Operators are set to invest USD77 billion cumulatively in AI cloud infrastructure between 2025 and 2030

02 June 2025 | Research and Insights

Article | PDF (3 pages) | Cloud and AI Infrastructure| NaaS Platforms and Infrastructure | AI

AI has become a cornerstone of telecoms operators’ strategic agendas. Not only does it elevate customer experience and strengthen brand loyalty, but it also accelerates automation at scale, modernises networks and supports next-generation services and business models, including ‘as-a-service’ offerings of network and compute infrastructure. Some telecoms operators are beginning to chart new territory as AI infrastructure and services providers for enterprises, tapping into fresh and expanded revenue streams. These shifts are intensifying the pressure to build or reconfigure cloud infrastructure across private and public environments to support the mounting demands of AI-driven workloads and services.

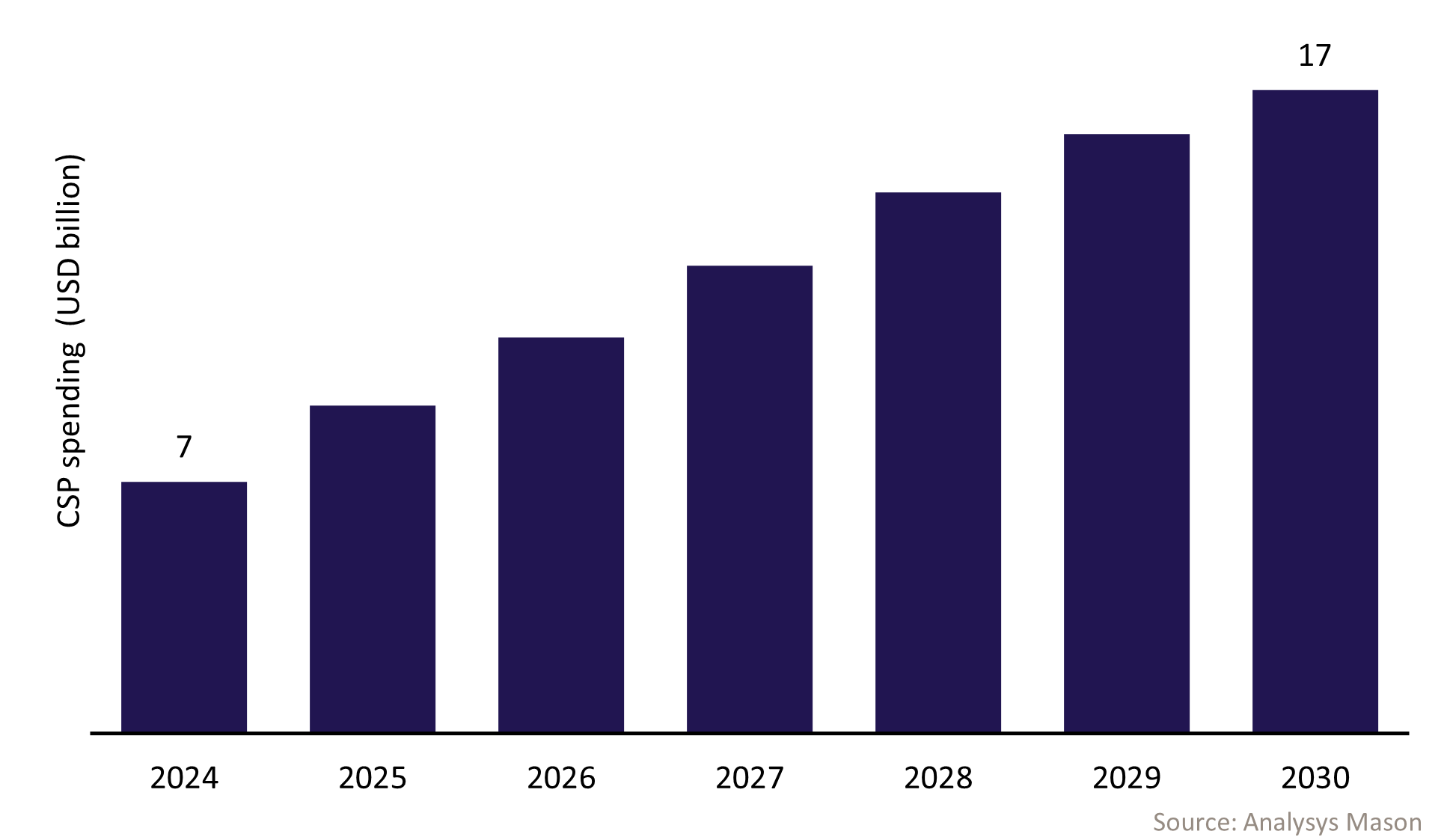

In our recently published Telecoms AI cloud infrastructure: worldwide forecast 2024–2030 report, we estimate that telecoms operators investments in AI cloud infrastructure will reach USD17 billion by 2030, growing at a CAGR of 17% from 2024. The forecast includes investments aimed at powering both internal AI use cases and AI-related services for enterprise and consumer markets. This article highlights the key findings from that research.

Figure 1: Telecoms AI cloud infrastructure total spending, worldwide, 2025

AI cloud infrastructure spend is growing fastest in network operations, fuelled by breakthroughs in GenAI, agentic AI and AI RAN

Customer care, marketing and productivity use cases have so far driven most of operators’ initial investments in AI cloud infrastructure. More recently, however, the momentum has now shifted towards applying AI across Day 0, 1 and 2 network operations, spanning core, transport and RAN domains.

Traditional AI technologies (for example, predictive AI) currently account for the largest share of network operations-focused investments in supporting use cases such as service assurance and monitoring, security and network design and planning. But the tide is turning. Momentum is building around generative AI (GenAI) and agentic AI,1 with operators increasingly trialling these technologies across a range of network operation scenarios. Some advanced operators have begun commercialising GenAI-based solutions including knowledge assistants for field operations, network optimisation and security threat detection. These early deployments are laying the groundwork for broader commercialisation over the next 2 to 3 years, with GenAI projected to account for 30% of network operations use cases by 2030.

AI RAN,2 though still in its early stages, is fast emerging as a strategic investment priority for operators seeking to supercharge RAN functionalities and operational efficiency. We expect that integrating AI capabilities within RAN will further accelerate AI cloud infrastructure growth from 2028 onwards. Initially, operators are leaning on external cloud platforms to deliver AI-powered RAN use cases, but frontrunners, such as SoftBank and T-Mobile, are already experimenting with embedding AI within RAN through early trials. As vRAN and Open RAN adoption grows, advanced operators will begin integrating AI infrastructure directly into the RAN, using accelerators or adjacent servers in distributed units (DUs) and centralised units (CUs), to support Layer 1 and radio enhancements, and enable broader RAN automation and orchestration. There is also an emerging opportunity to repurpose this infrastructure for third-party enterprise workloads, though the demand and business case are still evolving.

B2B and B2C AI use cases will drive most AI infrastructure spend as operators pursue AI service provider role ambitions

Operators in the Asia–Pacific (APAC) region are leading the charge in AI cloud infrastructure investment to support B2B and B2C services such as AI-as-a-service (AIaaS), GPU-as-a-service (GPUaaS), sovereign AI and large language model (LLM) training in local languages. Chinese operators, particularly China Telecom and China Mobile, are significantly scaling up their AI computing capacity through major investments. While access to advanced AI chips remains constrained by export controls, local chip alternatives are advancing rapidly, with Huawei emerging at the forefront of this effort. These operators are key architects in China’s hyperscale cloud market, competing with Alibaba and Tencent, and play a central role in the national AI infrastructure build-out.

Operators across the wider APAC region are catching up to China. SK Telecom is developing a national network of regional AI data centres as part of its ‘AI infrastructure superhighway’ vision, which includes GPUaaS, sovereign AI and edge AI services. KT is investing in AI cloud and has partnered with Microsoft to develop custom AI models using KT’s infrastructure. SoftBank is working closely with NVIDIA on both AIaaS and 5G. In India, Reliance Jio is making major investments with plans for gigawatt-scale AI data-centre capacity. Singtel is also ramping up investment across its footprint and via Bridge Alliance partners.

Outside APAC, European telecoms operators are the most active in B2B and B2C AI-focused investments. Operators such as Iliad, Orange and Swisscom are particularly targeting the GPUaaS market, aiming to differentiate themselves by meeting local enterprise needs through sovereign cloud offerings.

Geopolitics, operators’ cloud operations capabilities and the rise of more efficient models could reshape AI investments

Several important factors will influence the trajectory of telecoms operators’ AI cloud investments in both the near and long term:

- Geopolitical issues. While operators remain strategically committed to AI, the rising costs of AI cloud components, driven by trade tensions and tariffs, may force some to delay or scale back spending. Hardware is particularly vulnerable. Although semiconductors are currently exempt from many tariffs, this could change, and broader supply chain disruptions may still affect availability and pricing. Meanwhile, the EU is intensifying its focus on digital sovereignty, which could constrain the role of public cloud providers in the region, despite efforts to align with regulations and build trust through local partnerships. This could present an opportunity for telecoms operators with sovereign cloud provider ambitions, while for others it may imply higher infrastructure costs.

- Telecoms operators’ success in B2B/B2C AI services. Uncertainty remains over whether operators will successfully monetise their AI investments or whether the current momentum could lead to a bubble. Success requires more than accumulating GPU capacity; it depends on building a strong developer ecosystem, delivering public cloud-like service experiences with automated, cost-efficient operations and complying with sovereignty requirements. While some operators may succeed independently in certain markets, others will likely need close collaboration with partners such as public cloud or GPUaaS providers. However, even if operators struggle to monetise AI through enterprise services, proven and substantial efficiency gains in internal operations use cases could still drive continued investment.

- Smaller, more efficient models. The emergence of smaller, domain-specific AI models may reshape AI cloud investment strategies. These models require less compute, power and memory, reducing the need for large-scale GPU deployments and enabling more cost-effective, distributed workloads. This could create opportunities to deliver AI services closer to the edge, especially essential for RAN. However, it also lowers the barriers compared to deploying large, centralised AI models requiring significant GPU infrastructure, leading to more intense competition in the AI cloud services market.

1 Agentic AI refers to AI systems that can autonomously pursue goals, make decisions and take actions based on internal objectives or prompts, often with limited or no human oversight.

2 AI RAN refers to the three primary methods of integrating AI into RAN (AI-on-RAN, AI-for-RAN, AI-and-RAN), as defined by the RAN AI Alliance.

Article (PDF)

DownloadAuthor

Gorkem Yigit

Research DirectorRelated items

Client project

Building a corporate strategy to achieve over 20% revenue growth, diversify the portfolio beyond core telecoms and harness AI-driven value creation

Client project

Developing a go-to-market strategy and a first-of-its-kind business case for an Asian telecoms operator’s entry into the GPUaaS market

Podcast

TMT predictions 2026: operators are at a crossroads