer to end users and securing demand for their fleet, triggering a wave of strategic investments in these integrators (Intelsat-AMN, Spacecom-NuRAN, Hispasat-AXESS). Local banks (NuRAN-Cameroon) and development finance institutions are starting to value the double returns in these projects in terms of financial and socioeconomic benefits offering equity investments (AMN-CDC Group-DEG-Proparco) and loans (NuRAN). The whole value chain acknowledges these funding difficulties and, when evaluating equipment vendors and other partners, financial conditions including deferred payments and equipment leases are becoming as important as performance and price. In fact, a new role in the ecosystem is emerging with some companies specializing in financing equipment (SatLease Capital).

Optimizing rural operations

Satellites are enticing for the last 5% of the network. This pushes satellite integrators to master rural operations. This is certainly not an easy task, especially in emerging markets. Many deployments need to be done in remote villages, sometimes requiring multiple days of travel through dirt roads and other challenging topographical conditions. The extra time and cost to reach those locations and the additional preparation of the installers to be ready to solve any issue in these ultra-rural locations obviously need to be considered when building business plans.

Products must also be properly defined for these deployments. For example, power consumption is not a top priority for many of the equipment vendors, both on the satellite and RAN sides, but this can be a major factor when deploying a site that needs to run on solar panels. User reviews from Starlink report power consumption of the terminal of 100 Watts (these are particularly high given Starlink’s need for an active antenna), which could be a major challenge in ultra-rural deployments. Other factors like ease of installation, low-maintenance, security, coverage also need to be considered.

Supply chain

The satellite industry is not immune to the global electronic components shortage and shipping saturation. Consequently, multiple deployments had to be put on hold due to equipment supply not being able to meet the large post-COVID-19 demand. NSR quantifies this at 10–20% of shipments and revenue that would have naturally happened in 2021 being postponed to 2022.

Multiple equipment vendors are noting these challenges in their quarterly results: Gilat highlighted “we are experiencing the global shortage of electronic components and materials”, while Comtech mentioned during the quarterly results presentation “We are closely monitoring our inventory needs and our supplier base and we cautiously expect these constraints to ease up during the second half of fiscal 2022… we’ve seen lead times for parts that are normally 20 to 30 weeks being extended to 40, 50, and in some cases, 60 weeks.” NSR initially estimated these challenges to be resolved by mid-2022 but the crisis is proving to be more persistent than initially assessed and ramp-up of projects could be impacted throughout the year. Actually, more concerns are arising with inflation and continued pressures on shipping crippling the supply chain.

Sharpening the fundamentals

The revitalization of satellite backhaul started when the arrival of HTS, more powerful satellite ground segment and cheaper RAN equipment converged to make rural deployments ROI-positive for mobile operators. In the past, satellite was only used as a last-resort solution for areas only covered when mandated by regulators. Now, a growing share of deals are driven by commercial interest where there is no longer a need for universal service obligations, validating the thesis of satellite backhaul being a highly elastic market.

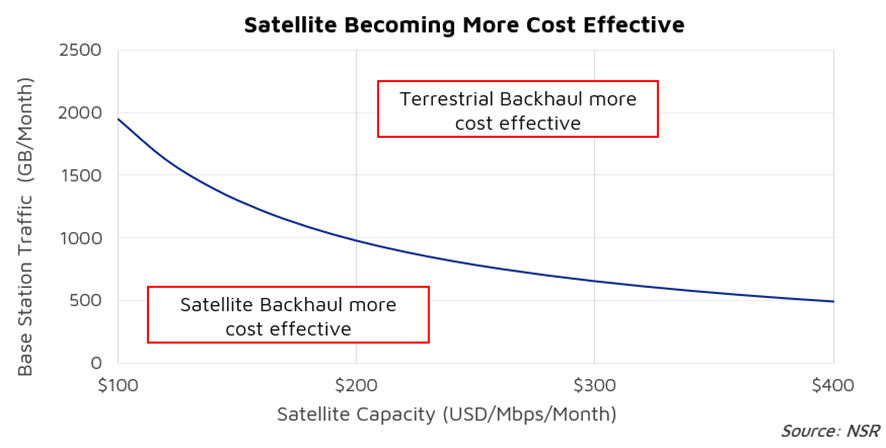

But consumer trends continue to evolve, specifically the consumption of much higher data volumes. At satellite capacity pricing of USD200 per megabit per second per month, which is a typical range for backhaul deals today, satellite would be more cost effective than terrestrial if the BTS consumes less than 1TB per month or the same as 1000 subscribers consuming 1GB per month on average. However, as these subscribers become more sophisticated whereby migration to LTE and eventually 5G, heavy use of OTT, high-quality formats like HD, UHD or VR become the norm, satellite will need to continue increasing efficiencies to remain competitive.

Bottom line

With major deployments across the globe like BAKTI in Indonesia or Altán Redes in Mexico and revitalized interest on satellite from Tier-1 MNOs like Verizon, satellite is again on the agenda for mainstream telecoms operators. The opportunities for backhaul are extraordinary with a massive addressable market still waiting to get online.

Now is the time to focus on execution. Structuring solid ‘infrastructure-as-a-service’ business models through creative finance, streamlining rural operations, leveraging the ecosystem of partners, and navigating current supply chain challenges, specifically the electronic shortage and shipping delays, and continuing to fuel elasticities through attractive total cost of ownership offers are the key pillars for satellite backhaul growth.

NSR supports equipment vendors, service providers, satellite operators, end-users, public agencies and financial institutions in their technology and business strategy assessment and planning. Please contact info@nsr.com for more information.

Article (PDF)

Download