Manufacturers and launch service providers must navigate satellite and space infrastructure bottlenecks

The global space economy is growing rapidly, fuelled by technological developments, commercial ventures and international collaboration. Advances in software and manufacturing processes should result in lower prices but the reality is more nuanced. Indeed, these gains are often offset by several factors including supply chain disruptions, mission complexity, delays and funding constraints. Manufacturers and launch service providers must adapt to the shifting competitive landscape by differentiating their offerings, enhancing their operational efficiency and exploring strategic partnerships to stay ahead of the curve.

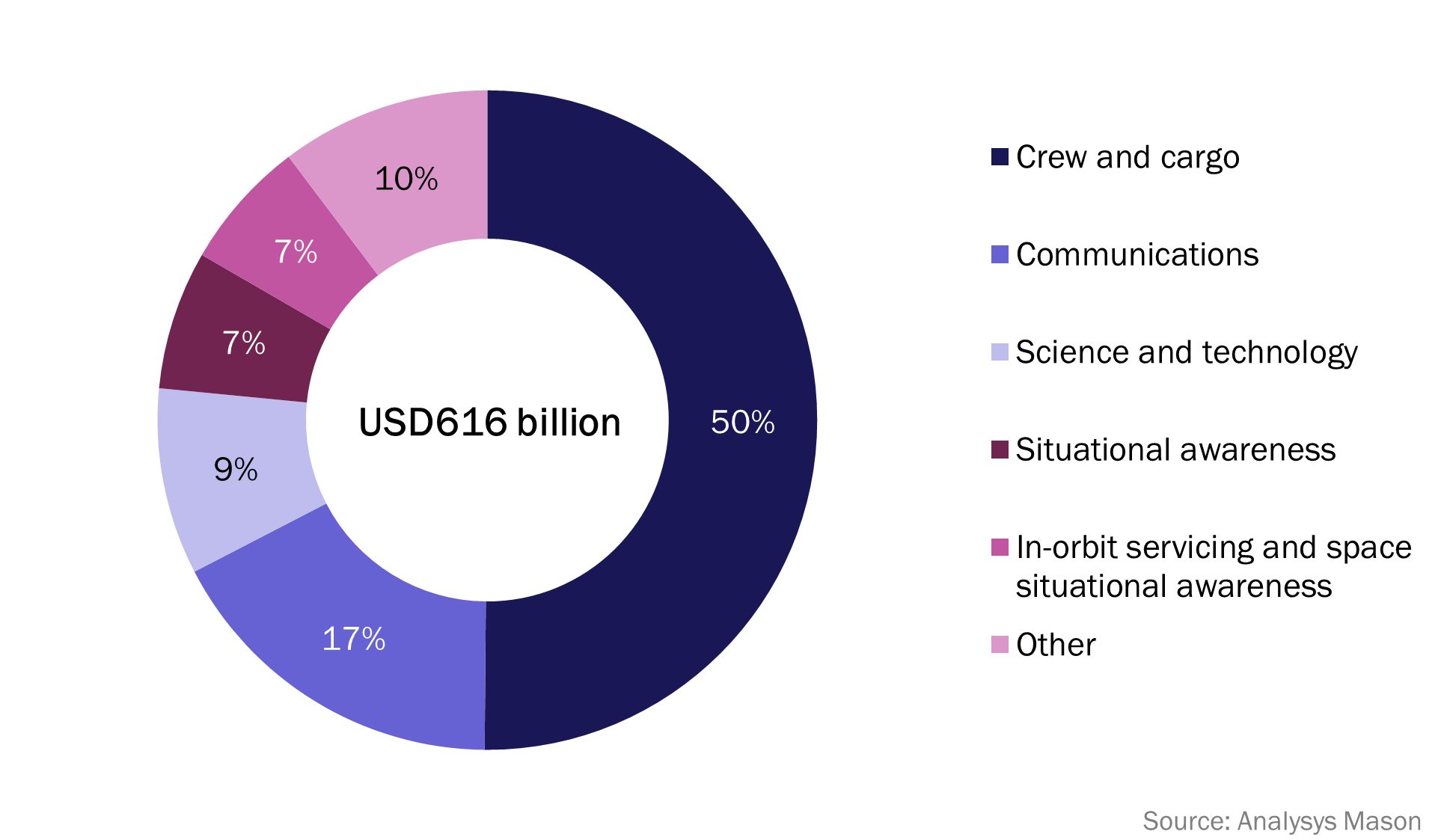

Analysys Mason’s Global space economy, 4th edition report shows that the satellite and space infrastructure segment is expected to generate over USD600 billion in cumulative revenue between 2022 and 2032 (Figure 1). The satellite and space infrastructure market is thriving due to a surge in demand for crew and cargo and communications services. High-mass geostationary (GEO) missions and crew and cargo missions to low-Earth orbit (LEO) and beyond account for the most satellite infrastructure revenue, while non-GEO communications constellations represent the majority of missions.

Figure 1: Breakdown of cumulative revenue for the satellite and space infrastructure segment, by sub-segment, worldwide, 2022–2032

Satellite manufacturers are forming partnerships, making acquisitions and changing their designs to adapt to disruption

Supply chain disruptions have emerged as a significant concern for satellite manufacturers because they exacerbate delays and increase production costs. Manufacturers are contending with a myriad of challenges that impede their ability to meet customer demand and deliver products on schedule, such as component shortages and logistical hurdles. As a result, satellite manufacturing and launch companies are building direct relationships with suppliers and are focusing on acquisitions to mitigate disruptions and ensure revenue generation. For example, L3Harris is considering forming supplier partnerships for its satellite business and SpaceX has acquired a parachute supplier in a bid to preserve its supply chain. Low-Earth orbit (LEO) players are increasingly opting for non-radiation-hardened electronics because these electronics allow manufacturers to prioritise cost-efficiency and performance in component design, without the need for extensive radiation hardening. This demonstrates the adaptations, innovations and strategic shifts that have been implemented in a bid to maintain operational efficiency in the satellite infrastructure supply chain.

The transition towards lower-mass-class missions is another notable trend in the satellite infrastructure market. These missions provide opportunities for innovation and cost savings, thereby enabling satellite launch companies to experiment with new technologies in space and rapidly deploy large-scale constellations for global connectivity and earth observation. However, this trend also poses challenges for manufacturers and launch service providers, such as the need to optimise production processes, adapt launch services to accommodate small satellites and address constraints on mission capabilities and performance. Overcoming these challenges requires collaborative efforts, innovation and strategic planning among industry stakeholders.

Satellite manufacturers and launch service providers must adopt a multi-faceted approach

Satellite manufacturers and launch service providers must adopt a multi-faceted approach that encompasses several key strategies. They must diversify their supplier bases to reduce their reliance on a single source and mitigate geopolitical risks and chip shortages. They should also foster strong supplier relationships to enable early warnings of disruptions, and should implement flexible production processes to accommodate alternative components or materials. Agile practices and the strategic stockpiling of critical components will also enable rapid adjustments to market fluctuations.

Launch service providers should collaborate with satellite manufacturers to develop modular satellite architecture with standardised interfaces, thereby enabling in-orbit repairs or upgrades using readily available components. Manufacturers should also focus on carrying out thorough risk assessments, employing redundancy measures and implementing contingency plans to ensure mission resilience. This proactive approach combines risk management, technological innovation, collaboration and continuous improvement to efficiently achieve successful outcomes.

Article (PDF)

DownloadAuthor

Dallas Kasaboski

Principal Analyst, expert in space infrastructureRelated items

Article

Applications facilitate AI adoption in customer engagement

Tracker

GEO FSS communications satellites tracker 2025

Framework report

Unlocking new markets with sustainable products and services: opportunities for vendors, operators and cloud providers