E-pharmacies in India: global and local trends point to a positive future

Amazon acquired US-based e-pharmacy company PillPack for USD753 million in 2018, in a move that sent shockwaves through the pharmaceutical industry around the world. The ripples were felt in India as well, resulting in a series of big-ticket investments in the year following the acquisition. The Government of India is due to implement a new regulatory framework and guidelines relating to online pharmacies that should help to further stimulate this sector. This article assesses the state of the e-pharmacy industry in India, the drivers of its growth and its future prospects.

Online pharmacies can address the gaps left by the traditional pharmacies in India

India’s pharmaceutical sector is the third-largest in terms of volume in the world and the thirteenth-largest in terms of value. The retail pharmaceutical market in India was worth around USD24 billion in 2018 and is growing rapidly. However, the sector is facing several challenges due to low industry margins, rising price pressure, poor documentation and tracking, non-compliance with laws (selling medicine without prescriptions), poor inventory management and a limited ability to stock all available stock-keeping units (SKUs). The retail pharmacy sector needs technical solutions to overcome these challenges and increase efficiency.

This need gap provides a perfect opportunity for e-pharmacy players to add value. E-pharmacies offer a way for customers to order medicines from the comfort of their homes, at discounted prices with just a few clicks. The sector has tremendous potential for growth fuelled by an increasing number of patients with chronic diseases, such as diabetes, hypertension etc., which require regular medication. In addition, the e-pharmacy market will be boosted by the increasing availability of smartphones, digital payments and health insurance, and the rising levels of disposable income.

We expect the e-pharmacy sector to flourish in India for three main reasons.

Online pharmacies add value for consumers

Five factors are attracting consumers to e-pharmacy solutions (see Figure 1).

Figure 1: Factors offered by e-pharmacy companies that add value to consumers

![]()

Source: Analysys Mason, 2019

Convenience. Customers who require regular medication value the ability to have medicines delivered to their doors.

Accessibility/availability. E-pharmacies can offer a wide range of SKUs to their customers by aggregating supply – such scale is difficult to achieve for local pharmacies.

Affordability. E-pharmacies can source products directly from manufacturers and can, therefore, offer more-significant discounts than local pharmacies.

Information and education. E-pharmacies can provide knowledge to customers to help them to make informed decisions.

Compliance and authenticity. The authenticity of drugs can be assured because e-pharmacies store all records digitally, which effectively reduces the risk of counterfeit medicine.

The e-pharmacy sector in India has caught the attention of investors

The growth potential and opportunity in the e-pharmacy sector has generated a lot of interest from investors. The key players in the sector such as PharmEasy, 1mg, NetMeds and Lifcare have recently raised significant capital. For instance, PharmEasy has secured funding of USD100 million while 1mg has secured USD80 million. With increasing interest from big investors such as Softbank (according to public sources), the sector can expect an upward trend in investment.

Government policies and regulation look favourable

The e-pharmacy sector in India is positive about new regulations that are likely to come into effect by the end of 2019. The government released draft regulations in 2018, which were well received by the sector. The draft guidelines allow for the Drug Controller General of India (DCGI) to regulate the e-pharmacies and for online retailers to sell drugs all over the country with a single licence (as opposed to having separate licences, and retail presences in every state). This will make it easier to do business, relieve cost burdens and help the players to expand into more regions.

Given that the e-pharmaceutical sector will make it easy for people to access affordable medicines, and that it has government and investor support, revenue is expected to grow strongly at about 54% CAGR in the next 4 years to reach about USD2.1 billion in 2023, when the sector will account for around 5% of revenue in the overall pharmaceutical sector (see Figure 2).

Figure 2: Revenue of the e-pharmacy sector and share of pharmaceutical market revenue, India, 2019 and 2023

Source: Analysys Mason, 2019

Competitive landscape

Around 85% of the e-pharmacy market in India is dominated by four major players. Medlife accounts for around 30% of revenue in the market followed by PharmEasy, 1mg and NetMeds. Other players include CareOnGo, Lifcare, mChemist, MedsOnWay and Myra. E-pharmacy players have a major presence in metros, but they plan to expand their reach in Tier 2 and Tier 3 cities as well. Customer acquisition is mainly driven by a high level of discounts and promotions.

Figure 3: Revenue market share and reach of key e-pharmacy players, India, 2019

![]()

Source: Analysys Mason, 2019

E-pharmacy players are also looking forward to offering a wide range of complimentary services. The aim is to become a one-stop solution for all healthcare needs. Such services include online consultations, doctor appointments, partnerships with diagnostics centres, sample collection, online health blogs, medicine refills and subscriptions. These services aim to attract and retain customers, and increase options for revenue generation. Medlife, PharmEasy and 1mg offer diagnostic laboratory tests and sample collection. Medlife and 1mg offer online doctor consultations through their websites and apps, and Medlife offers offline doctor appointments.

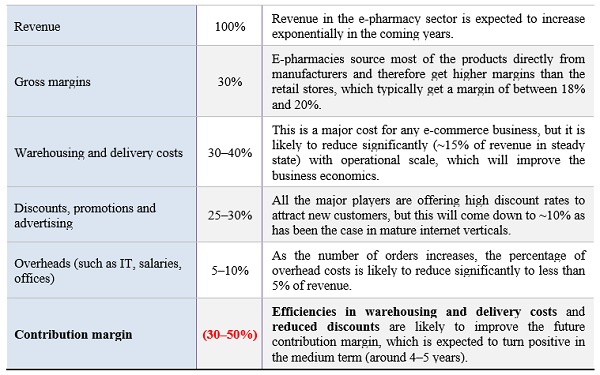

The unit economics for online pharmacies are expected to improve

The e-pharmacy sector in India is in a nascent stage and all the players are burning huge amounts of cash in discounts and promotions. The aim is to gain a customer base and drive change in customer behaviour towards the online purchase of medicines, a model tried and tested by players in the e-commerce and food delivery sectors. The unit economics are expected to improve in future because discounting will reduce and scale efficiency will kick in for supply chain and warehousing (see Figure 4).

Figure 4: Analysys Mason’s estimate of the contribution margin for an e-pharmacy business

The e-pharmacy sector is at the stage that the e-commerce and online food delivery sectors were at 5 and 2 years ago respectively. The lessons from these sectors will be invaluable as the e-pharmacy market in India seeks to build on the increasing number of investments and the favourable regulatory changes.

Downloads

Article (PDF)Authors

Rohan Dhamija

Managing Partner | Director Head - Middle East and India (South Asia)Latest Publications

Project experience

Enhancing Microsoft’s product and marketing strategy and strengthening its position as a thought leader in the SMB segment

Project experience

Using segmentation and insights from digital-native businesses to inform a global networking vendor’s sales and marketing strategy in Asia–Pacific

Project experience

Transforming a global financial management software vendor’s go-to-market strategy through advanced customer segmentation