The small GEO satellite market is on the cusp of sizeable growth

The year 2024 started with a low number of (geostationary) GEO communications satellite orders compared to previous years; five so far, and most were small satellites (those with mass less than 1000kg). This trend looks likely to continue for the next few years but the question is will it carry on in the longer term?

Demand for small GEO satellites is growing and established manufacturers are playing catch-up

Analysys Mason expects the next few years to be a period for satellite manufacturers and operators to test different satellite designs, such as small GEOs, before they settle on the most efficient one. Emerging players have entered this highly competitive market and announced several new platforms that broaden the supply of satellites mass less than 1000kg.

It is a sure sign that a market is getting attention when established players such as Lockheed Martin choose to expand their offering by investing in small communications satellites manufacturing. It later withdrew its bid to buy a greater share in this manufacturer, but Lockheed Martin is still Terran Orbital’s biggest client for satellites that must be delivered under sizeable contracts to the US government. Nevertheless, the relationship is likely to expand into small GEO satellites as Terran Orbital unveiled a new 300kg platform for this market in March 2024.

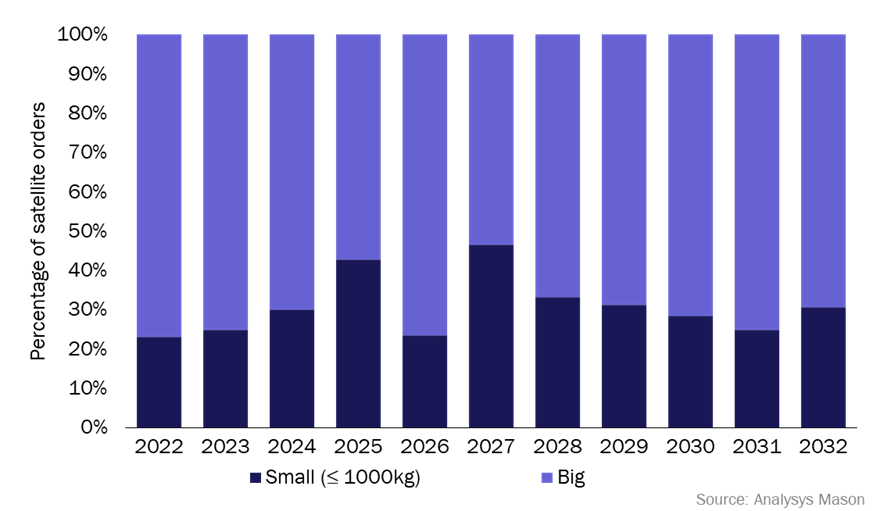

These two companies probably have their eyes set on the more than 150 GEO communications satellites that will be ordered in the next decade (see Analysys Mason’s Satellite manufacturing and launch services: trends and forecasts 2023–2033 report). Furthermore, Analysys Mason expects that 1 in 3 orders will be for GEO satellites with a mass of less than 1000kg. However, the demand will not be smooth and constant (Figure 1).

Figure 1: GEO communications satellite orders by type, worldwide

Small GEO satellites are adding to the challenges faced by manufacturers

During the recent decline in GEO satellite orders, smaller satellite manufacturers have come under pressure to fulfil orders more quickly between design and launch. This is an important differentiator for manufacturers such as OHB, which developed a small GEO platform with the European Space Agency (ESA) and boasts that compared to other manufacturers it can offer shorter integration times, lower costs and simpler systems that reduce programme risks.

Astranis claims that its order-to-launch period is 18-to-24 months and plans to launch four satellites in 2024. It has deals with operators in Mexico, the Philippines and Thailand among others, and its business revolves around leasing satellite capacity from the satellites that it builds and owns. This decreases the capex efforts of its target clients, which are often in areas where fibre networks do not satisfy the growing demand for broadband internet connections.

This is arguably the driver for other broadband small GEO satellite manufacturers as well; for example, Swissto12 expanded its facilities to meet demand for its radio-frequency (RF) products and its HummingSat GEO platform (ordered by Intelsat and Viasat).

Small GEO satellites cost less than large traditional GEO satellites and therefore provide access to new customers that were not thinking of buying GEO satellites before. Much like in the countries mentioned above, these platforms help broaden the reach of satellites to ever expanding markets, despite tough market conditions overall.

As the market moves towards smaller, more nimble and flexible solutions, the next competitive battleground for manufacturers will be in addressing the demand from new and current customers for small GEO communications satellites.

GEO satellite manufacturers must address the changing market dynamics and the demand for smaller satellites

The trend of miniaturisation is underway and small GEOs are accounting for a significant proportion of the total number of satellite orders, but there is a concurrent move to offer small GEOs with mass close to 1 ton (1000kg). This will enhance the small GEO satellite value proposition because these bigger satellites have a longer lifetime than the smaller ones, and the new materials and in-house development of components could also shorten the value chain.

The new launchers coming online, such as Ariane 6, Starship and Vulcan, could support the case for a rebirth of larger GEO satellites. On the other hand, these new launchers could also help operators to ‘stack up’ a few small GEOs in one launch vehicle and instantly create a fleet that offers global coverage for basically the price of one large GEO. The uncertainty in the market is also affected by the launchers that are available and the strategies that satellite operators choose to launch the satellites.

In retrospect, vertical integration could offer a strong business case for growth because it reduces time to launch. And advanced technology with regular technology updates then becomes a differentiating factor.

In the end, providing a strong offer to answer the demand for less costly, focused GEO satellites is a way to help expand the market and gain market share as the trend for satellites below 1000kg will keep opening new opportunities and will probably continue to grow.

Article (PDF)

DownloadAuthor

Claude Rousseau

Research Director, expert in space and satelliteRelated items

Article

Europe should bridge the gap between various international lunar efforts

Tracker report

Space infrastructure investment: trends and analysis 2024

Article

Data centres are increasingly being launched into space but must meet stringent requirements