Fixed and ICT services helped Gulf-based operator groups to offset the strong decline in mobile revenue in 2020

stc was the only regional operator in the Gulf region to report strong revenue growth in 2020 thanks to the strong demand for business connectivity and ICT services, as well as limited exposure to international markets. Etisalat, Omantel, Ooredoo and Zain reported lower revenue in 2020 than in 2019 due to the impact of COVID-19 on the economy and population movement, as well as increased competition; these challenges were felt more strongly in their domestic markets. All five operator groups have reported strong take-up of fixed broadband, ICT and fintech services since the beginning of the pandemic.

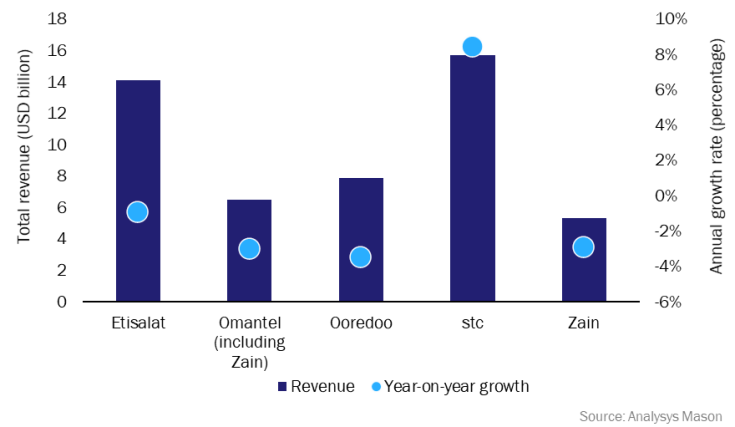

This article examines the 2020 financial performance of the five operator groups mentioned above (see Figure 1) and discusses their revenue growth opportunities for 2021.

Figure 1: Group annual revenue and year-on-year growth rates for Etisalat, Omantel, Ooredoo, stc and Zain, 20201

Operators’ performance during 2020 was mixed because of the challenges posed by COVID-19

Etisalat, Omantel, Ooredoo and Zain reported revenue declines in 2020 due to movement restrictions imposed in the countries within which they operate to contain the spread of COVID-19. In particular, the mobile markets in Kuwait, Oman, Qatar and the UAE were adversely affected by the departure of millions of expatriates, which make up a large proportion of the population (50% to 90%) and the prepaid subscriber base. The performance of opcos outside the region was more mixed, as shown in Figure 2.

stc fared better than its peers because it is less exposed to risky international markets. Its domestic market is also less dependent on expatriates (which form only 35% of the population) and the operator has a rapidly growing postpaid subscriber base, which made it less exposed to line disconnections and spending cuts than the other operators. stc has also benefited from the strong demand for business connectivity and ICT services from the public and private sectors.

Figure 2: Group performance in 2020 and expected developments in 2021, Etisalat, Omantel, Ooredoo, stc and Zain, 2020

| Operator | Strong points in 2020 | Weak points in 2020 | Expected developments in 2021 | |||

|---|---|---|---|---|---|---|

|

Etisalat |

|

|

|

|

|

Etisalat is looking for options for its mobile subsidiary Ufone in Pakistan; Ufone could be merged with its fixed subsidiary PTCL |

|

Omantel (Oman only) |

|

|

|

|

|

Omantel plans to sell its tower network in a deal that could be worth over USD500 million |

|

Ooredoo |

|

|

|

|

|

Ooredoo is in talks with CK Hutchison to combine their Indonesian subsidiaries |

|

stc |

|

|

|

|

|

|

|

Zain |

|

|

|

|

|

Zain plans to merge its tower infrastructure with Mobily’s under a joint venture (JV) towerco |

Source: Analysys Mason

Operators plan to increase their focus on the B2B segment and financial services to drive future revenue and profitability growth

The five Gulf-based telecoms groups will continue to face various challenges during 2021 that will hinder their growth, including:

- slow economic recovery and the potential deterioration of macroeconomic conditions

- increased competition in some markets such as Kuwait, Oman and Saudi Arabia because of the entry of new players

- governmental actions such as nationalisation programmes to reduce dependency on expatriates and the introduction or the increase of VAT to offset the widening budget deficit

- geopolitical challenges and currency devaluation in overseas markets, especially for Etisalat, Ooredoo and Zain.

The main priority for each operator will be to minimise churn, protect its existing high-value customer base in the domestic markets and invest in increasing their spending. They will also maintain focus on their international portfolio as an engine for organic growth. However, they are unlikely to expand geographically given the current climate of uncertainty.

We expect operator-led fintech propositions to contribute more to operators’ revenue in 2021 as usage of contactless payment and e-commerce increases. For example, stc reported strong adoption of its stc pay in Saudi Arabia and it is considering expanding the solution to the rest of the region. Take-up of Zain’s mobile wallet in Iraq and Jordan was also strong, and the company was also awarded a consumer micro-financing licence in Saudi Arabia. Etisalat set up a JV with Noor Bank to introduce its digital payment platform eWallet in the UAE, while its subsidiaries, Marco Telecom and Ufone, launched mobile wallets in 2020.

Operators will also continue to expand their ICT portfolios to capitalise on the growing demand for security and cloud services, driven by national digitisation programmes. For example, stc plans to build 12 new data centres by the end of 2022 and it has partnered with Alibaba Cloud to offer its cloud services in Saudi Arabia. Etisalat added two data centres in the UAE and partnered with AWS and Microsoft to enhance its public cloud offering. Zain also launched Zain Data Park (ZDP) in Kuwait and Jordan to provide enterprises with cloud hosting and managed services.

Most Gulf-based groups managed to come out of 2020 reasonably well considering the adverse impact of COVID-19 on the population and the economies where they operate. If anything, the pandemic has revealed the strong appetite of consumers and businesses for connectivity and digital services.

1 Omantel acquired a controlling stake (21.9%) in Zain Group in November 2017.

Article (PDF)

Download