What are virtualised RAN (vRAN) and Open RAN?

30 June 2023 | Research

Article | PDF (5 pages) | Operator Spending| Wireless Technologies

Many operators have begun the process of migrating their networks to the cloud, initially through virtualisation, and increasingly in a cloud-native environment. Significant progress has been seen in the enterprise and packet core domains, but the radio access network (RAN) remains largely untouched, and migration in this domain comes with daunting performance and integration challenges. However, it will be difficult to achieve the full benefits of 5G if as much of the network as possible is not deployed in the cloud. The benefits of a cloud-based network include service agility, resource flexibility and scalability, all of which will help operators to extend their 5G business models to new markets, but only if they succeed in virtualising the RAN while also achieving the performance improvements required for 5G services. The Open RAN provides a multi-vendor approach that its supporters hope will make the virtualised RAN (vRAN) easier and more cost-effective to deploy.

What is the architecture of the vRAN?

The vRAN is a version of the RAN in which some or all of the digital baseband functions are implemented in software on a cloud platform, which is commonly distributed across many edge locations. The way in which the RAN functions are split between the cloud baseband platform and the radio unit on the cell site – the functional split – varies in different architectures. In most cases, the cloud-based functions are shared by multiple cell sites, which is where the physical radio/antennas reside. This enables the flexible allocation of RAN resources to many sites, as required.

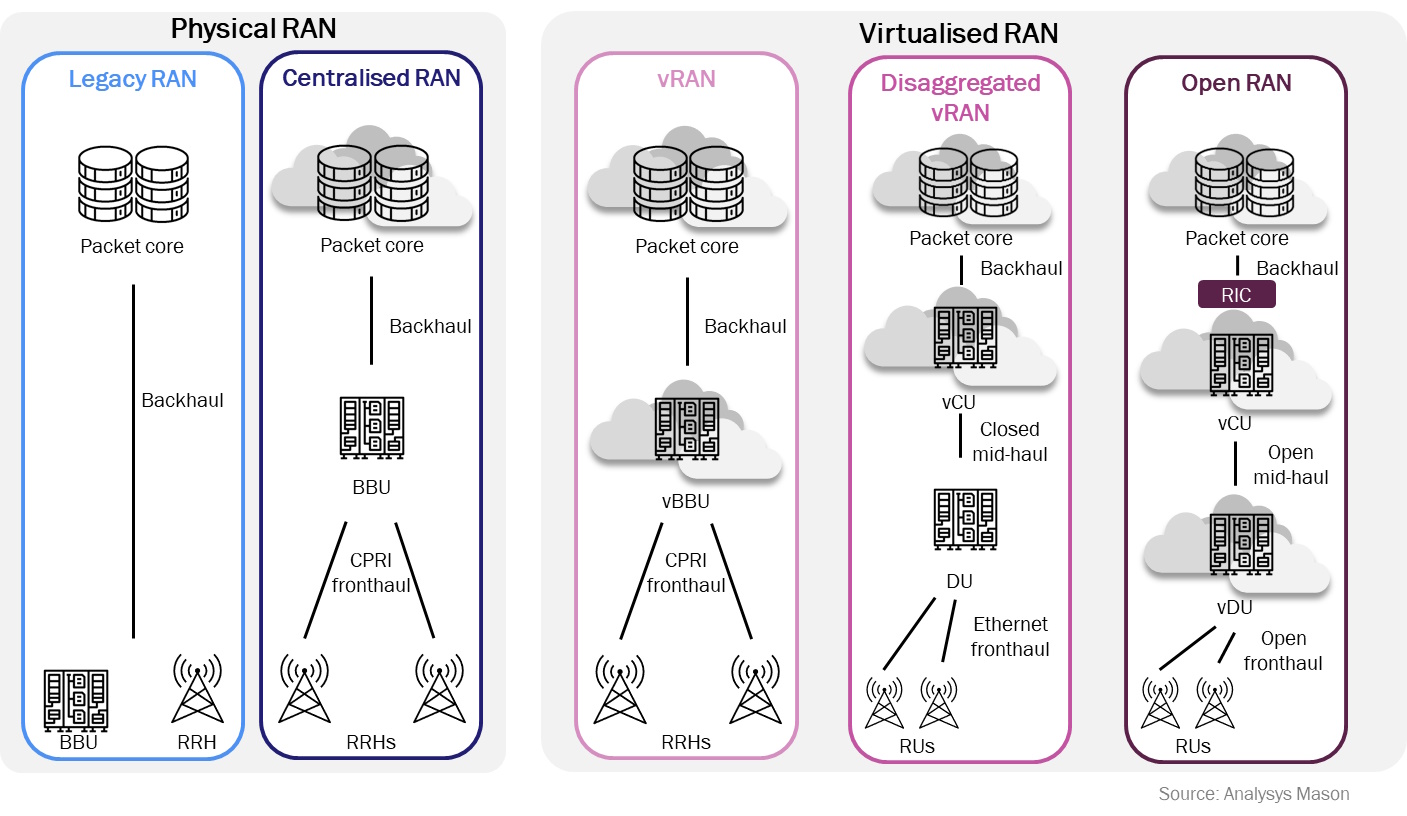

There is a degree of confusion around the terms used to describe the vRAN. We define several stages in the evolution of the vRAN (Figure 1), though it should be noted that the terminology may be used differently by other companies.

- Legacy RAN. Hardware and software are fully integrated in the legacy RAN and the base station is an appliance based on proprietary semiconductors.

- Centralised RAN. This represents the first attempt to support the flexibility of a shared baseband, which has been implemented in some 4G networks. Baseband units (BBUs) are separated from the radio units (RUs)/antennas and multiple radios can share a single ‘base station hotel’. The baseband units are still proprietary appliances.

- First generation or single-split vRAN (sometimes also called cloud-RAN). The first vRANs were deployed for 4G, mainly in customised implementations by operators such as SK Telecom in South Korea. They deployed the BBU as a virtualised platform on generic cloud hardware and up to 20 cell sites shared a virtual BBU (vBBU). In the 5G era, these RANs are called single-split vRANs.

- Disaggregated vRAN. The 5G network is often more disaggregated than the 4G network and consists of three main elements. The radio unit contains the cell site equipment, such as the active and passive antennas and the RF front end. It may support some RAN functions, while the rest are cloudified and further split between a centralised unit (vCU) and a distributed unit (vDU). Functions that do not require a real-time response, such as service management orchestration (SMO), run on the vCU, which can serve a large area (up to 100 cell sites) and provide the efficiencies and agility of a cloud platform.

Figure 1: The evolution of the vRAN architecture from physical to virtualised, disaggregated and open architecture

Unlike other network domains, the 5G RAN includes functions that have to run in near-real time and make extremely high processing demands. These include dynamic spectrum allocation and the beamforming that accompanies massive MIMO antenna arrays (both of these are very important contributors to 5G performance and user experience). These functions need to run far closer to the cell site than would be possible if they were run on the CU, and specialised cloud hardware with large numbers of accelerators is required to support the most processor-intensive tasks. This has led to the emergence of the DU, which supports near-real-time functions and will increasingly be deployed on an edge cloud node that can also support other operator functions, such as distributed core or services for customers.

The DU can be placed in many locations, ranging from being co-located with the CU in a data centre, to being deployed on or near the cell site. This will depend on the latency requirements of the network and the balance that the operator strikes between the efficiencies of centralisation and the responsiveness of very distributed RANs. The 3GPP has defined 10 different splits for how functions are allocated between the CU, DU and RU; an overview of the 5 most common is given in Figure 2.

Figure 2: Overview of the locations of RAN functions in the main 3GPP-defined functional splits in practical use

| Function | Split 2 | Split 4 | Split 6 (nFAPI) | Split 7 (inc. O-RAN) | Split 8 |

|---|---|---|---|---|---|

| Radio resource control | Cloud-based vCU | Cloud-based vCU | Cloud-based vCU | Cloud-based vCU | Cloud-based vCU |

| Packet data convergence protocol | Cloud-based vCU | Cloud-based vCU | Cloud-based vCU | Cloud-based vCU | Cloud-based vCU |

| Radio link control | Physical RU/DU | Cloud-based vDU | Cloud-based vDU | Cloud-based vDU | Cloud-based vDU |

| Medium access control | Physical RU/DU | Physical RU/DU | Cloud-based vDU | Cloud-based vDU | Cloud-based vDU |

| High physical layer | Physical RU/DU | Physical RU/DU | Physical RU/DU | Cloud-based vDU | Cloud-based vDU |

| Low physical layer | Physical RU/DU | Physical RU/DU | Physical RU/DU | Physical RU/DU | Cloud-based vDU |

| Digital front end | Physical RU/DU | Physical RU/DU | Physical RU/DU | Physical RU/DU | Physical RU/DU |

Source: Analysys Mason

Is the vRAN the same as the Open RAN?

Disaggregated vRANs can be deployed as single-vendor platforms, but they can only be deployed as multi-vendor systems with difficulty. However, operators are increasingly interested in the Open RAN, in which the various hardware and software elements can be sourced from different suppliers. This is enabled by three key changes to the legacy RAN.

- Fully open and standardised fronthaul interface. This allows RUs/antennas to be deployed with third-party baseband units (CUs or DUs). This interface was based on CPRI technology in first-generation centralised and virtualised RANs, which although standardised, has been implemented in proprietary ways by each vendor, thereby preventing interoperability. The O-RAN Alliance has specified the Open Fronthaul interface, which aims to provide a fully interoperable link between RUs and basebands, with a universal implementation of the eCPRI protocol (the new generation of CPRI).

- Open, cloud-based baseband platform. This enables RAN software (either virtual network functions or cloud-native functions, collectively termed xNFs) from multiple suppliers to be run on common cloud servers and software. Rakuten in Japan envisages a future ‘app store’ from which operators can select these xNFs and download them onto generic cloud infrastructure.

- Open radio ecosystem. RUs/antennas will always be based on specialised hardware, but they are based on standard specifications and merchant semiconductors in an Open RAN environment. This would result in lower-cost units (as seen in the Wi-Fi market), and third-party RAN software could be deployed on RUs from multiple vendors. Several groups are working on Open RAN specifications. The most prominent is the O-RAN Alliance, which has also developed an important new element of the disaggregated vRAN architecture: the RAN Intelligent Controller (RIC). This enables RAN control functions to be abstracted from the base stations and run in the cloud, thereby opening the RAN control segment to non-RAN vendors. There are both non-real-time and near-real-time versions of the RIC.

Other significant Open RAN projects include the Open Networking Foundation’s SD-RAN, Telecom Infra Project’s OpenRAN and Small Cell Forum’s 5G Network Function API (5G nFAPI).

How could vRAN and Open RAN shake up the current 5G supply chain?

Operators that support Open RAN aim to lower the barriers for new vendors to enter the RAN market in order to increase competition in their supply chains and gain access to a broad innovation base. Legacy RAN architecture is very expensive to develop, especially the proprietary chips, and consolidation has resulted in only a small number of vendors for macro networks. The market has been dominated by Ericsson, Huawei and Nokia, with ZTE and Samsung having a far smaller presence. NEC and Fujitsu also supply base stations to local operators in Japan.

The leading vendors have protected their market position through proprietary platforms and interfaces, thereby making it difficult for operators to swap to a new vendor within the established group, let alone introduce a new entrant. Operators’ choices have been further constrained in some markets by sanctions against Chinese suppliers. Some operators have therefore migrated to the Open RAN to gain access to a broader supply chain. Indeed, five leading European mobile network operators (MNOs) (Deutsche Telekom, Vodafone, Orange, Telefónica and Telecom Italia) have signed a memorandum of understanding to encourage a European ecosystem for the Open RAN.

Open RAN vendors are not obliged to supply all elements of the solution, and some will specialise in either RUs/antennas or software. The cost of innovating in a software-only technology and deploying that software on common hardware is clearly far lower than that of developing an integrated base station. The more the RAN is disaggregated, the more elements there are for different suppliers to target. Server suppliers such as HPE and Dell are supplying hardware for DUs, VMware and Red Hat are active in vRAN cloud infrastructure and the RIC is an example of an element that has been opened up to non-RAN suppliers, such as Juniper, for the first time.

Will the Open RAN achieve its goals?

It is unclear how many of the Open RAN supply chain goals will be achieved, at least in the period before 2026. A considerable amount of integration and optimisation is required to enable a truly multi-vendor network to achieve the same performance levels as an integrated macro RAN that supports heavy traffic loads and ultra-low latency. The development of non-captive processors and radios that can support such requirements in software is in its infancy. This is why many early trials and deployments have been in smaller networks such as enterprise small cells or rural extensions, where challenger vendors in the vRAN ecosystem (including Mavenir, Parallel Wireless and JMA) are already having an impact.

Eventually, the vision is of a platform that allows elements to be mixed and matched relatively simply, probably based on pre-integrated blueprints such as those that exist for Wi-Fi. However, for large-scale networks, this approach will take years to mature. In the meantime, the integration and performance challenges in a 5G macro RAN could result in a lock-in by integrators (who may also be the traditional RAN vendors that are using their radio expertise). Alternatively, traditional RAN vendors may reinvent themselves sufficiently to dominate the Open RAN market, thereby providing operators with the confidence of their long track records combined with the reassurance of support for open interfaces. Indeed, Nokia and Samsung have already committed to deliver 5G vRAN platforms that have the option of supporting the O-RAN architecture, and Nokia contributed much of the seed code for the O-RAN RIC.

However, it is clear that the Open RAN movement is intensifying operators’ interest in the vRAN, and it will have a permanent impact on how vRANs are deployed. The innovations of challenger vendors and the support from operators have accelerated the development of a commercial 5G vRAN platform. The broader Open RAN architecture also introduces suppliers and expertise from the cloud industry, which will help operators and players in their ecosystems to make the transition into an unfamiliar world. The high-profile Open RAN deployment by Rakuten Mobile in Japan highlights the challenges of this kind of roll-out, and its early commercial failures indicate that vRAN is not a guarantee of success. However, it also provides a glimpse of the 5G network of the future: fully software-based, multi-vendor and potentially deployed in the public edge cloud.

Article (PDF)

Download

Discover our range of curated resources with all the latest data and analysis related to vRAN and Open RAN.

Author

Caroline Gabriel

Partner, expert in network and cloud strategies and architectureRelated items

Article

NVIDIA GTC Paris 2025: digital twins and sovereign AI signal a new era for telecoms infrastructure

Tracker

5G coverage tracker 1H 2025

Article

Telstra highlights the failure of established operators to address the threat posed by low-cost challengers