Satellite broadband is booming in Latin America, thus confounding expectations

28 January 2026 | Research and Insights

Article | PDF (4 pages) | Latin America Metrics and Forecasts | Space

The addressable market for satellite broadband in Latin America (LATAM) is growing, despite expectations that growth in the number of connections would be constrained by high prices. Indeed, the number of connections is soaring, and there has been a wave of collaborations between governments and telecoms operators. Nonetheless, satellite will remain a niche technology, mainly used for providing connectivity in remote areas where fibre and fixed-wireless access (FWA) cannot reach. Operators must therefore have a clear understanding of where demand is strongest in order to capitalise on the profitability of satellite broadband.

Satellite broadband will be used to connect remote areas in LATAM

Fibre roll-outs in LATAM will be largely complete by 2030, and fibre will cover roughly 90% of all premises. Fibre take-up will be strong but not universal; only around 60% of those covered will actually adopt the service. FWA will account for some, but not all, of the residual take-up.

Satellite broadband providers have an opportunity to provide coverage in unconnected areas. They can also offer exclusive advantages in those areas that are covered by fibre. These include greater flexibility, because the service is not tied to a single location and can be relocated freely, and faster service availability, because there is no installation lead time.

Our earlier assumptions for growth in the number of satellite broadband connections in LATAM were conservative, reflecting the belief that premium pricing was beyond the means of rural consumers, despite the above-mentioned benefits. However, the number of satellite broadband connections has grown much more extensively than previously expected since Starlink’s launch in the region in 2021. Indeed, Starlink is now the dominant satellite broadband provider in LATAM; it operates in 28 countries in the region as of 2024. This growth has been driven by governments and operators that have been increasingly turning to satellite to reach rural areas and to expand into new market segments.

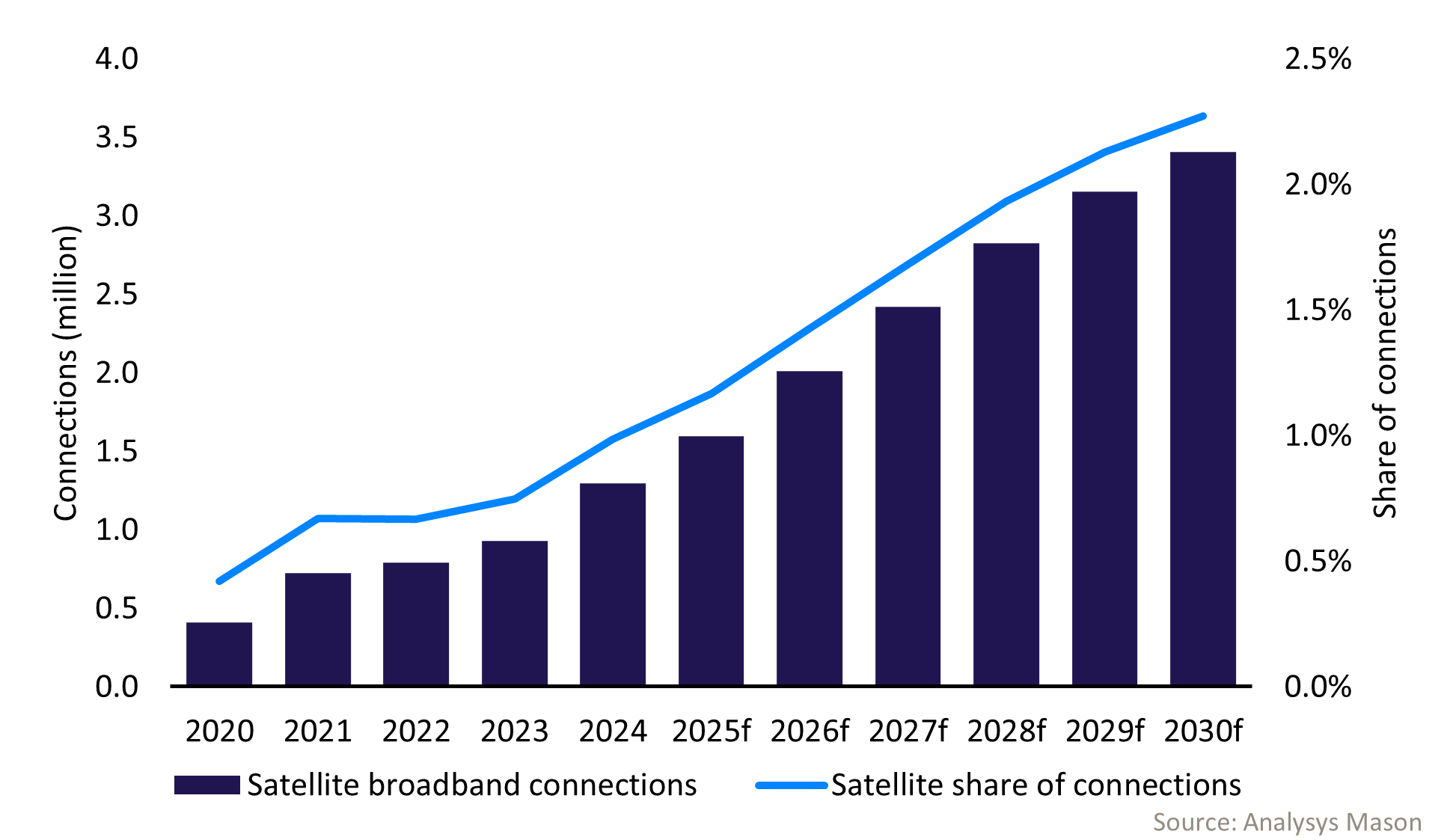

As a result, we expect that the number of satellite broadband connections in the largest markets in LATAM1 will grow by 43% between 2025 and 2030 to reach 3.4 million (equivalent to 2.3% of all broadband connections) (Figure 1).

Figure 1: Satellite broadband connections and the satellite share of broadband connections, largest markets in LATAM

Governments and operators increasingly believe that satellite connectivity is the most practical solution for rural areas

Governments in LATAM are more frequently using satellite connectivity to bridge the digital divide in rural areas. However, its use remains largely limited to specific projects to connect a handful of hospitals and schools. Mexico is the only country in LATAM so far to have implemented satellite broadband as part of its national broadband connectivity initiative, ‘internet for all’. It awarded Starlink a USD90 million contract to provide free internet until the end of 2026.

Similarly, telecoms operators in LATAM are increasingly partnering with satellite providers to expand their broadband coverage and target new market segments, particularly in the B2B space (Figure 2). Claro, GTD, IFX and Telecentro have all signalled that their agreements with Starlink will expand their enterprise offerings to new verticals, ranging from agriculture to offshore oil rigs.

Figure 2: Largest operators that have partnered with satellite players for fixed broadband, LATAM

| Operator | Satellite provider | Details |

|---|---|---|

| Claro | Starlink/Hughes | Claro was the first operator in Colombia to launch broadband services over Starlink’s network in 2024. Claro has an existing satellite contract with Hughes for broadband. |

| GTD | Starlink | GTD became one of the first authorised Starlink resellers in Chile, Colombia and Peru in 2023. |

| IFX | Starlink | IFX announced, in October 2025, that it is an authorised reseller of Starlink’s services in LATAM. |

| Telecentro | Starlink | Telecentro (Argentina) and Starlink extended the terms of their existing partnership in mid-2025. Telecentro will now target the education, banking, agriculture and mining sectors with satellite broadband. |

| Telefónica | Starlink | Telefónica signed a deal with Starlink in 2023 to offer broadband services across its footprint in LATAM. Telefónica aims to use satellite broadband to connect remote residential and business customers.2 |

| TIM Brasil | Starlink | TIM Brasil was the first major operator in Brazil to announce a partnership with Starlink in July 2025. It plans to connect 2000 schools with satellite broadband services.3 |

| Vrio | Amazon Leo (formerly Project Kuiper) | Vrio operates the DirecTV Latin America and Sky Brasil brands. It partnered with Amazon Leo in 2024 to provide broadband services to residential customers in Argentina, Brazil, Chile, Colombia, Ecuador, Peru and Uruguay. |

Source: Analysys Mason

This emphasis on expanding into new B2B market segments indicates that the demand for satellite broadband is greater among business and enterprise customers than among consumers. This may reflect businesses’ greater ability to pay premium prices than consumers.

Starlink’s services are significantly more expensive than comparable terrestrial offerings

Starlink’s residential ‘lite plan’ costs USD35–40 per month in most countries (the full version costs USD50–60). This is more expensive than alternatives such as 5G FWA, which typically costs around USD30. Set-up costs are also much more expensive: Starlink’s Mini Kits and Standard Kits cost USD200–350. By comparison, an FWA device can be purchased outright for around USD200, or acquired via a 12-month instalment plan.

Nonetheless, the demand for Starlink’s services continues to grow in LATAM, which has reset expectations that customers in the region would resist paying premium prices for satellite connectivity. Take-up will continue to grow as operators adapt their offerings to make them more affordable and appeal to a wider customer base, despite satellite broadband being the most expensive commercial technology in LATAM.

If you want to learn more about this topic and other market drivers in LATAM, please read our forecast report, Latin America telecoms market: trends and forecasts.

1 The largest markets are Argentina, Brazil, Chile, Colombia, Mexico and Peru.

2 Telefónica has sold most of its operations in LATAM as of December 2025, or is planning to do so. It currently only operates in Brazil, Chile and Mexico. It sold its operations in Argentina in February 2025, but still offers ‘Movistar Link’ for businesses, meaning that its contract with Starlink remains valid.

3 This agreement stems from TIM Brasil’s obligation to provide internet access to these schools under the terms of its 2012 4G auction bid.

Article (PDF)

DownloadAuthor

James McManus

AnalystRelated items

Article

Satellite operators becoming manufacturers will benefit from SaaS, despite market fragmentation

Podcast

Predictions for the space industry in 2026

Article

D2D services must balance capabilities, expectations and willingness to pay